Javier Milei couldn’t have hoped for a better reception from investors on his first day as Argentina’s president-elect.

On Wall Street, the country’s stocks soared the most in at least a decade and bonds climbed on optimism that he might be able to fix the beleaguered economy and tame inflation. The corporate world was also elated, with chief executives from MercadoLibre Inc. and Globant SA joining Elon Musk to note their approval.

Day two is going to be a lot tougher. Tuesday will see the reopening of local markets and banks after a holiday weekend, and concern is growing about the potential for a wave of Argentines withdrawing pesos to buy dollars. While banks took steps to ensure they’d have enough cash on hand in the run-up to the vote, executives are telling regulators in private conversations that they may need additional help to shore up the system.

“Tomorrow’s gonna be the day that we see the tone,” Hans Humes, the chief executive officer of Greylock Capital, said in an interview on Bloomberg Television.

Milei, a little known libertarian congressman just a few months ago, won over Argentines and investors by pledging a radical economic overhaul, with a signature proposal to scrap the peso and replace it with the US dollar. While the details of the plan were always sketchy, he framed it as an obvious move after the local currency’s value plunged 90% over the past four years, leaving it worth less than “excrement.”

Read More: Milei’s Win Sealed by a Risky Gamble That Turned Rival Into Ally

But the problem is how to keep the economy operating during the transition. Milei hasn’t revealed the specific steps and timeline the switch would entail or explained in detail how he would slash the country’s massive budget deficit — a painful but crucial measure to make the plan work — leaving Argentines to guess at what’s in store.

The nation has restricted its peso’s daily decline for years through a hodgepodge of currency controls and import restrictions that have spun off myriad exchange rates.

Instead of giving a hint of his intentions Monday, Milei’s office said he wouldn’t be revealing any cabinet appointments until his Dec. 10 inauguration. The president-elect announced plans to soon visit Miami, New York and Israel on a trip that has “a spiritual meaning more than other characteristics.”

Given that backdrop, many Argentines will see the least risky option as immediately liquidating their pesos to buy greenbacks on the black market used to skirt currency controls, fearing that the rate will only worsen the longer they wait. Online cryptocurrency exchanges showed the peso weakening after Milei’s win.

“We are marching somewhat toward the unknown,” said Alberto Ramos, the chief economist for Latin America at Goldman Sachs Group Inc.

Volatile Transition

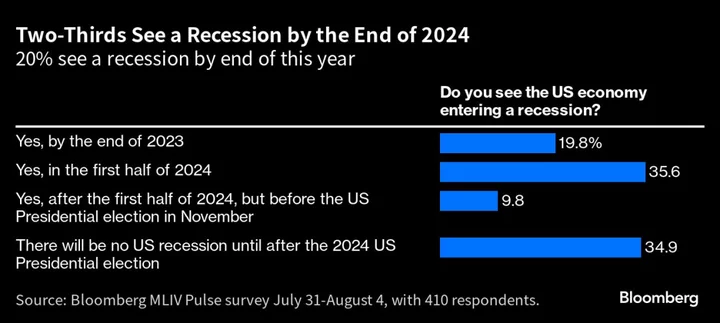

Selling pesos to buy dollars could cause serious problems for the economy. A disorderly process risks fueling hyperinflation and a volatile transition to using the new currency, which could undermine Milei and his ideas for a radical economic overhaul before they can even get off the ground. That would be a disappointment to his supporters, who appreciated the maverick politician’s blunt discussion of what ails the country — an economy headed for its sixth recession in a decade, inflation topping 140%, a poverty rate that’s climbed to 40% — and his pledges to do whatever it takes to set things right.

“There’s a chance that this works out, but there’s a lot of challenges,” said Gorky Urquieta, co-head of the emerging markets debt team at Neuberger Berman. “It’s going to be a high-wire act with a lot of risks involved in the execution, but I think the market’s gonna give him the space.”

First, though, Argentina will need to get through Tuesday.

Delayed devaluation

Bank executives don’t expect a major devaluation of the official exchange rate in coming days, but are concerned about the potential for chaos if a wave of cash withdrawals materializes and have been in touch with officials at the central bank, according to people with direct knowledge of the matter.

To ease pressure on the gap between exchange rates during the transition period and allow more export dollars to flow in, policymakers agreed to let exporters liquidate more of their sales abroad at the so-called blue-chip swap exchange rate, the people said, asking not to be identified because the information isn’t public. The central bank also plans to keep buying government bonds in pesos in the secondary market to alleviate selling pressure, while also continuing to issue peso contracts in the futures market, the people added.

A spokesman for Argentina’s central bank declined to comment.

Proponents of Milei’s plan to get rid of the peso point out that much of the country has been dollarized for a while now — many real estate transactions and expensive imports are already priced in the US currency. The idea of formally switching over the entire economy may not seem as radical as it otherwise would be.

Read more: Wall Street Welcomes Milei Victory, Warns of Challenges

“Confidence in the local currency is very low and there is already a significant degree of informal dollarization in the economy,” said Ramos of Goldman Sachs. “But that is just a reflection of the fact that the familiar has has not served the country well.”

Author: Kevin Simauchi, Ignacio Olivera Doll and Carolina Wilson