Indonesia’s central bank resumed raising interest rates, surprising the markets as it moved to help bolster the rupiah amid risks from a conflict in the Middle East.

Bank Indonesia increased its seven-day reverse repurchase rate by 25 basis points to a fresh four-year high of 6% on Thursday. The decision was predicted by just one of the 31 economists surveyed by Bloomberg, with all others expecting no change.

It’s the first rate hike since January, when policymakers said they had already done enough to guide inflation back to the 2%-4% target. While price gains are still under control, growing risks from a worsening conflict in Israel and Palestine nudged policymakers to action to support the local currency.

The financial market uncertainty needs a stronger policy response, Governor Perry Warjiyo said at a briefing on Thursday to announce the rate decision. The central bank expects Indonesia’s economic growth to still remain solid, supported by strong domestic consumption.

That marks a turnaround for Warjiyo, who had only on Oct. 6 seen rates on hold for a while in light of the strong dollar. Those comments were made before fighting erupted on Oct. 7, and shows how abruptly the calculus has changed for monetary authorities already grappling with higher-for-longer rates in the US and other developed markets.

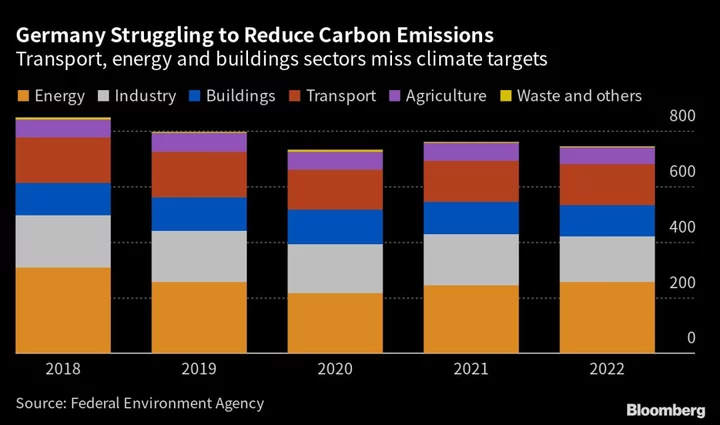

As fears of a broader Middle East conflict sends global oil prices higher and the El Nino dry spell hits food supplies, central banks across Asia have been reluctant to pivot so soon while the specter of inflation looms.

The rupiah has sunk 2.5% so far this month — the biggest loser in the region — adding to worries of imported inflation. Bank Indonesia had so far stuck to intervening in the FX market and sold rupiah securities to smooth out volatility and lure inflows.

Bank Indonesia will keep optimizing the rupiah securities to support stability in the local currency, the governor said, adding that authorities will ensure inflation remains manageable at 2%-4% this year.

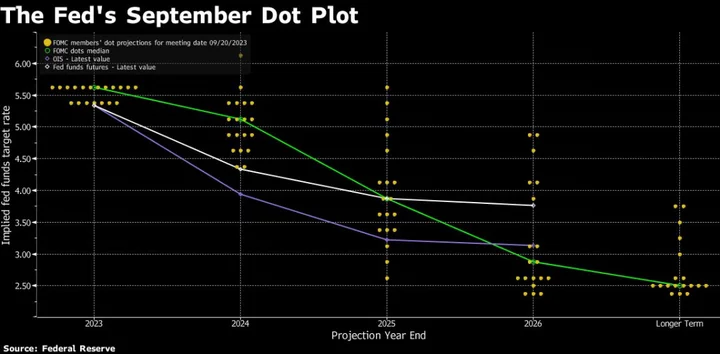

Also, should the Federal Reserve move again in November it would lift US rates at par with Indonesia’s, risking further selloffs from yield-hungry investors.

The central bank expects capital outflow pressures to persist in the fourth quarter, Warjiyo said.

As it stands, FX reserves were at a 10-month low in September, even before the renewed round of rupiah weakness this month. Interest in Bank Indonesia’s rupiah notes and export term deposits has likewise petered out, crimping the inflow of dollars into Southeast Asia’s largest economy.

--With assistance from Norman Harsono, Eko Listiyorini and Tomoko Sato.