New Zealand’s central bank kept interest rates unchanged for the first time in almost two years amid signs that the weaker economy is slowing inflation.

The Reserve Bank’s Monetary Policy Committee held the Official Cash Rate at 5.5% Wednesday in Wellington, as predicted by all 19 economists in a Bloomberg survey, ending a streak of 12 consecutive increases. The last time policymakers left interest rates unchanged was in August 2021.

“Interest rates are constraining spending and inflation pressure as anticipated and required,” the RBNZ said in a statement. “The Committee is confident that with interest rates remaining at a restrictive level for some time, consumer price inflation will return to within its target range.”

New Zealand’s 525 basis points of tightening, the most aggressive since the OCR was introduced in 1999, has stalled economic growth while surging immigration is taking the pressure off wage inflation. The slump in consumer spending may not reverse anytime soon because many fixed-term mortgages still haven’t rolled onto significantly higher interest rates.

The New Zealand dollar eased after the announcement but then rebounded higher. It bought 62.36 cents at 2:31 p.m. in Wellington, up from 62.23 cents ahead of the decision.

“We still see the RBNZ as done with tightening, though don’t expect a lower OCR until May next year,” said Nick Tuffley, chief economist at ASB Bank in Auckland. “From here the RBNZ will keep watching the data to confirm whether or not inflation is likely to decline in line with its expectations.”

Some economists say the RBNZ will still need to deliver one more rate increase later this year to be sure of returning inflation to its 1-3% target.

Ahead of the Pack

The RBNZ was one of the first central banks to begin raising rates as global inflation pressures began to emerge in the wake of the pandemic, outpacing peers such as the Reserve Bank of Australia, the US Federal Reserve and the Bank of England.

In its record of meeting, the RBNZ’s policy committee noted that some other central banks continue to increase rates in response to stubbornly high core inflation.

“The Committee noted that monetary policy in New Zealand reached a more restrictive level earlier than in many other economies,” it said.

The RBNZ’s decision was an interim review rather than a quarterly Monetary Policy Statement, so the bank didn’t issue new forecasts and there is no press conference with Governor Adrian Orr.

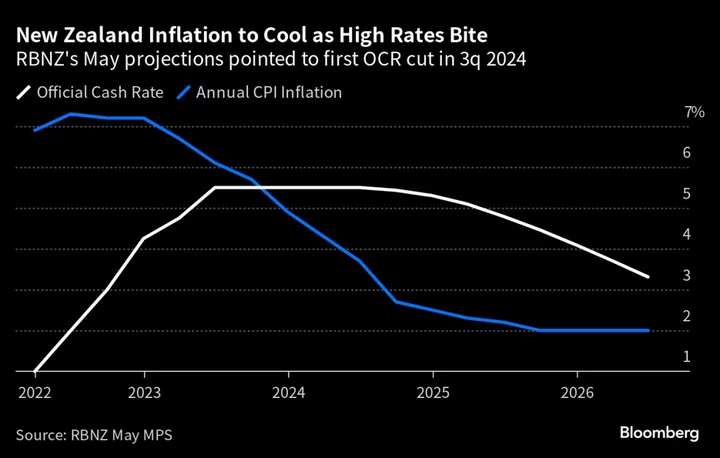

In its most recent projections in May, the RBNZ forecast the benchmark rate would stay at 5.5% until the third quarter of 2024.

Inflation eased to 6.7% in the first quarter. Second-quarter data is due on July 19, and some economists expect a further drop to 6% or lower.

Inflation is expected to continue to decline, and with it measures of inflation expectations, the RBNZ said today.

“While employment is above its maximum sustainable level, there are signs of labor market pressures dissipating and vacancies declining,” it said.

New Zealand’s economy contracted in the final months of 2022 and the first quarter of this year, and while it may have stabilized in the second quarter, three of the nation’s biggest banks predict another recession will start later this year.

“Recent indicators suggest that growth is likely to remain weak in the near term,” the RBNZ said. “Consumer spending growth has eased and residential construction activity has declined.”

(Updates with economist’s comment in sixth paragraph)