Traders are betting that interest rates in the US will remain higher than inflation far into the future, driving the dollar to fresh highs against some of its major peers.

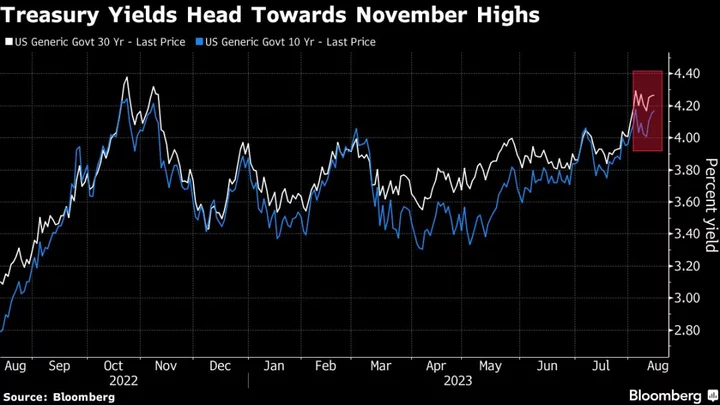

The 10-year real yield — or the rate after accounting for inflation — rose above 1.79% on Monday in early New York trading, edging toward the highest since 2009. The allure of positive returns is driving money back into greenback, which has rallied about 3% back from a more than one-year low last month.

The rebound filtered across currency markets Monday, pushing the dollar toward its highest against the yuan this year and driving it above 145 yen, near a level that pushed the Bank of Japan to intervene last year to bolster the currency.

The moves are being accentuated as hedge funds continue to trim their record short positions in the greenback. A barometer of market positioning and sentiment in the options market shows investors are the most bullish the currency since late March.

The shift shows how the dollar can benefit even as the Federal Reserve approaches the end of its tightening cycle, buoyed by prospects of resilient economic growth. That’s starting to cast doubt on recent calls that the currency’s rebound had run its course.

“It is hard for the dollar to go down meaningfully when the market is focused on either US outperformance or higher US yields,” wrote Goldman Sachs strategists including Kamakshya Trivedi.

Meanwhile, several policymakers are insisting there is more work to do to get inflation back below target. A recent surge in natural gas and crude oil prices has highlighted inflationary risks, while a surge in debt issuance is weighing on the market.

Even one-time bond king Bill Gross said US debt was “overvalued” and estimates the fair value for 10-year Treasuries is 4.5%. That rate on Monday was within striking distance of the year-to-date high of 4.20%.

Bond Market Sees No End to Tumult as Fed Casts a Hawkish Shadow

Data from the Commodity Futures Trading Commission last week showed shorts on the greenback retreated to the lowest level in eight weeks.

“Real rates in the US are very attractive globally, and it can only be a movement of the herd which suggests that shorting the dollar was a really productive venture at this point,” said Peter Chatwell, head of global macro strategies trading at Mizuho International Plc.

--With assistance from Vassilis Karamanis, Anchalee Worrachate, James Hirai, Neha D'silva, William Selway and Michael Mackenzie.

(Updates with context, comments and prices throughout.)