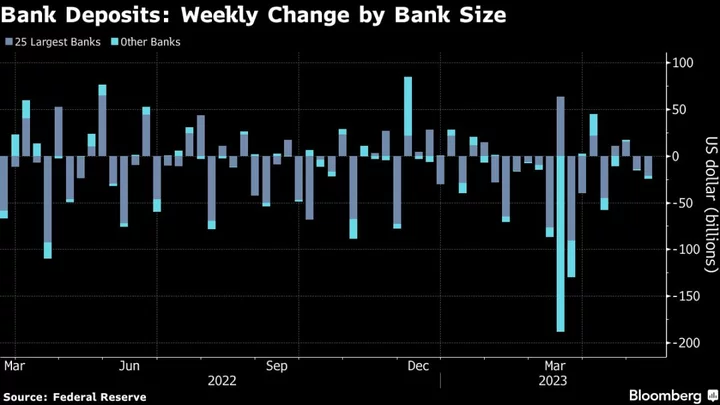

US bank deposits fell for a third week to the lowest level in nearly two years, extending a yearlong slide as customers continue seeking higher returns in money-market funds. Lending was little changed.

Deposits at commercial banks decreased by $26.4 billion in the week ended May 10 to $17.1 trillion, according to seasonally adjusted data from the Federal Reserve out Friday. The drop was mostly at large banks. On an unadjusted basis, deposits slid $57 billion after rising $66.5 billion in the prior week.

Commercial bank lending eased $3.3 billion on a seasonally adjusted basis. On an unadjusted basis, loans and leases fell $17.4 billion.

To gauge credit conditions, economists are closely monitoring the Fed’s so-called H.8 report, which provides an estimated weekly aggregate balance sheet for all commercial banks in the US. In recent months, multiple US banks, with combined domestic assets exceeding $500 billion, have failed.

Deposits at large banks decreased $21.6 billion, constituting the lion’s share of the latest weekly decline.

The Fed’s report showed residential real estate loans declined a seasonally adjusted $2.6 billion, while lending for commercial properties rose slightly. Consumer loans also ticked up from the prior week, while commercial and industrial loans fell $3.5 billion.

The biggest 25 domestic banks account for almost three-fifths of lending, although in some key areas — including commercial real estate — smaller banks are the most important providers of credit.

The report is primarily based on data reported weekly by a sample of about 875 domestically chartered banks and US branches of foreign-related institutions.

For a list of banks which have failed since Oct. 1, 2000, click here

For a list of commercial banks ranked by assets, click here

(Adds graphic)