Sri Lanka is taking an unfavorable view toward a proposal by foreign dollar bondholders for restructuring its debt, signaling possible complications in negotiations that are key for accessing further funding to support its economic recovery.

“This proposal has not received a favorable response from Sri Lanka,” the Ministry of Finance said in an official statement, referring to a suggested plan released by the bondholder group last week. The proposal included a 20% haircut and new macro-linked bonds which would adjust payout depending on macroeconomic outcomes.

“The authorities and their advisors intend to take the necessary time to consider the proposal and assess its compatibility with parameters in Sri Lanka’s IMF-supported program,” the statement said. Sri Lankan officials and creditor nations have been batting for the need for comparable and fair treatment in the debt recast process.

“The authorities have already expressed to the bondholders’ advisers their serious reservations about the construct of the macro-linked bonds proposed by the group,” the statement added. Bondholders have diverging views on growth and exchange-rate trajectories projected under the International Monetary Fund program.

Disagreement between the authorities and investors over the terms of restructuring poses a risk to further funding from the IMF, essential to keeping a recovery in the island nation’s economy on track. Junior Finance Minister Shehan Semasinghe said Wednesday that authorities are assessing debt restructuring terms from foreign holders of its dollar bonds.

After concluding domestic debt restructuring and agreeing a tentative deal with the Export-Import Bank of China in recent weeks, the focus for Sri Lanka is on securing agreements with dollar bondholders and other official creditors. Sri Lanka has invited bondholders to further engage with the nation’s debt advisers, while suggesting a value-recovery instrument “if structured appropriately, taking into account the position of other creditors.”

Value recovery instruments would “provide larger debt relief upfront but provide higher payouts if the country outperforms stated targets.” said Avanti Save, credit strategist at Barclays. Macro-linked bonds on the other hand would increase the amount of debt relief for Sri Lanka if particular macroeconomic targets are not hit, she said, adding that “the quick response suggests keenness to move ahead with restructuring.”

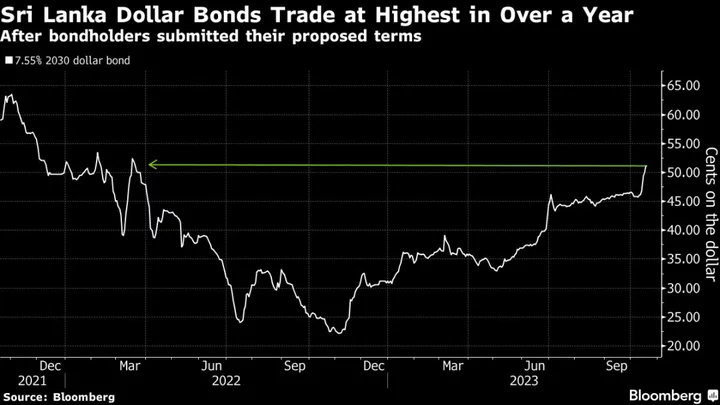

Sri Lanka’s 7.55% 2030 dollar reversed early gains to fall one cent to 49 cents on the dollar , while a 5.75% 2023 dollar bond dropped about two cents to 50.8 cents on the dollar, snapping a week of gains, according to indicative pricing compiled by Bloomberg.

(Adds comment in para 7 and detail in para 6, market reax in last para)