Stocks in Asia fell Wednesday as investors await consumer and producer price data from China that’s projected to show ongoing weakness.

Shares in Japan opened lower while futures contracts for Hong Kong slipped 0.3% and Australian stocks were mostly flat. A gauge of US-listed Chinese stocks dropped 2.4% after a larger-than-forecast slump in trade data increased concerns over the world’s second-largest economy. Problems at Country Garden, once China’s largest developer, are adding to the gloom.

US equity futures were little changed in early Asian trading after shares trimmed losses on Tuesday as dip buyers emerged following a slide driven by worries about the financial system and the economy.

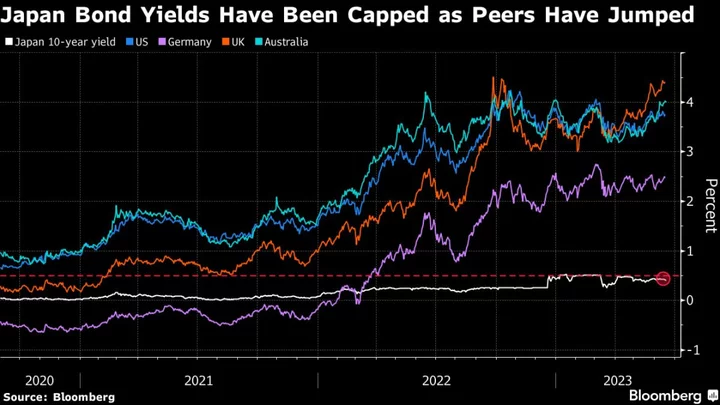

Australian and New Zealand government bond yields fell after a rally in Treasuries on Tuesday, helped by a well received three-year note auction. The dollar was steady in a muted start to currency trading after touching its highest level in over a month in the prior session amid haven demand on worries over everything from China’s outlook to the health of US and Italian banks.

The equity declines on Wall Street waned in afternoon trading, with the S&P 500 finishing down by 0.4%. Apple Inc. halted its longest losing streak this year. Eli Lilly & Co. led gains in health-care companies after sales of its weight-loss treatment blew past expectations and a new study raised the prospect that its drug could benefit heart disease as well. Banks fell as Moody’s Investors Service downgraded 10 small and midsize American lenders and said it may do the same with a handful of major firms.

The recent “orderly” pullback in US stocks has reduced the risk of a chaotic selloff and reduced some of the short-term positioning risk that has been a worry for investors, according to Chris Montagu, a strategist at Citigroup Inc.

After the closing bell came news that Walt Disney Co.’s ESPN has signed a long-term exclusive partnership for sports betting with Penn Entertainment Inc., a regional casino operator. Shares in WeWork Inc. fell 25% in post-market trading after the company said there was “substantial doubt” about its ability to continue operating, citing sustained losses and canceled memberships to its office spaces.

Treasury 10-year yields dropped to around 4% in Asian trading. Tuesday’s $42 billion sale of three-year notes produced a lower-than-expected yield, a sign that demand was stronger than anticipated.

Just a few days before a key inflation report, investors also waded through remarks from central bank officials.

Fed Bank of Philadelphia President Patrick Harker said the central bank may be able to cease rate hikes, barring any surprises in the economy, though rates would need to stay at their current elevated levels for some time. Harker also noted that “sometime probably next year, we’ll start to bring the interest rates down.” His Richmond counterpart Thomas Barkin argued it was too soon to say whether another an increase in September would be appropriate.

Oil edged lower Wednesday after a rebound Tuesday as Ukrainian President Volodymyr Zelenskiy said his country would retaliate if Russia continues to block its ports. Copper — a barometer of the global economy — slid on the disappointing Chinese trade figures.

Key events this week:

- China CPI, PPI, Wednesday

- India rate decision, Thursday

- US initial jobless claims, CPI, Thursday

- Atlanta Fed President Raphael Bostic pre-recorded remarks for employment webinar, Thursday

- UK industrial production, GDP, Friday

- US University of Michigan consumer sentiment, PPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 9:20 a.m. Tokyo time. The S&P 500 fell 0.4%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 0.9%

- Hang Seng futures fell 0.3%

- Japan’s Topix fell 0.3%

- Australia’s S&P/ASX 200 rose 0.1%

- Euro Stoxx 50 futures fell 1.2%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0961

- The Japanese yen was little changed at 143.27 per dollar

- The offshore yuan was little changed at 7.2368 per dollar

- The Australian dollar was little changed at $0.6538

Cryptocurrencies

- Bitcoin fell 0.6% to $29,815.8

- Ether fell 0.3% to $1,858.08

Bonds

- The yield on 10-year Treasuries declined two basis points to 4.00%

- Australia’s 10-year yield declined four basis points to 3.97%

Commodities

- West Texas Intermediate crude fell 0.1% to $82.81 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.