London’s home rental cost showed signs of easing, with a drop in demand and evidence that tenants are refusing to pay record costs to secure a place to live, a survey of property appraisers showed.

The Royal Institution of Chartered Surveyors said tenant demand across the UK recorded the slowest quarter-on-quarter increase in October since 2021. London is the only region where demand for rentals declined during the period.

“After a bullish increase in rental rates, particularly smaller flats, we see these flattening out as tenants simply reach affordability limitations,” said Jonathan Price, an estate agent at Southside Property Management Services Ltd. in Bromley on the southern outskirts of London.

Tenants probably will have to shoulder a 4% increase in rent in the next year across the UK, reflecting a shortage of available properties and a jump in demand, the survey found. Still, the figures indicate rent increases may be nearing their peak.

The report marks a rare sign of relief in the rental market, where a shortage of properties has allowed landlords to lift what they charge at a double-digit pace. Tenants priced out of the housing market by soaring mortgage costs are now having to scramble to secure rental properties that are also increasingly unaffordable.

“We are seeing signs of demand slowing, and rents may well begin to peak,” said Allan Henry Fuller, an estate agent in Putney in west London. “We still desperately need more rental property to stem demand and stabilize rents.”

The data give an indication of the interplay between the rental and property sales market. Landlords in recent months have started to sell properties after growing mortgage costs and regulatory burdens squeezed the profit they can make, exacerbating a shortfall of places available to rent.

London real estate agent Jilly Bland said, “stock continues to fall away from lettings towards sales as more and more landlords choose a sale over re-letting.”

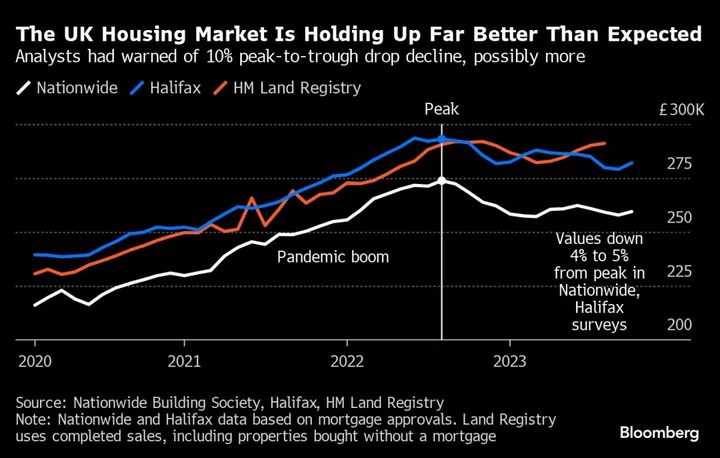

The survey also showed the housing market will remain under pressure in the coming months as buyers absorb a jump in borrowing costs. House prices fell in October at a slightly slower pace than in September and expectations for the year ahead remain firmly in negative territory.

Data from mortgage lenders show the housing market stabilizing, with prices rising in October. A shortage of homes on the market may cushion sellers against the worst predictions for a sharp downturn in prices. RICS said interest rates at the highest level since 2008 will probably bear down on the market.

“Mortgage affordability will remain stretched over the near-term, leaving little prospect of a strong rebound in residential sales volumes, even if expectations have now moved away from cyclical lows,” Tarrant Parsons, senior economist at RICS, said in a report released Thursday.

The RICS report is one of the most forward-looking pulse checks for the housing market. Its measures the difference between the share of respondents reporting a rise or a fall in prices, sales and demand.

“Plenty of caution remains evident with respect to both buyer and seller activity across the UK housing market, albeit the latest survey feedback points to a slightly less negative picture than that reported over the previous few months,” Parsons said.

--With assistance from Andrew Atkinson.

(Adds chart. A previous version of this story corrected the name of organisation in second paragraph)