More than four in 10 university graduates living outside London are doing jobs that do not require a degree, according to new research that lays bare a growing divide in the economic geography of the UK.

The analysis by the Institute for Fiscal Studies shows how an increasing concentration of high-skilled jobs in London is damaging the life chances of those who cannot afford to live in the British capital.

“The rise in high-skilled professional services jobs in the last 30 years has been very much focused on London, which means that graduates from other places need to move to reap the returns to their education,” said Xiaowei Xu, a senior research economist at IFS. “This is often not an option for those from poorer family backgrounds.”

“The current economic geography of the UK limits both social mobility and the effective use of talent across the country.”

The struggle to relocate to London for work also helps to explain the labor shortages that are holding back the British economy. Many sectors still have more vacancies than suitable candidates to fill them.

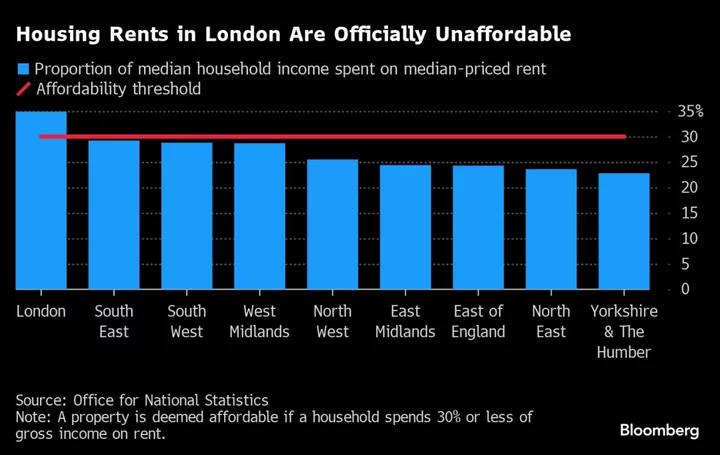

The IFS said its findings reflect the “hollowing out” of middle-paying occupations since the early 1990s, with low-paid services such as hospitality and high-paid services such IT and finance seeing the fastest growth. But while low-paid services have grown everywhere, high-end jobs have mainly emerged in London where housing costs are high, it said.

The proportion of university-educated workers outside London in non-graduate jobs has jumped from 31% in 1993 to 42% today. The share is highest in Lincolnshire and Cumbria in northern England, at 58% and 52% respectively. In London, it has remained stable at about 37%.

The gap underlines the challenge facing the winner of the next general election to spread prosperity from London and the South East to poorer parts of the country.

In a separate report, the Resolution Foundation said millennials — Britons born between 1981 and 1999 — have failed to close the living standards gap with earlier generations since the financial crisis, unlike their US counterparts.

In the UK, they have been hit by long-term pay stagnation and are earning no more than those born in the 1970s did at the same age, the think tank said. They are also less likely to be home owners and instead be living in high-cost, low-security private rented accommodation.

“Young people across advanced economies were hit by the financial crisis, putting a stop to decades of progress where each generation enjoyed higher living standards than their predecessors,” said Sophie Hale, the think tank’s principal economist. “Fifteen years on, this ‘crisis cohort’ are no longer young. And while many US millennials have bounced back, their counterparts in Britain are still wearing economic scars as they approach middle age.”