China escalated its defense of the yuan by delivering a strong verbal warning to speculators and forceful guidance to investors with its daily reference rate, measures that pushed the managed currency away from a 16-year low.

The nation’s financial regulators will take action to correct one-sided moves in the market whenever it’s needed and they are confident in keeping the yuan basically stable, the People’s Bank of China said in a statement on Monday. The PBOC warning came a few hours after policymakers set a daily fixing that was stronger-than-expected by a record margin and state-owned lenders were also seen actively selling dollars, according to traders who asked not to be named as they were not allowed to comment publicly.

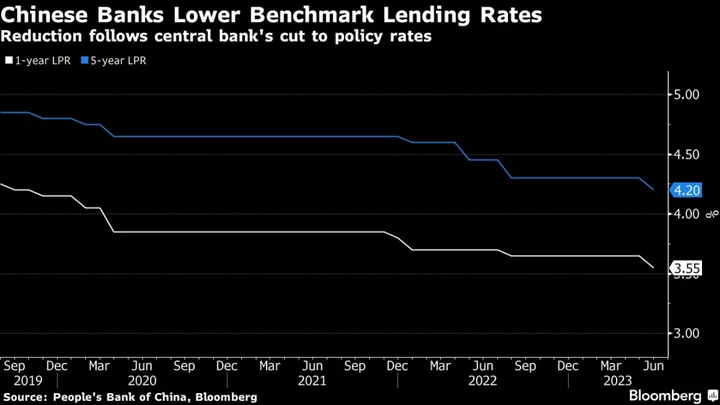

Adding fuel to the yuan’s rebound, China also reported Monday that credit expanded more than expected in August. And traders were cognizant that more dollar liquidity is due to be added to the market later this week as a result of the recent cut to the amount of foreign currency reserves lenders need to keep, a move that will also help support the yuan.

“Participants of the foreign-exchange market should voluntarily maintain a stable market,” the PBOC statement said. They should “resolutely avoid behaviors that disturb market orders such as conducting speculative trades.”

The onshore yuan jumped about 1%, the most since March, to around 7.27 per dollar before slightly paring gains.

What made Monday’s statement more noticeable than previous measures was that it said speculation needed to be extinguished. In the past, the PBOC took on yuan short-sellers by engineering cash crunches in the currency and burning through its foreign-exchange reserves.

While the central bank has been supporting the market since June, via tools including the daily fixing, it had failed to stop the currency from weakening to levels last seen in 2007.

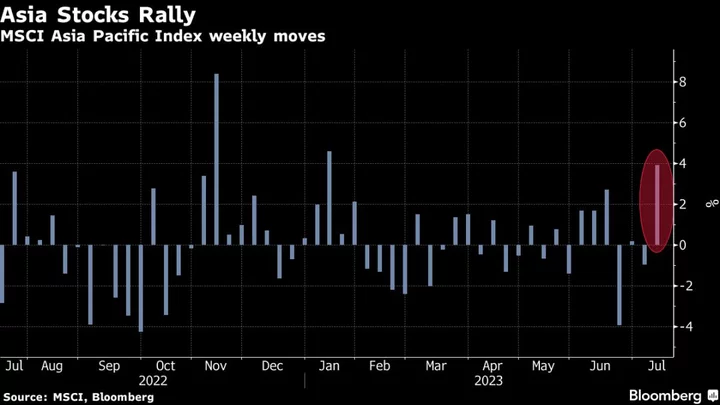

Beijing will hope the yuan’s nascent rebound, which was also accompanied Monday by a rise in mainland stocks, will mark the start of a gradual return of confidence toward Chinese assets. China’s efforts to rejuvenate growth and boost sentiment with a drip-feed of property, equities and monetary measures have yet to have a sustained impact.

“We could soon confirm a stabilization of China growth that will lend strong support to the yuan given heavy short positioning and ultra bearish consensus sentiment,” said Becky Liu, head of China macro strategy at Standard Chartered Plc. The PBOC sent “a strong signal to stabilize the yuan indicating a step up of measures if needed.”

The central bank statement was also timed perfectly for it to deliver the best results, said Xiaojia Zhi, head of research at Credit Agricole CIB. It ran right when the dollar was weakening on hawkish comments from the Japanese central bank head and before China’s report in strong credit growth, she added.

State Bank Support

State-owned banks were also prominent Monday, selling dollars in both morning and afternoon sessions, according to traders. That caused lenders to begin unwinding bullish dollar positions, triggering a wave of so-called stop loss orders, they added.

Weighed by China’s increasingly gloomy economic outlook and interest-rate divergence with the US, the onshore yuan slumped perilously close to the weak end of its 2% fixed trading band versus the dollar last week.

Despite the PBOC’s efforts to support the yuan, many strategists argue the central bank will only aim to slow the pace of declines and is unlikely to do anything too drastic to reverse the weakening trend.

“If the yuan continues to depreciate, the central bank will have to take more action,” said Zhou Hao, chief economist at Guotai Junan in Hong Kong.

--With assistance from Qizi Sun and Ran Li.

(Updates throughout)