New Zealand’s central bank raised interest rates by a quarter-percentage point and unexpectedly signaled that no further policy tightening would be needed to tame inflation, sending the nation’s currency tumbling.

The Reserve Bank’s Monetary Policy Committee lifted the Official Cash Rate to 5.5% from 5.25% on Wednesday in Wellington, as expected by 18 of 21 economists surveyed by Bloomberg. The central bank’s forecasts showed the OCR has now peaked, with cuts beginning in the third quarter of 2024.

The kiwi dropped as much as 1.3% to its lowest since May 2 as traders were surprised by the MPC’s decision not to keep the door open to further tightening. The yield on policy-sensitive 2-year bonds dropped the most in six months.

New Zealand has been in the vanguard of global tightening, outpacing even the Federal Reserve in the scale of rate hikes. The RBNZ has been trying to rein in a sharp burst of inflation and Wednesday’s decision to call an end to tightening suggests it’s now relying on lags in policy to keep cooling consumer prices.

“The real surprise for the market was the RBNZ effectively declaring ‘mission accomplished’ on rate hikes,” said Prashant Newnaha, senior Asia-Pacific rates strategist at TD Securities in Singapore. “Quite clearly this is a board that is content moving to the sidelines, letting prior rate hikes and expectations of the economy entering recession to naturally drive inflation down.”

The bank’s forecasts show a shallower economic slowdown, with a mild recession projected for the second and third quarters of this year.

“The committee is confident that with interest rates remaining at a restrictive level for some time, consumer price inflation will return to within its target range of 1-3% per annum,” the RBNZ said. “Inflation is expected to continue to decline from its peak and with it measures of inflation expectations.”

Most economists expected the central bank to retain a tightening bias and keep the door open for a further rate hike if needed.

The MPC’s record of meeting showed members discussed the option of keeping rates unchanged and voted 5-2 in favor of Wednesday’s hike, the first time they haven’t reached a consensus.

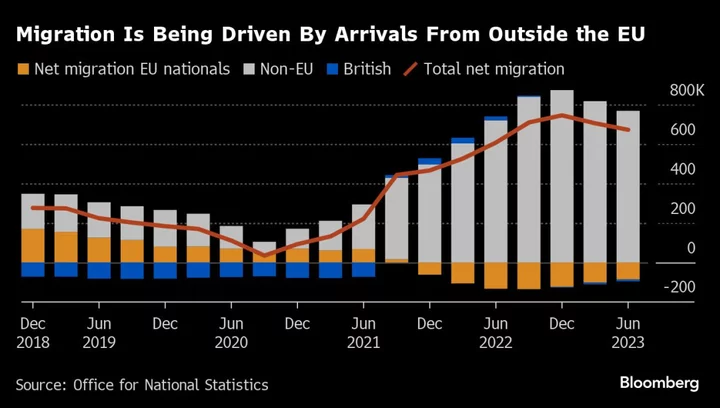

The RBNZ highlighted a surge in immigration that economists expect will fuel economic growth and add to inflation pressure, but said it expects the pace of arrivals to ease over coming quarters.

It also downplayed concerns about fiscal policy boosting demand, including reconstruction on the North Island from damage caused by a cyclone.

“The RBNZ no longer seems to believe that a marked economic slowdown is necessary in order to get inflation down,” said Sharon Zollner, chief New Zealand economist at ANZ Bank in Auckland. “If a relatively modest slowdown of that ilk is enough to bring inflation sustainably lower, that’s a great outcome, relatively speaking.”

--With assistance from Matthew Burgess and Swati Pandey.

(Adds comments from economists, chart.)