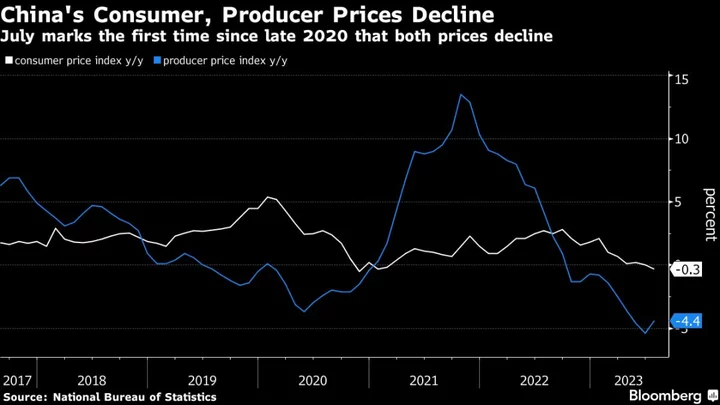

Stocks in Asia are set for a mixed open, with optimism that the US will be able to avert a first-ever default being tempered by evidence this week that China’s economic activity is losing steam.

Future contracts for Japanese shares advanced 1%, setting them on a course for their best week since October, after the S&P 500 hit a nine-month high on signals that American lawmakers are making progress on debt-ceiling talks. Australia’s benchmark is set to eke out a narrow gain, while Hong Kong’s is poised to drop about 1% after Alibaba Group Holding Ltd. sales disappointed, adding to signs that China’s post-Covid recovery is faltering.

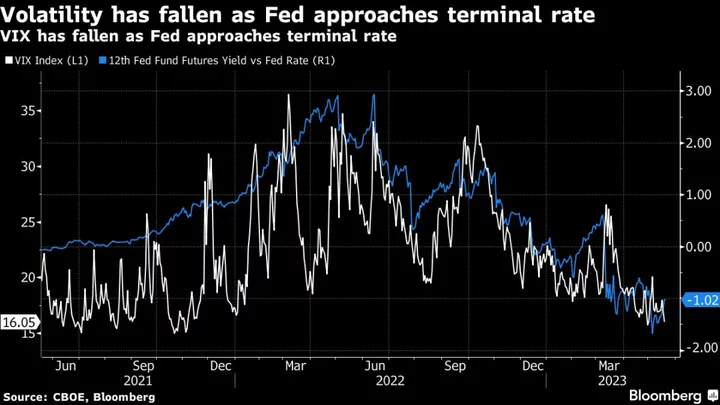

Treasury yields rose Thursday on speculation the Federal Reserve will need to keep interest rates higher for longer as inflation remains elevated, while a Bloomberg gauge of the dollar advanced the most in two months. Tech led the US stock rally, with the Nasdaq 100 gaining almost 2% to the highest since April 2022, while Wall Street’s fear gauge, the Cboe Volatility Index, tumbled.

House Speaker Kevin McCarthy and Senate Majority Leader Chuck Schumer are making plans for votes in the coming days on a bipartisan deal to avert a US debt default. Equities briefly pared gains Thursday after one key McCarthy ally, Financial Services Chairman Patrick McHenry, tempered expectations for a quick agreement, saying the two sides are “not close to being done.”

Treasury Secretary Janet Yellen told top bank executives that a failure to raise the debt ceiling would be “catastrophic” for the financial system, reiterating that the matter should be addressed without delay.

In Asia, the yen touched its weakest this year against the dollar amid receding speculation the Bank of Japan will deliver an early tweak to its yield-curve control policy. Volumes in Chinese shares on the mainland and Hong Kong are shrinking as the focus returns to the nation’s lackluster economy.

That has fed into commodities, with the Bloomberg Commodity Index set for a fifth weekly decline, the longest such streak since September. Oil has benefited from some of the risk-on sentiment, set for its first weekly advance in more than a month.

Fed Rate Bets

Meantime, traders amped up wagers on a June central bank hike to about 40% after Fed Bank of Dallas President Lorie Logan said the case for a pause next month is not clear. In contrasting remarks, central bank Governor Philip Jefferson outlined the dovish case for patience.

Treasuries sold off across the curve. The two-year bond yield, which is more sensitive to imminent Fed moves, approached 4.3%. The dollar closed at the highest since March, climbing against all of its developed-market peers.

The Fed is “in a really tough spot,” Katerina Simonetti at Morgan Stanley Private Wealth Management, told Bloomberg Television. “The big decision for them is the timing because once they announce that they’re done raising rates, markets are just going to assume that they’ve succeeded. And it might not necessarily be the case. Inflation so far is proving to be sticky.”

Friday’s OpEx

About $1.7 trillion of derivatives contracts tied to stocks and indexes are scheduled to expire Friday, according to data compiled by Goldman Sachs Group Inc. strategist John Marshall.

The monthly event, known as OpEx, typically obliges traders to either roll over existing positions or start new ones. That usually involves portfolio adjustments that lead to a spike in trading volume and sudden price swings.

Key events this week:

- Japan CPI, Friday

- ECB President Christine Lagarde participates in panel at Brazil central bank conference, Friday

- New York Fed’s John Williams speaks at monetary policy research conference in Washington; Fed Chair Jerome Powell and former chair Ben Bernanke to take part in panel discussion, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures rose 0.3% as of 7:19 a.m. Tokyo time. The S&P 500 rose 0.9%.

- Nasdaq 100 futures rose 0.4%. The Nasdaq 100 rose 1.8%

- Hang Seng futures fell 1.1%

- Nikkei 225 futures rose 1%

- S&P/ASX 200 futures rose 0.2%

Currencies

- The Bloomberg Dollar Spot Index rose 0.6%

- The euro was little changed at $1.0773

- The Japanese yen was little changed at 138.67 per dollar

- The offshore yuan was little changed at 7.0528 per dollar

- The Australian dollar was little changed at $0.6624

Cryptocurrencies

- Bitcoin rose 0.7% to $26,902.12

- Ether rose 1% to $1,813.86

Bonds

- The yield on 10-year Treasuries advanced eight basis points to 3.65%

Commodities

- West Texas Intermediate crude was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.