Pakistan investors are bracing for a sudden jolt as former premier Imran Khan’s showdown with the powerful military, and the government, reaches a tipping point.

Warnings of a massive drop in the rupee are flaring up, with some analysts forecasting another 20% decline is possible. Heightened tensions after Khan’s arrest last week may push an International Monetary Fund’s $6.7 billion bailout further out of reach, with bond managers staring at the specter of a sovereign default.

Khan, who was later released by the top court, is challenging the military’s influence in politics and pushing the government to hold early elections. Risks are rapidly increasing for investors as the upheaval is a potent reminder of the nation’s history with three coups since 1958, while an apparent assassination attempt on the 70-year-old politician in November underscored that violence may intensify.

“To be invested in Pakistan means you should be prepared for bigger risks,” said Edwin Gutierrez, head of emerging-market sovereign debt at abrdn plc, a long-time investor in the nation. “Black swans are a bigger probability.”

Moody’s Investors Service said this month the nation may default after June if it fails to secure IMF funding. In February, the company downgraded Pakistan’s sovereign credit rating to an all-time low. Pakistan’s external debt service is estimated at about $22 billion for fiscal year 2024, which begins in July, according to Columbia Threadneedle Investments, about five times the nation’s foreign-exchange reserves.

Bond investors are growing more nervous, with the extra yield they demand to hold Pakistan’s dollar bonds over US Treasuries climbing above 35 percentage points to a record this month. Pakistan’s dollar bonds are trading at distressed levels, with notes due in 2031 quoted at about 34 cents on the dollar.

The rupee slid to a record-low 299 per dollar at close last week and ended at 285.6 on Thursday. The currency has lost about 20% this year, among the worst performers in the world.

Khan said he fears another arrest after police surrounded his home in Punjab province on Wednesday, stoking concerns of a repeat of the violent clashes last week. Authorities now say they intend to search his home for supporters who were suspected of attacking military facilities during the unrest.

“Any worsening of the political environment such as the imposition of martial law could deter the IMF,” said Patrick Curran, a senior economist at Tellimer based in Portland, Maine. “Default risk will continue to loom large and bonds and the currency will remain under pressure.”

The rupee may slump to as low as 350 per dollar in June if Pakistan fails to secure the loan, said Adil Ghaffar, chief executive officer at Premier Financial Services Pvt. in Karachi, who correctly predicted the currency may decline to current levels in January. Standard Chartered Plc, meanwhile, is sticking to its call for the rupee to decline to 300 by the middle of the year, according to Farooq Pasha, an economist in Karachi.

“The rupee trajectory remains subject to considerable uncertainty as market sentiment is fragile,” Pasha said. “Politics will remain the key risk in the near-term until the elections.”

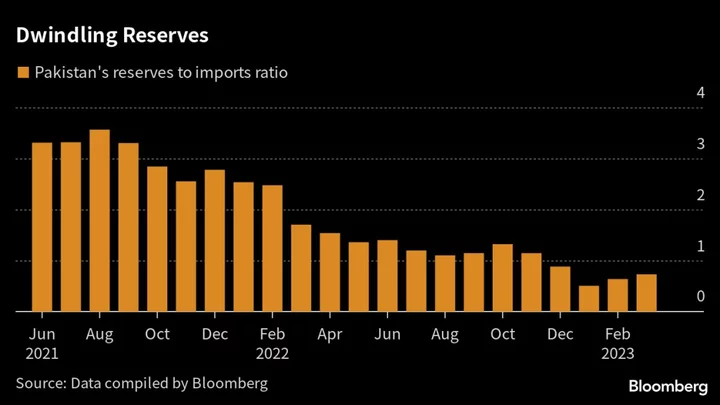

Pakistan’s dollar stockpile, which stood at $4.3 billion in mid-May, is not enough to cover even one month of imports despite heavy restrictions, according to Bloomberg Economics. Import cover fell to the historically low level of 0.5 months in January, said Ankur Shukla, an analyst in Mumbai. It has risen slightly after the nation secured loans from China.

For Johannes Loefstrand, portfolio manager of the frontier markets fund at T. Rowe Price in London, stock picking in Pakistan is more crucial than ever. The company is invested in Systems Ltd., an information technology company which benefits from the rupee weakness as its revenue is mainly in foreign currency.

Coups

Pakistan’s military has long dominated the political landscape, ruling directly for 32 of the 76 years since independence from British rule and backing many of its civilian regimes.

The South Asian nation last had a coup in 1999 when General Pervez Musharaff came to power. Though the army vowed last year to stay out of politics, Khan’s arrest is casting doubt on that promise. The military has denied any involvement in the shooting last year that injured his leg.

A general election is due to be held by October this year. Emboldened by strong support in opinion polls, Khan called for an early vote and forced the dissolution of two provincial assemblies to build momentum for this but the government is reluctant to go ahead.

IMF Bailout

Pakistan has been negotiating with the IMF to restart its bailout program since November, with the financing gap among the biggest roadblocks. There’s about $2.7 billion left to disburse from the $6.7 billion program that’s scheduled to expire next month.

“Significant additional financing is essential to complete the loan review,” IMF spokeswoman Julie Kozack said this month.

The nation has a tumultuous track record with the IMF. Most of its previous bailouts — 13 since the late 1980s — weren’t completed. The government got a $1.1 billion loan in August, part of a package it secured in 2019. But the program has been halted multiple times because of Islamabad’s failure to meet loan conditions and attempts to change terms.

--With assistance from Ankur Shukla (Economist).

Author: Karl Lester M. Yap and Faseeh Mangi