South Africa is poised to lift interest rates for a 10th straight meeting to alleviate pressure on the rand fueled by government policy missteps that may lead the central bank to revise its inflation forecasts higher.

Most economists’ estimates in a Bloomberg survey is for a 50-basis point increase to 8.25%, with expectations ranging from 25 to 75 basis points. The vote-split prediction suggests three members of the monetary policy committee will back a half-percentage point hike, with two preferring a quarter-point increase.

Forward-rate agreements used to speculate on borrowing costs show traders are less certain that a 50 basis-point increase is a done deal after softer-than-anticipated inflation data on Wednesday. They’re pricing in an 81% chance for such a move. An increase of that size would be the first back-to-back 50 basis-point hikes in 15 years, when the fallout from the global financial crisis weighed on the local currency.

Daily power outages, logistical constraints, the recent gray listing of the country by the Paris-based Financial Action Task Force and allegations by the US that Pretoria supplied weapons to Russia have all fed into recent rand weakness. Had it not been for factors like the persistent blackouts, South Africa would have had lower inflation and stronger economic growth over the past year, Governor Lesetja Kganyago said on May 10.

Read More: South Africa Is its Own Worst Enemy, Central Bank Governor Says

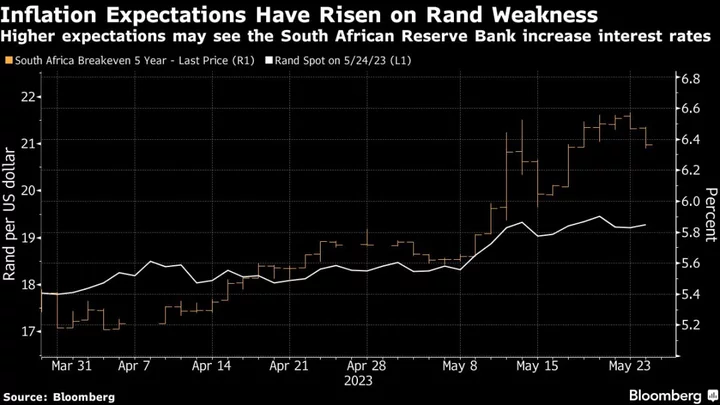

The rand has depreciated more than 7% since the MPC’s previous meeting on March 30, making it the second-worst performing emerging-market currency against the dollar after Argentina’s peso, of those tracked by Bloomberg.

The currency’s volatility and the potential for that to be reflected in higher inflation expectations will likely sit uncomfortably with the South African Reserve Bank, said Standard Chartered Bank Chief Economist for Africa and the Middle East Razia Khan. She forecast a 50 basis-point hike.

An increase of that size will add pressure to consumers already struggling to deal with double-digit food inflation and rising medical costs.

“The price of our foreign policy, our economic policy and failing state resources is that borrowers will have to pay almost 1% of the value of their mortgages as interest every month,” Nolan Wapenaar, co-chief investment officer at Anchor Capital, said in a research note. “Businesses will close, and jobs will be lost.”

The central bank has already trimmed its economic growth forecast for this year to 0.2% because of factors including the power outages, which it estimates will shave 2 percentage points off output growth. It may rein in that projection again on Thursday.

The interest-rate decision will be announced during a televised briefing that starts at 3 p.m. local time. Kganyago will also give the voting breakdown and updates of the central bank’s forecasts, including for inflation, rates and economic growth.

The MPC has increased interest rates by 425 basis points since November 2021 to rein in inflation that’s been above the 4.5% midpoint of the target range at which it prefers to anchor price-growth expectations for two years. Its March forecasts showed headline inflation reaching the middle of the target range only in 2025.

--With assistance from Simbarashe Gumbo and Rene Vollgraaff.