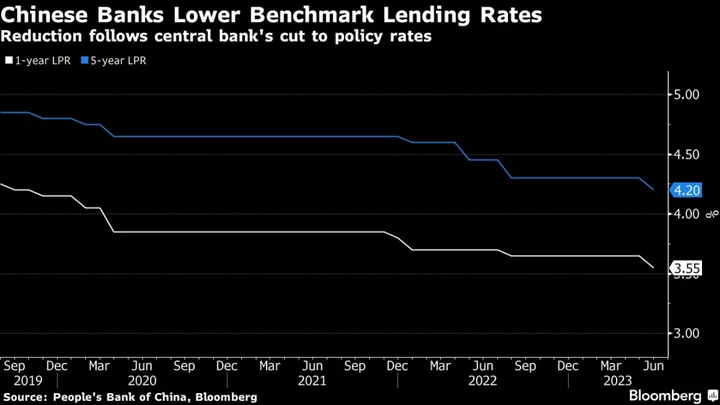

Chinese banks followed the central bank by lowering their benchmark lending rates on Tuesday, although a relatively modest reduction to the mortgage reference rate disappointed investors.

The one-year and five-year loan prime rates were reduced by 10 basis points each, according to a statement by the People’s Bank of China.

While that was in line with the reduction in the PBOC’s policy rates last week, some economists had predicted a bigger reduction of 15 basis points in the five-year rate, a reference for mortgages, to support the ailing housing market.

Reducing both rates by the same magnitude “shows policymakers wish to avoid sending an overly optimistic signal about the property market under the principle of ‘housing is for living, not speculation,’” said Bruce Pang, chief economist and head of research for Greater China at Jones Lang LaSalle Inc.

Chinese stocks in Hong Kong underperformed the broader regional market. The Hang Seng China Enterprises Index was down almost 2% at the mid-day trading break, with property stocks among the top losers. The offshore yuan extended its drop following the announcement. The yield on China’s 10-year government bonds dropped two basis points to 2.68%.

The LPRs are based on the interest rates that 18 banks offer their best customers and were last reduced in August. The easing was largely expected as the rates are quoted as a spread over the rate on the central bank’s one-year policy loans, or the medium-term lending facility, which was lowered last week by 10 basis points.

“The 10 basis-point cut in the five-year LPR was a bit disappointing to China bulls who are looking for even stronger stimulus to support the struggling property market,” said Ken Cheung, chief Asian FX strategist at Mizuho Bank Ltd.

The PBOC on Tuesday also net injected 180 billion yuan via its open-market operation, the most since the end of March, in order to maintain ample interbank liquidity.

What Bloomberg Economics Says...

More active, broad-based monetary easing will be needed to recharge the slowing economy. We see further cuts in both the reserve requirement ratio and lending rates in the second half of the year.

Eric Zhu, China economist

For the full report, click here

Recent official data showed the economy’s post-reopening recovery is fast losing steam, with a weak property market a major drag on growth. Officials are considering more support measures for the economy, including for the housing sector, although the timing of a rollout is unclear.

Citigroup Inc. this week joined other Wall Street investment banks that have downgraded their forecast for China’s economic growth this year. Citi economists now expect gross domestic product to expand 5.5% in 2023, down from a previous estimate of 6.1%. They cited weak confidence across households, companies and investors that threatens to further weigh on the slowing economic recovery.

Frances Cheung, a rates strategist at Oversea-Chinese Banking Corp in Singapore, said the interest rate level in the economy “is not the main hurdle to loan demand and the market is hoping for some fiscal support.” A stimulus package would help improve economic prospects, she said.

The central bank’s easing has already pushed the average mortgage rate to a record low. Earlier this year, authorities extended measures to allow lower mortgage rates for first-time home buyers in some cities. Banks have also been allowed to reduce their deposit rates, in order to preserve their shrinking interest margins.

--With assistance from Shikhar Balwani, Chester Yung and Tian Chen.

(Updates with additional details.)