For decades since they were privatized, the UK’s public service providers have favored inflation-linked bonds as a cheap and easily-accessible means of financing. That’s now coming back to bite as borrowing costs surge to a 16-year high, potentially putting the government back on the hook to clean up the mess.

UK companies are the biggest issuers of inflation-linked debt in the developed world, with more than £40 billion ($51 billion) worth of the securities currently outstanding. Much of that total is linked to firms that manage Britain’s water, energy supplies, railways and affordable housing.

While many of the companies are in private hands, if they come up against financing problems, the burden quickly falls on the government, which has a responsibility to ensure vital services are being fulfilled. That’s the last thing Prime Minister Rishi Sunak needs as he struggles to tame a cost of living crisis, industrial action and the government’s own spiraling borrowing costs, which have pushed national debt above 100% of GDP for the first time since 1961.

Investors are already in talks to raise more than £1 billion for Thames Water, the UK’s biggest water company, which announced it was having trouble servicing its debts. The government believes the utility can raise the funds on its own without a bailout, according to a Bloomberg report. Last year Bulb Energy Ltd. was nationalized after it failed to hedge against price rises.

The Bulb bailout shows that “the public as ever will be on the hook for these firms’ failure, whether through the public balance sheet or as service users,” said Adrienne Buller, director of research at the Common Wealth think-tank. “The justification for the returns is that investors are bearing risk, but it seems when public utilities and services are involved it’s all reward, no risk.”

Privatization Wave

Many of Britain’s public service providers were sold to private owners by Margaret Thatcher’s Conservative government in the 1980s in a bid to stimulate economic growth. Such companies often opted to raise money via long-dated inflation-linked bonds because the securities were attractive to UK pension funds. Payouts on many pension schemes are indexed to inflation and providers were often prepared to accept a lower coupon for securities that offered protection against rising consumer prices.

For more on inflation-linked debt, listen to the Credit Edge podcast here

Many other investors avoid inflation-linked bonds issued by UK utility companies because the duration makes them volatile and “there’s little liquidity,” according to Chris Bowie, a partner at Twentyfour Asset Management LLP.

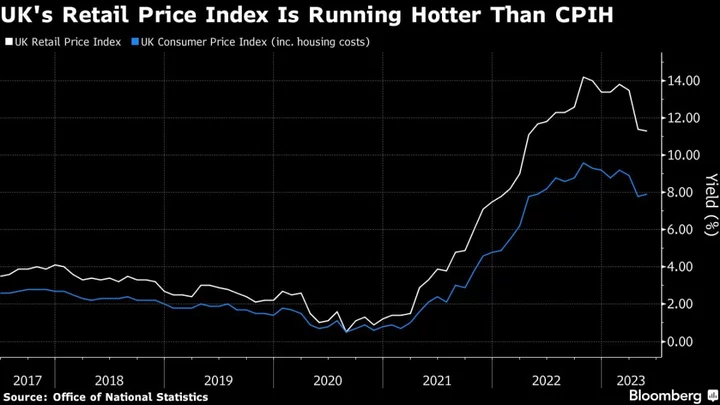

The problem now is that a large portion of the outstanding debt is linked to the retail price index, an old inflation metric that includes mortgage interest payments and has skyrocketed over the past two years to 11.3%. At the same time, the metric used to determine what some firms such as water companies can charge customers is based on the consumer price index plus housing rents, which has also risen, but not nearly as much.

“As long as the revenues and debt are linked to the same inflation index there’s no problem,” said Paul Vickars, a utilities analyst at Bloomberg Intelligence. But at UK water companies, “debt and interest are increasing faster than earnings and assets, hence financial pressure.”

More than half of the £60.6 billion of debt issued by water companies in England and Wales is indexed to inflation, according to Ofwat, the industry regulator for the two countries. The sharp increase in the cost of goods and services meant Yorkshire Water’s net interest payable in the 2021-2022 financial year more than doubled to about £595 million from a year earlier.

Southern Water Ltd is suspending dividend payments until at least 2025 after its financing costs increased by more than 40% in the year to April 1, largely due to the inflation-linked debt.

Other public service providers such as Network Rail, the national railway network manager, have also recorded a substantial hit to their earnings because of the impact of consumer price rises on their inflation-linked debt. Inflation has risen more since the start of 2021 than in the 10 years through 2020, according to a Bank of England calculator.

Network Rail recorded a £1.2 billion hit to its profits in 2022 from RPI-linked debt while revenues remained roughly the same. The gauge has increased since then, and is running over three percentage points higher than the more commonly used CPI measure.

The company replaces the bonds as they mature with government funding. Net cash generated from its operations after borrowing costs has remained steady at about £4 billion annually in recent years. A Network Rail spokesman said that all of the company’s external debt would be replaced by government borrowing upon maturity and that its inflation-linked bonds will not impact operations or investments.

Local Councils

Public services that weren’t privatized are also struggling to adapt to higher borrowing costs following government cutbacks in recent years. Councils in England face a funding gap of almost £3 billion over the next two years just to keep services at current levels, the Local Government Association said on Tuesday.

All but essential spending will stop at Woking Borough Council after it filed a so-called Section 114 notice due to a £1.2 billion budget shortfall. Croydon Council reported that its planned expenditure in the coming years is likely to exceed its financial resources. Most of its debt is short-term, leaving it “exposed to current higher interest rates.”

Some local governments are reviewing “their capital programs to make sure they’re still affordable, and in some cases trimming those capital programs by taking out things that are no longer viable,” said David Whelan, a managing director at Link Group, a financial services provider that advises local authorities. “What they’re spending on now is what they call the basic needs around housing, education, environment and leisure within the boundaries of the local authority.”

Housing associations, non profit organizations that receive some funding from the government to provide affordable homes, are being stretched by a rise in borrowing costs and a decreased ability to cover their debt burden. Slowing property sales and falling prices are adding to the strain.

The associations’ interest cover — a measure of how easily a company can pay interest on its outstanding debt — averaged 87% over the past financial year, the Regulator of Social Housing wrote in a June report, noting that this is the “lowest figure recorded in the regulator’s quarterly surveys.” The metric stood at 150% just over five years ago. In the same period, the companies’ total agreed borrowing facilities rose 45% to £123 billion.

“A few who have been raising funds on the bond markets for new development may find themselves over-stretched,” said Yolande Barnes, chair of University College London’s Bartlett Real Estate Institute. “We might see some mergers as those with lower gearing bail out any that get into trouble. One default would massively increase the cost of finance for everyone else.”

Author: Neil Callanan, Abhinav Ramnarayan and Greg Ritchie