Turkey’s central bank hiked interest rates by double the amount markets expected on Thursday, bolstering the lira.

The Monetary Policy Committee raised the benchmark one-week repo rate by 500 basis points to 40%. The expectation was for an increase of 250 basis points and the currency extended gains after the decision.

The MPC, led by Governor Hafize Gaye Erkan, signaled it would slow the pace of tightening from now. It’s lifted rates by more than 30 percentage points since President Recep Tayyip Erdogan was re-elected in May, reversing years of loose fiscal and monetary policies that were blamed for enabling inflation to soar and scaring foreign investors away.

“The current level of monetary tightness is significantly close to the level required to establish the disinflation course,” the MPC said in a statement. “Accordingly, the pace of monetary tightening will slow down and the tightening cycle will be completed in a short period of time.”

“The monetary tightness will be maintained as long as needed to ensure sustained price stability,” it added.

The Turkish lira was up 0.3% at 28.76 per dollar as of 3 p.m., after initially rising as much as 0.8% on the decision. Banking stocks led gains on the Borsa Istanbul.

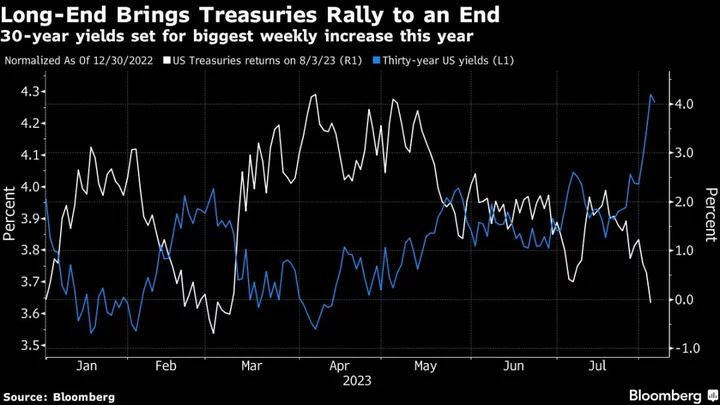

Yields on two-year sovereign bonds jumped more than one percentage point. The country’s credit default swaps, used to protect bond payments over five years, erased their increase for the day.

TURKEY REACT: Oversized Rate Hike Signals More Increases Coming

With its sixth straight rate hike since June, the central bank is turning another corner in ending an era of cheap money. Real rates are now in positive relative to projected inflation at the end of 2024, a gauge that’s preferred by policymakers when talking about monetary tightening. The central bank sees inflation at 36% in annual terms by then.

Thursday’s decision will resonate with a market that’s increasingly sensing an opportunity for outsized returns if Turkey stays the course with the makeover of economic policies in recent months.

The extra tightening underscores how the central bank’s “geared toward reinstalling investor confidence in the institution as well as Turkish assets,” said Simon Harvey, London-based head of foreign-exchange analysis at Monex, a currency dealer. “This outcome should keep the pace of lira depreciation moderate.”

The currency’s down almost 35% against the dollar this year. That’s one of the worst performances globally, but largely down to the central bank reducing some interventions that investors said left the unit heavily overvalued.

Still Vulnerable

Some of the world’s largest investors such as Amundi SA had said they were looking for a rate increase to at least 40% before pouring money back into local debt markets. Erkan will hold investor talks in New York in January in a bid to encourage such moves.

Despite the tightening, the lira remains vulnerable with year-on-year inflation at 61% at the latest reading in October.

Thursday’s move indicates “the pressure on the currency is bigger” than admited by policymakers, said Viktor Szabo, investment director for emerging markets debt at Abrdn. “Carry is really high, but so is inflation, and it’s hard to tell how much further adjustment in the exchange rate is needed.”

Carry Traders Who Got Burned in Turkey Are Dusting Off Old Tools

Still, the symbolic milestone of achieving positive real rates by at least one indicator hinges on the accuracy of the official outlook, which is more upbeat than the views of many economists and the central bank’s own survey of expectations.

And with local elections slated for March, another takeaway for investors is that the pace of Turkish rate hikes is expected for a downshift. Erdogan is keen to win back major cities such as Istanbul and Ankara and may want lower borrowing costs for Turks around the time of the vote.

Erkan has declined to say when she expects rates to turn positive relative to current inflation. She became governor in June, just after Erdogan appointed Mehmet Simsek, a former Merrill Lynch bond strategist, as his new finance minister.

The MPC said it would continue making “quantitative tightening decisions” to support rise in the repo rate. Under similar previous guidance, the central bank tightened reserve requirements for the lira to mop up liquidity in the interbank market.

Subsequently after the decision, the central bank announced three separate decisions that are expected to mitigate some impact of interest rate hikes on citizens and export-oriented businesses, including unchanged maximum interest rate on credit card expenditure until the end of the year.

--With assistance from Srinivasan Sivabalan, Tugce Ozsoy and Ugur Yilmaz.

(Updates with analyst commentaries, central bank’s decision, updated market metrics.)