Stocks rose in Asia on the last trading day of the quarter amid optimism over spending during China’s Golden Week holiday and on talks of a possible meeting between US and China leaders. Treasuries and the dollar declined.

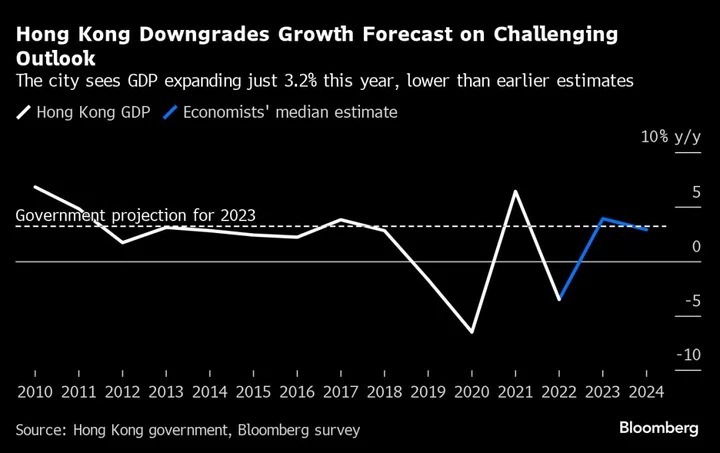

Hong Kong shares led equity gains, while benchmarks also advanced in Australia and New Zealand. Mainland markets are shut for a holiday through the end of next week. China’s Vice Premier He Lifeng and Foreign Minister Wang Yi are discussing possible visits to the US to prepare for a potential summit between Xi Jinping and Joe Biden, the Wall Street Journal reported, citing people it did not identify.

“It looks like a broad relief rally across the region after a week of declines,” said Marvin Chen, a strategist at Bloomberg Intelligence in Hong Kong. The bounce may be short lived, “but there are catalysts on the horizon with the Golden Week Holiday consumption data and the third plenum policy meeting toward the end of October and early November,” he said.

The MSCI Asia Pacific Index has still fallen almost 4% since the end of June, the biggest quarterly decline since September 2022. Sentiment toward equities has been sapped due the prospect that global interest rates will stay elevated for longer, while inflation is being supported by rising oil prices.

Futures for the S&P 500 and Nasdaq 100 were little changed after the US indexes gained Thursday on the back of a rally in tech behemoths including Nvidia Corp. and Meta Platforms Inc.

September is still shaping up to be the worst month this year for US stock benchmarks and the poorest month for global bonds since February after the Federal Reserve left interest rates at the highest in 22 years at its most recent meeting.

Treasury yields rose in Asia after slipping from 16-year highs in New York following weaker-than-expected consumer spending data and dovish Fed comments. The US 30-year yield is on track for the largest quarterly increase since 2009.

The dollar weakened against all except one of the Group-of-10 peers Friday, but Bloomberg’s index of the US currency has still gained 2.6% this quarter.

The yen briefly extended losses after the central bank announced an unscheduled bond-buying operation. The country’s 30-year bond yield climbed to the highest since 2013 amid upward pressure on global yields.

Meanwhile, oil climbed, with Brent set for its best quarter since March 2022, following production cuts by OPEC+ linchpins Saudi Arabia and Russia.

In the US, dovish-leaning comments from one policymaker and weak consumer spending data helped stoke hope for some easing of the Fed’s messaging. Even if the US enters a recession it should be able to skirt a more severe downturn, according to Richmond Fed President Tom Barkin. Chair Jerome Powell sidestepped investor concerns over the outlook for interest rates at an event.

Key events this week:

- Eurozone CPI, Friday

- US consumer spending, wholesale inventories, University of Michigan consumer sentiment, Friday

- ECB President Christine Lagarde speaks, Friday

- New York Fed President John Williams speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 1:18 p.m. Tokyo time. The S&P 500 rose 0.6%

- Nasdaq 100 futures rose 0.2%. The Nasdaq 100 rose 0.8%

- Japan’s Topix index fell 0.8%

- Hong Kong’s Hang Seng Index rose 2.7%

- Australia’s S&P/ASX 200 Index rose 0.5%

Currencies

- The Bloomberg Dollar Spot Index fell 0.1%

- The euro rose 0.1% to $1.0578

- The Japanese yen was little changed at 149.43 per dollar

- The offshore yuan was little changed at 7.2921 per dollar

- The Australian dollar rose 0.5% to $0.6457

Cryptocurrencies

- Bitcoin fell 0.5% to $26,944.28

- Ether fell 0.3% to $1,651.16

Bonds

- The yield on 10-year Treasuries advanced two basis points to 4.60%

- Japan’s 10-year yield advanced one basis point to 0.765%

- Australia’s 10-year yield advanced six basis points to 4.51%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rob Verdonck and Abhishek Vishnoi.

(A previous version was corrected for mentioning Korean stocks when Korea is shut for a holiday)