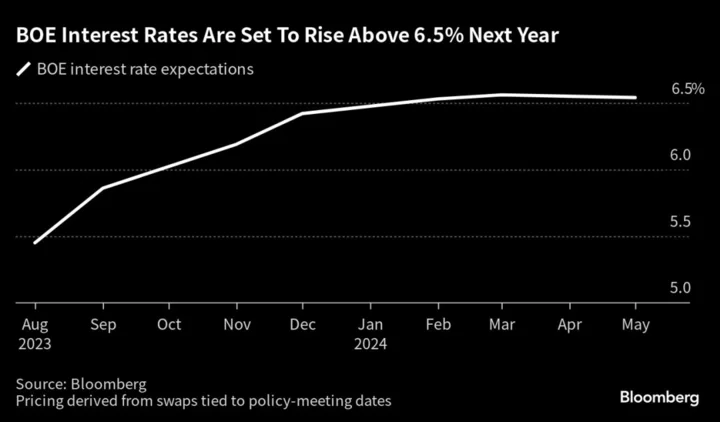

Oil steadied near the highest since April as softening US inflation prompted optimism the Federal Reserve’s rate-hiking cycle may be nearing an end, improving the demand outlook.

Global benchmark Brent held near $80 a barrel after trading above that level on Wednesday for the first time since early May. US consumer price inflation dropped to the lowest in more than two years, while the dollar slumped to a 15-month low. A weaker greenback makes commodities priced in the currency more attractive for foreign buyers.

Oil demand is still set to hit a record this year, even though it won’t grow as fast as previously expected as some developed economies continue to falter, the International Energy Agency said in its monthly report. Rising oil usage and production restrictions implemented by OPEC+ group members are expected to tighten balances through the second half of the year, buoying prices.

The Organization of Petroleum Exporting Countries predicted in a separate report an even tighter global oil market next year, as the group anticipates a much bigger demand increase than other major forecasters. It forecasts consumption will climb by 2.2 million barrels a day to reach 104.3 million a day — double the growth rate projected by the IEA for 2024.

Cooling inflation has “raised optimism the US rate-hike cycle may be nearing an end, thereby reducing the risk to demand from a potential recession,” said Ole Sloth Hansen, head of commodity strategy at Saxo Bank AS. The IEA and US Energy Information Administration “both maintaining a robust outlook for demand” signals support for prices as markets tighten in the coming months.

Oil is still down this year as traders continue to watch for signs of recession in the west — even amid the improving US outlook — while waiting for China’s recovery to pick up. OPEC+ heavyweights Saudi Arabia and Russia are removing barrels to prop up the market. Russia’s flagship Urals crude has breached a price cap set by the Group of Seven, a possible economic win for Moscow.

China’s crude imports jumped to the highest level in three years on a daily basis last month, even as trade data signaled a wider economic slowdown. The surge in purchases comes as refiners returned from maintenance and independent processors were granted more import quotas.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.

--With assistance from Yongchang Chin.