A rally in the ruble that’s propelling it toward the strongest since July is the latest piece of Russia’s economic jigsaw to fall into place before a widely expected tilt by Vladimir Putin at another presidential term in March elections.

The currency’s reversal of fortunes since early October has brought it to around 90 per dollar, a level near to the average for next year forecast by the Economy Ministry. The recent appreciation was among the key factors that acted as a check on inflation, according to Bloomberg Economics, which now expects a slowdown after price growth likely peaked in September.

The exchange rate has increasingly emerged as a barometer of the economy’s health amid sweeping international sanctions as Russia closes in on two years of its war against Ukraine. It’s also a critical variable for a budget that will allocate more on the military next year than toward any other single item.

Dragged down by plummeting export proceeds and heavy government spending, the ruble in October briefly hurtled past the psychologically important level of 100 per dollar. The depreciation has spurred the central bank to double official borrowing costs so far this year to 15%, including an emergency interest-rate hike in August.

But setbacks didn’t stop until the government clawed back more dollars by restoring some capital controls on major exporters. It was a decision made because Russia needed “the ruble a little stronger,” Putin said last month.

Buoyed by the stiffer restrictions, alongside rate hikes and crude around $80 a barrel, the ruble is the world’s best performer against the dollar since early October. It’s gained over 4% so far this month versus the US currency.

The challenge now is to find a sweet spot for the ruble’s value that holds off inflationary pressures without cutting into government revenues.

Under the Economy Ministry’s latest outlook that’s used to calculate the budget, the Russian currency is expected to average 90.1 per dollar in next year’s baseline scenario. Thanks in part to bigger inflows of hard currency, it projects gains through the first half of 2024 before the exchange rate stabilizes at 90-92 from mid-year.

The view is broadly in line with expectations in the market. The currency may continue to advance to 85, but it’s likely to slip back to the 90-95 range early next year under pressure from sanctions and geopolitics, according to Iskander Lutsko, chief investment strategist at ITI Capital Ltd.

What Bloomberg Economics Says...

“Recent ruble strength, tighter credit conditions and the government’s increasing grip on fuel prices will mean that inflation likely peaked in September at an annualized rate of around 14% and will come down to 9.4% in October..”

—Alexander Isakov, Russia economist. Click here to read more.

Barclays Plc predicts the ruble at 90 per dollar this quarter and the subsequent six months. “On balance, we expect recent policy rate hikes will curb local demand, limiting imports, while the recent rise in the price of Urals should help to stabilize the ruble,” said Marek Raczko, foreign currency strategist at Barclays in London.

Read more: Russia’s Cash Inflow Gains Momentum as Oil Exports Recover

The negative impact of factors such as companies using local notes to replace eurobonds, major debt redemption by the state or corporate buyouts of non-residents has also lessened, according to Evgeny Suvorov, chief Russia economist at CentroCredit Bank.

“There’s no need to expect a significant decline in the ruble before March,” he said.

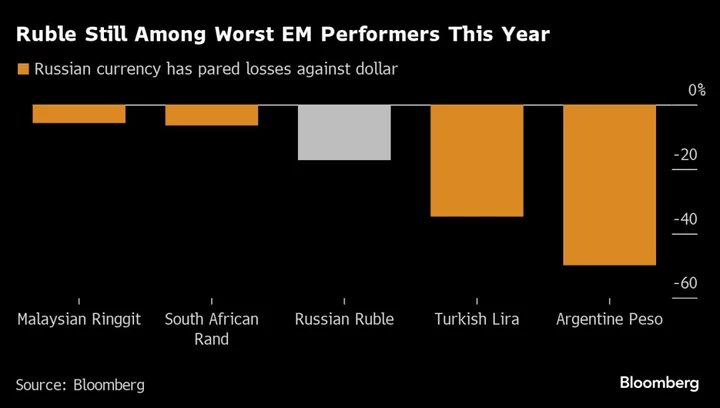

The currency remains about 17% down against the dollar this year even after paring losses. Other emerging market assets also perked up this week, as US inflation figures stoked bets the Federal Reserve’s hiking cycle is over and economic data from China helped boost risk appetite.

The ruble was significantly undervalued in the summer but benefited from an improving outlook for raw materials, increased export prices and a decrease in imports, according to Sofya Donets, an economist at Renaissance Capital in Moscow. Fundamentally it should be in the region of 85 per dollar, she said.

“Will the ruble be able to go there and strengthen? We are still cautious,” she said. “At the end of the year we believe there will be 90 rubles per dollar due to ongoing capital outflows.”