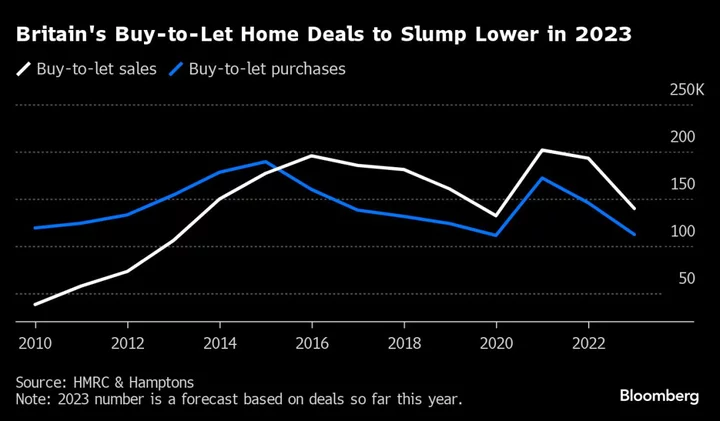

Britain’s buy-to-let property deals are slumping as cautious buyers retreat and landlords endure the highest interest rates in 15 years.

Buy-to-let investors are on track to sell about 140,000 homes in Britain this year, roughly 53,000 fewer than in 2022, according to a report from broker Hamptons International. Despite the slowdown in sales, landlords are still letting go of more homes than they’re buying.

“Strong rental growth is softening the blow, but they’re also drawing on their equity and cash reserves to see them through,” said Aneisha Beveridge, head of research at Hamptons. “Portfolio investors — who tend to be more highly leveraged — are juggling their assets by selling one or two properties to reduce their mortgage debt on the rest of their portfolio, rather than selling up entirely.”

Read more: More Buy-to-Let Borrowers Are Struggling After UK Rate Rises

UK households are facing pressures on multiple fronts, triggered by pricey mortgage rates and the worst cost-of-living crisis in a generation. Meanwhile, tenants are bearing the brunt of the turmoil as landlords — whose interest-only mortgages are particularly exposed to rate hikes — either sell up or hike rents to deal with extra costs and stricter regulation.

That’s contributing to a decline in new rental investment, according to Hamptons. Landlords bought 11.2% of all homes sold in Britain between January and September, representing the lowest number of buy-to-let properties purchased during those months since at least 2010, barring the first three quarters of 2020.

Landlords have been selling more homes than they bought in every year since 2016 after changes to tax and regulation were introduced. Hamptons estimates that by the end of 2023 individual landlords will have sold 294,300 more homes than they’ve bought since then.

The consequence for tenants is 43% fewer rental properties available in Britain during the first 10 months of this year compared to the same period in 2015. In London, where landlords have bought only 9% of homes sold this year, supply has halved relative to 2015 levels, according to the data.

That’s causing tenants’ bills to surge, with average rent on a newly let home in Britain rising almost 12% year-on-year to £1,345 in October. This marked the third consecutive month of double-digit increases.

Read more: Rich Investors Swoop In as Britain Squeezes Small Landlords

Still, so-called build-to-rent schemes — which typically offer professionally managed flats run by rich investors — are filling some of the gap left by private landlords, the report said. What’s more, many buy-to-let investors aren’t reliant on debt, keeping them insulated from higher borrowing costs.

“Most landlords cashing in are one of the 10%-20% of mortgaged investors who face making losses when remortgaging at higher rates,” Hamptons’ Beveridge said. “Typically, they bought low-yielding properties in the south of England relatively recently or they’ve been aggressively maximising their leverage and extracting equity to grow their portfolio.”