Traders betting the Bank of Canada will raise its benchmark interest rate on Wednesday are already scanning the horizon for signs the economy will slump and drag down the nation’s currency with it.

Foreign-exchange strategists, including those at Macquarie and Nomura International, are predicting a roughly 4% decline for the loonie by year end from current levels. A volatile housing market and competition for foreign investment with its closest neighbor, the US, are among the forces likely to tip the currency lower.

The Canadian dollar has been able to eke out a more than 2% advance against the greenback in the first half of 2023. In contrast, a slowdown in Toronto’s housing market after the central bank’s surprise rate hike in June and a May consumer price reading which rose by the smallest amount since 2021 could help cap future BOC increases and in turn the loonie.

“Our bearish view for the second half 2023 remains predicated on the prospect that Canada will suffer a more severe slowdown than the US,” said Thierry Wizman, global currencies and interest rate strategist at Macquarie Futures USA.

The impact of Canada’s rate increases, particularly within the housing market, are likely to come with a lag, he added.

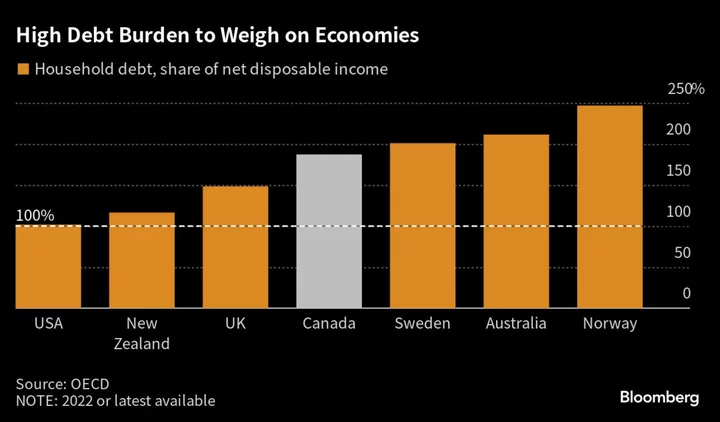

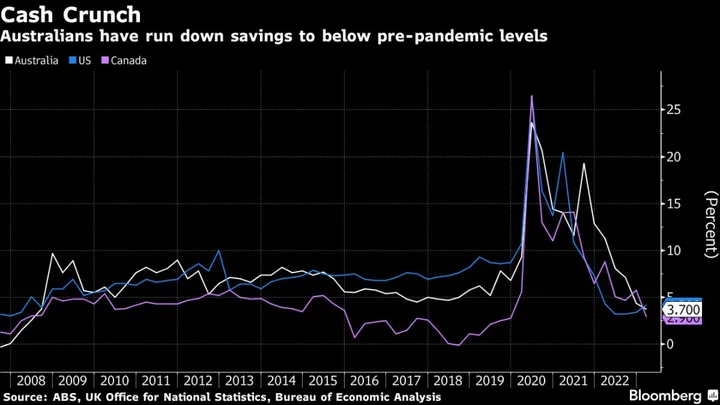

“The rise in rates has already happened and households will begin to feel the squeeze as fixed-rate mortgages are rolled over at higher rates,” Wizman said. “Until now, this effect has been delayed as banks try to extend durations on new mortgages to lighten the payment burden for households that are overly indebted. But this has its limits.”

He expects the loonie to fall to 1.38 per dollar by year end, a view echoed by the Royal Bank of Canada. The Canadian currency traded around 1.32 per greenback on Wednesday, nearly 1% off of its June highs.

Nomura International’s 1.37 target is similar. “US economic resilience will ultimately adversely affect CAD,” strategists Jordan Rochester and Yusuke Miyairi wrote in a recent note. “The latest inflation print is unlikely to encourage the BOC to rush and deliver an additional hike in July,” they said.

Key to the currency’s outlook is the rate differential between US and Canada, typically a solid guide to the loonie’s value. Should US growth outpace that in Canada, it is likely Fed rates will stay higher for longer relative to the BOC’s.

Economists are widely expecting Canada’s rate to rise by another 25 basis points on Wednesday before being capped at 5% when Governor Tiff Macklem ends his tightening campaign. Meanwhile, swaps traders have priced in 16 basis points of rate increases at the meeting, with the odds of a hike rising to just shy of two in three.

On Monday, a trio of Federal Reserve officials said that higher rates will be needed to reach the central bank’s 2% inflation target. A report Wednesday, however, showing price levels eased more than estimated in June sent Treasury yields down sharply as traders priced in lower expectations of Fed hikes later this year.

There are also signs the Canadian economy still has steam.

Labor market data released Friday came in triple the estimates of economists, with the economy adding roughly 60,000 jobs even as wage growth moderated. While Canada’s April GDP reading came in flat, lower than projected, the economy is expected to have grown by 0.4% in May. Economist expectations of a recession, meanwhile, in Canada have been continuously pushed back as the nation proves more immune to higher rates.

(Updates to include US inflation data, new currency and rate levels, and updated charts)