By Elizabeth Howcroft

LONDON World stocks extended their gains on Friday, on track for their biggest weekly rise this year, while the dollar held near 15-month lows as investors bet that the U.S. Federal Reserve was nearing the end of its rate-hiking cycle.

Data on Wednesday showed U.S. consumer prices growing at their slowest pace in more than two years, then on Thursday data showed the smallest increase in U.S. producer inflation in nearly three years.

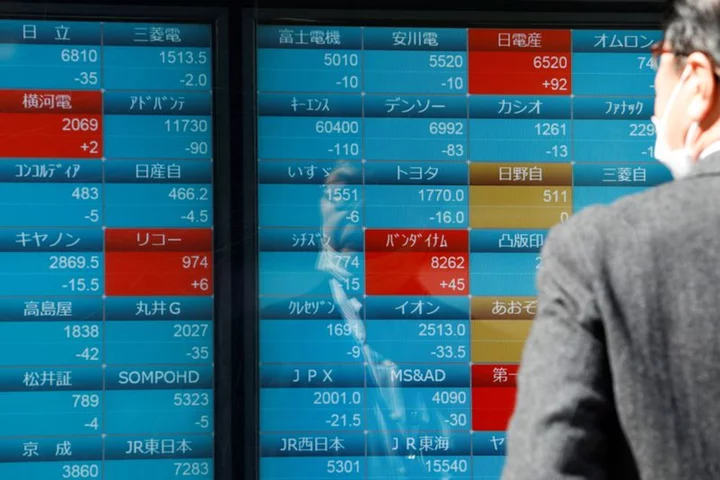

As investors bet on a milder inflation outlook, the MSCI World Equity index rose to its highest so far this year. It has seen gains every day this year and on Friday was up 0.2% on the day, on track for its best week since November 2022.

European stock indexes were mostly higher, with MSCI's Europe index up 0.2% and London's FTSE 100 up 0.1%. But the STOXX 600 was flat on the day, but still on track for its best week since March, and Germany's DAX was down 0.3%, also pulling back on recent gains.

Money market traders still expect the Fed to raise rates by 25 basis points on July 26, but they have reduced the chances of another this year.

Norman Villamin, chief group strategist at UBP, said he expected another Fed rate hike in July, but that the September meeting was more uncertain.

"We're probably closer to the end of the cycle," he said, although he added that above-target inflation is still expected to persist in the longer term.

"Getting the 3% (inflation reading) is one thing, getting back to 2% is going to be a much harder task," Villamin said. "That puts a floor on how low bond yields can go again."

Another factor cited by UBP's Villamin for the equity market rally has been a swell of liquidity from the Federal Reserve system.

The Fed's reserve repo account, which is where eligible firms can park cash at the central bank in exchange for risk-free return, stands at $1.8 billion, down from $2.3 billion at the end of April, according to Refinitiv data, indicating $500 billion of liquidity has come back into markets in that time.

The U.S. dollar index was at 99.786, holding near the 15-month low of 99.574 hit earlier in the session and set for its biggest weekly decline since November. The euro was steady at $1.1231, having earlier touched its highest in more than 16 months.

Meanwhile the Swedish crown was set for its biggest weekly gain against both the dollar and euro in 14 years.

Euro zone government bond yields were mostly lower, with the benchmark German 10-year yield at 2.454%.

Oil prices were a touch higher, helped by bullish sentiment over U.S. demand. Brent and WTI futures were both up by 0.1%.

Gold was on track for its best week since April, also helped by dollar weakness and boosted by expectations for the end of U.S. interest rate hikes.

Investor attention now turns to U.S. bank earnings, which begin with JPMorgan Chase, Citigroup, Wells Fargo and BlackRock reporting second-quarter results later on Friday.

(Reporting by Elizabeth Howcroft, Editing by William Maclean)