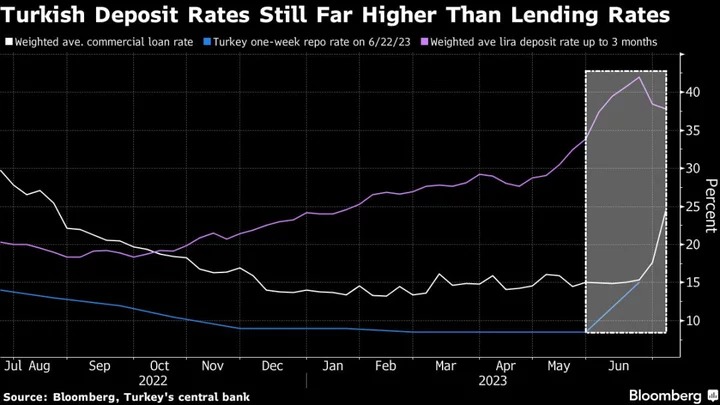

Turkish savers still get far higher interest on deposits than lenders charge for commercial credit, an anomaly that’s likely to persist with the central bank set to slow its already “gradual” monetary tightening.

The poor transmission of higher interest rates into the economy is an added challenge for a new team of policymakers installed by President Recep Tayyip Erdogan and now trying to undo years of unorthodoxy.

The legacy of measures that created incentives for banks to attract lira deposits while suppressing lending costs means rates are still lacking an anchor.

The average yield on lira deposits for up to three months of maturity is down from a two-decade peak of almost 42% in June but still hovers near 38% — more than double the central bank’s benchmark.

Meanwhile the weighted average interest on commercial loans has grown by over 9 percentage points to 24.5% in the two weeks since the central bank hiked rates on June 22, according to the latest available data.

Read more: Turkey Deposit Rate Near 40% vs. 15% Lending Rate Needs a Fix

The negative gap between lending and deposit rates that first opened up about nine months ago has started to narrow but still hinders the monetary transmission mechanism, according to Bloomberg Economics. Concerns over financial stability in Turkey and fiscal risks are among constraints on the central bank.

What Bloomberg Economics Says...

“Deposit rates are still far higher than lending rates, likely to hinder lending appetite. The central bank’s recent tightening in the main lever and easing in securities maintenance rules have narrowed the gap and we expect the central bank to further unwind its regulations and practices inhibiting the transmission mechanism.”

— Selva Bahar Baziki, economist. Click here to read more.

The aberration in rates is here to stay as the central bank moves slowly to dismantle policies blamed for chronic trade imbalances and an inflation crisis last year.

After June’s “first step” in a cycle of rate increases — when policymakers raised the benchmark by 650 basis points to 15% — their next hike this week may be around half as big, according to most economists surveyed by Bloomberg.

Gaining more sway over the cost of money in the $900 billion economy has been top of mind for Governor Hafize Gaye Erkan as she prepares for her second meeting in charge of the central bank.

According to minutes of the Monetary Policy Committee’s discussions in June, it moved toward simplifying rules after concluding “the current micro and macro-prudential framework fell short of supporting the macro-financial stability and distorts the functionality of market mechanisms.”

Among the requirements being eased is the so-called “securities maintenance ratio” that encouraged savings in the local currency.

“The effectiveness of monetary policy transmission will likely be boosted by the recent simplification of prudential regulations,” said Farooq Pasha, an economist at Standard Chartered Plc. “We therefore expect the gap between deposit and lending rates to continue to narrow on further monetary tightening.”

--With assistance from Harumi Ichikura.