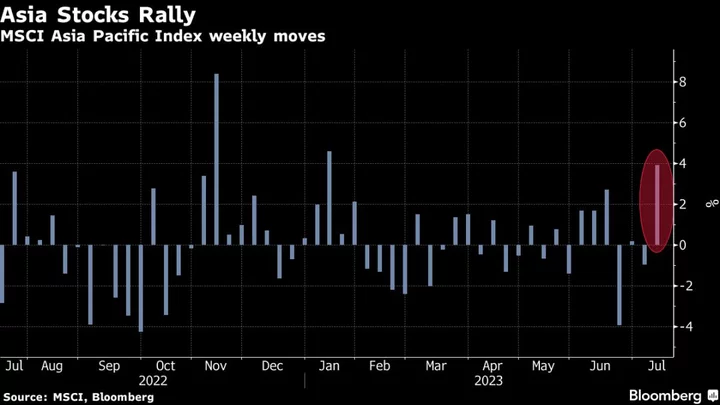

Asian stocks look poised for their best weekly gains since January amid a rebound in Chinese shares and bets that the Federal Reserve is approaching an interest-rate peak.

Shares rose in South Korea and Australia in early trade, while those in Japan were mixed. The gains extended the MSCI Asia Pacific Index’s weekly rally to above 4%. A measure of US-listed Chinese companies rose 2.6%, adding to the upbeat outlook as investors warm to signs of renewed efforts to bolster the economy.

The Australian dollar and the country’s government bond yields were steady after the government named Michele Bullock as the new central bank governor, who will succeed Philip Lowe when his term expires in September.

The dollar steadied Friday after sliding for a fifth-straight session. That’s put an index of the currency’s strength on pace for the worst week since November. Treasuries were little changed in Asia.

The yen traded around 138 to the greenback after strengthening for six consecutive days, the longest winning streak since 2020. There appears to be a sudden unwinding of speculative yen short positions, and a waning of yen carry trade momentum, Japan’s chief currency official, Masato Kanda, said late on Thursday.

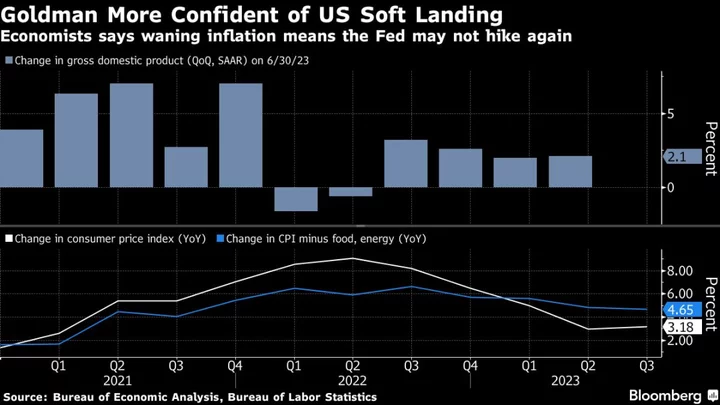

Wall Street and markets globally got an extra dose of encouragement to bid up riskier assets after another US inflation report highlighted the view that price pressures are easing in the world’s largest economy.

The producer price index for final demand rose 0.1% in June from a year earlier, the smallest advance since 2020. The figures came just a day after data showed consumer prices increased at the slowest pace since 2021.

Tech megacaps led gains on Thursday, with the S&P 500 topping 4,500 and the Nasdaq 100 up over 1.5%. Yields on policy-sensitive two-year Treasuries dropped 12 basis points to 4.63%.

Amazon.com Inc. hit a 10-month high after reporting record sales during its Prime Day sale. Google’s parent Alphabet Inc. rallied about 4.5%. Banks also gained ahead of results from JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo & Co. Two-year yields fell 11 basis points to 4.64%. The dollar dropped for a fifth straight day.

Disinflation has become a buzzword across trading desks, even though core inflation is still running above the central bank’s 2% target. Equities gained further traction on news that Fed Bank of St. Louis President James Bullard — who called for aggressive hikes — has resigned.

Fed Bank of San Francisco President Mary Daly, however, told CNBC Thursday that it’s too soon for policymakers to say they have done enough to return US inflation to their target. While the latest consumer-price report “is very positive,” the official said she’s in a “wait-and-see mode on that, because I remain resolute to bring inflation down to 2%.”

“Getting towards 2% is still going to take a lot of work,” Marvin Loh, a senior macro strategist at State Street, said on Bloomberg Television. “Higher for longer is still going to be a message that comes out of the Fed and ultimately might be appropriate.”

Traders are also awaiting the unofficial start of the second-quarter US earnings season Friday. Goldman Sachs Group Inc. strategists expect US companies to be able to meet the low bar set by consensus. Bloomberg Intelligence strategist Gina Martin Adams said “the S&P 500 earnings season will likely reveal more of the ‘less bad than feared’ trend that emerged in 1Q.”

In Asia, investors will turn their attention this morning to the People’s Bank of China, which has an opportunity to spell out its monetary policy outlook for the year amid rising speculation about support for the economy. Questions about the extent to which the central bank can continue to ease monetary policy are likely to be a key focus during a press conference about first-half financial data hosted by Deputy Governor Liu Guoqiang.

Key events this week:

- US University of Michigan consumer sentiment, Friday

- US banks kick off earnings, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 9:06 a.m. Tokyo time. The S&P 500 rose 0.85%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 1.7%

- Japan’s Topix index rose 0.2%

- Australia’s S&P/ASX 200 Index rose 0.2%

- Hong Kong’s Hang Seng futures rose 1%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.1221

- The Japanese yen was little changed at 137.95 per dollar

- The offshore yuan was little changed at 7.1532 per dollar

- The Australian dollar was little changed at $0.6885

Cryptocurrencies

- Bitcoin rose 0.2% to $31,436.79

- Ether rose 0.9% to $2,003.94

Bonds

- The yield on 10-year Treasuries advanced one basis point to 3.77%

- Australia’s 10-year yield declined six basis points to 3.99%

Commodities

- West Texas Intermediate crude rose 0.4% to $77.19 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.