Australia’s central bank chief Philip Lowe said monetary policy has now entered a “recalibration phase” under which the board will likely only need to make small adjustments in response to data.

Speaking in his final semi-annual testimony as Reserve Bank governor at Parliament House in Canberra on Friday, Lowe said policymakers are keeping their options open on further tightening as they assess which way services prices and household consumption break.

“It’s really only been roughly this year where policy has moved into restrictive territory and we’re still seeing the effects of that,” Lowe told lawmakers. “I see we’re really now in the third phase and it’s the calibration phase.”

“We’re kind of in a world where we’re just making I hope small adjustments to calibrate policy,” he said, underscoring the higher hurdle to raising interest rates further after 4 percentage points of hikes in 16 months.

Lowe is trying to cool prices while holding onto significant job gains in recent years and remains uncertain about how much cash consumers have to keep spending.

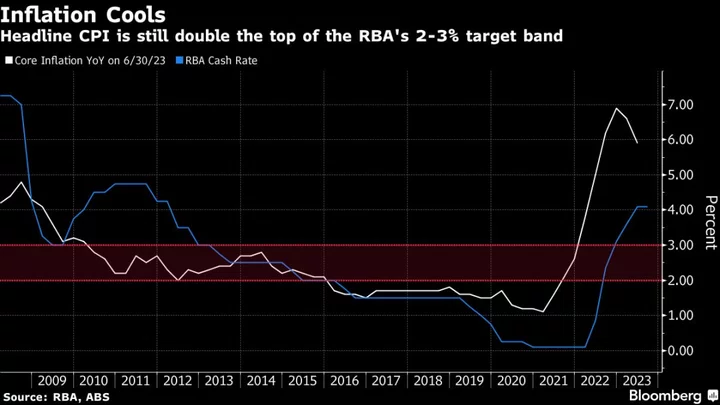

The RBA paused at its past two meetings at a cash rate of 4.1% amid signs of cooling inflation. Consumer-price growth remains twice the top of the 2-3% target.

“With inflation having been significantly above target for some time now, the board wants to have reasonable confidence that inflation will return to target over the current forecast period,” Lowe said in his opening remarks. “We will do what is necessary to achieve that outcome.”

The RBA forecasts inflation to fall back within its target in late 2025.

The governor has put the central bank in data-dependent mode when it comes to policy. The RBA is monitoring household spending, the outlook for inflation and the domestic and global economies.

“One related concern is that persistent high inflation could see inflation expectations adjust upwards,” he said. “The longer inflation stays high, the greater the likelihood that businesses and workers will come to doubt that inflation will return to target and, in response, they will adjust their behaviour.”

Lowe’s appearance comes just over a month before his deputy Michele Bullock takes the helm at the RBA. It will be the first time since the announcement of her promotion to the top job that Bullock will speak in public on policy. Her words will be closely scrutinized by traders and economists alike.

Lowe faced a mounting backlash over the RBA’s communications during the current tightening cycle, the most aggressive in more than three decades. He’s apologized for initially signaling that rates would remain at a record low until 2024 but has brushed aside other criticism as “noise” that comes with any tightening cycle.

Money markets reckon the RBA is likely done tightening, with only a small chance of a hike seen by early next year. Economists’ median estimate is for one more rate increase for a peak of 4.35%.

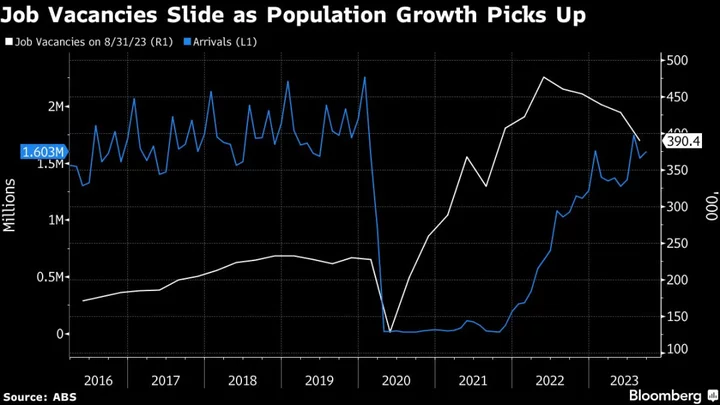

Labor market strength has been a key reason why the central bank anticipates Australia can avoid a recession. But there are now signs of a slowdown with three consecutive quarters of falling retail sales volumes, consumer sentiment at “deeply pessimistic” levels and job vacancies coming off a peak.

(Adds comments from Q&A.)