New Zealand’s central bank kept interest rates unchanged for a second straight meeting, while signaling a risk that it may need to tighten further to tame inflation.

The Reserve Bank’s Monetary Policy Committee held the Official Cash Rate at 5.5% — as expected — on Wednesday in Wellington. The bank’s new forecasts show a slightly higher track for the average OCR from the fourth quarter of this year through the final quarter of 2024, implying a chance of an increase.

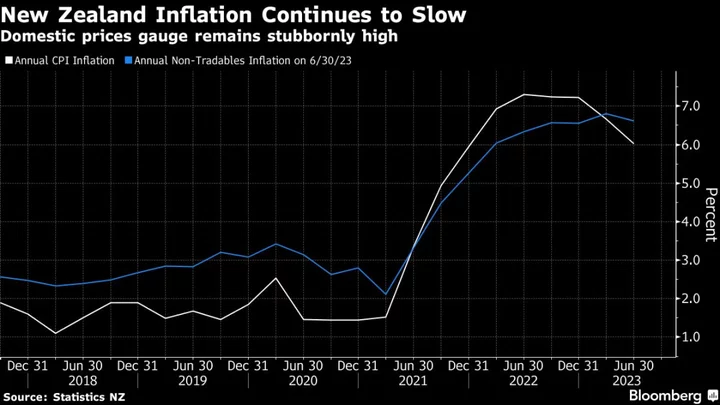

While latest indicators continue to point to a further loss of economic momentum, they also signal risks that price pressures could take longer to dissipate. New Zealand has been at the forefront of the global tightening campaign and its moves from here will be closely scrutinized for clues on how other central banks might respond.

“The RBNZ was wary over declaring victory too soon and has flagged the risk of the OCR moving higher-still,” said Mark Smith, senior economist at ASB Bank in Auckland. “We still view there to be a high hurdle to OCR moves.”

The New Zealand dollar rose to be as much as 0.3% higher on the day to 59.68 US cents, after falling as much as 0.3% prior to the RBNZ decision. Two-year swap rates advanced 3 basis points to 5.55%.

“The Committee agreed that the OCR needs to stay at restrictive levels for the foreseeable future to ensure annual consumer price inflation returns to the 1-3% target range,” the RBNZ said. “In the near term, there is a risk that activity and inflation measures do not slow as much as expected.”

Most economists think the OCR has peaked for this cycle and that the next move will be a cut. Still, ANZ Bank New Zealand and Westpac Banking Corp. forecast that one more quarter-percentage point hike will be necessary before the end of 2023.

The RBNZ’s updated forecasts now show the average OCR rising to a peak of 5.59% in mid-2024 and falling to 5.5% by the end of that year and further in 2025. Previously, they suggested rate cuts could start in the third quarter of 2024.

Governor Adrian Orr said at a press conference after the meeting that the higher OCR track isn’t a strong signal on the next move.

In its record of meeting, the policy committee noted that the estimate of the nominal neutral OCR has increased by 25 basis points to 2.25%.

“A reason the RBNZ now sees the risk the OCR will need to rise again is their reassessment of the long-run neutral level,” said Kelly Eckhold, chief New Zealand economist at Westpac Banking Corp. in Auckland. “This means that the RBNZ now believes that the OCR has not been constraining activity to the extent they had thought.”

While inflation remains elevated for longer in the forecasts, it is still projected to fall below 3% by the third quarter of 2024.

The economy is seen coming out of recession in the second quarter this year, only to contract again in the third and fourth quarters.

“The imbalance between demand and supply is moderating,” the RBNZ said. “However, a prolonged period of subdued spending growth is still required to better match the supply capacity of the economy and reduce inflation pressure.”

--With assistance from Garfield Reynolds.

(Adds market reaction, comments from economists.)