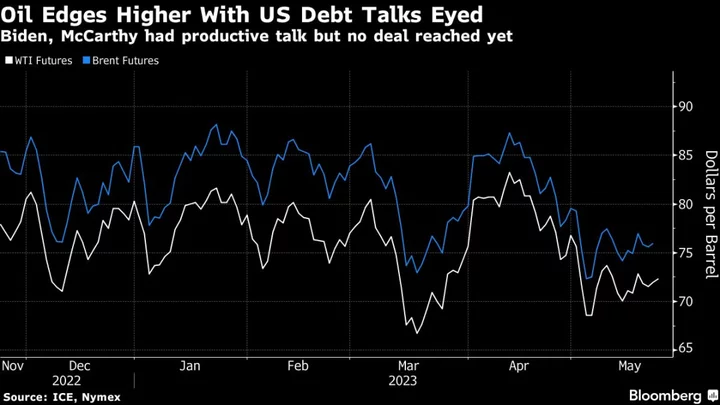

Oil steadied after US leaders including President Joe Biden sounded a positive tone on solving the debt-limit impasse, aiding risk appetite.

West Texas Intermediate for July was little changed above $72 a barrel after that contract added 0.5% on Monday. House Speaker Kevin McCarthy said he and Biden had a productive talk, although a deal to avert a default has yet to be struck. Before the meeting, Treasury Secretary Janet Yellen had warned it was now highly likely her department would run out of sufficient cash in early June.

The showdown in Washington has dominated sentiment in commodity markets in recent days as talks go down to the wire. A US default risks catastrophic financial and economic disruption that would imperil energy demand.

To get Bloomberg’s Energy Daily newsletter direct into your inbox, click here.

Crude has retreated by about 10% so far this year as China’s lackluster recovery after it abandoned Covid Zero, and the US Federal Reserve’s most aggressive monetary tightening campaign in a generation, combined to weigh on sentiment. Also, Russian oil exports have remained robust, with flows not yet showing signs of the output cuts that the country insisted it was making.

While Fed Chair Jerome Powell earlier signaled a pause in interest-rate increases in June, other central bank officials said they saw the need to raise borrowing costs even further, potentially depressing energy demand.

“Oil has managed to hold up relatively well, despite little progress in US debt-ceiling talks as well as some more hawkish comments from US Fed officials,” said Warren Patterson, head of commodities strategy at ING Groep NV. “Despite the move higher yesterday, sentiment still remains mostly negative.”

Oil traders will also be on alert for comments scheduled later Tuesday from Saudi Arabian Energy Minister Prince Abdulaziz bin Salman at the Qatar Economic Forum. Saudi Arabia, the de facto leader of the OPEC+ cartel, was among nations that surprised the global crude market recently with a supply cut that started to take effect from this month.