Israel delivered an unprecedented 10th consecutive interest-rate hike, with a top central banker saying political uncertainty linked to a proposed judicial overhaul forced more tightening than first envisaged.

Policymakers on Monday signaled any future moves will be data dependent after bringing borrowing costs to their highest level since 2006 to cool inflation. The decision to raise the benchmark to 4.75% from 4.5% was in line with forecasts.

Speaking in an interview after the rate announcement, Deputy Governor Andrew Abir said the central bank has had to react to elevated inflation after political uncertainty surrounding the Israeli government’s proposed judicial overhaul hurt the local currency.

The shekel has lost about 4% against the dollar so far in 2023. In the decade through the end of last year, it was one of the rare currencies in the world to strengthen against the greenback.

The extent of monetary tightening “has been the cost of the depreciation of the currency around the political uncertainty, increasing this premium for Israel around the judicial reforms,” said Abir, a voting member of the monetary committee and the central bank’s No. 2 official.

“There’s a lot of uncertainty over the next few months,” he said. “So it’s going be very much a wait-and-see process.”

The remarks offer a window into the central bank’s response to a political crisis that’s led to the country’s biggest unrest in decades.

Prime Minister Benjamin Netanyahu’s recently elected far-right coalition initiated plans to reduce the power of the courts, triggering mass protests from opponents who fear an erosion of the country’s democracy. Among those expressing concern are leaders of Israel’s technology industry, who have warned they could pull back funds and operations.

Netanyahu suspended the plans in late March, saying he would seek a compromise.

Attributing any economic difficulty to the judicial overhaul proposal was controversial in the first weeks of this government. But it’s now grown more into conventional wisdom that the ongoing uncertainty is affecting the shekel, a sentiment echoed by the deputy governor.

Looking ahead, the Bank of Israel’s approach hinges in part on “what happens if there is some form of compromise in the political world in terms of the judicial reforms,” Abir said.

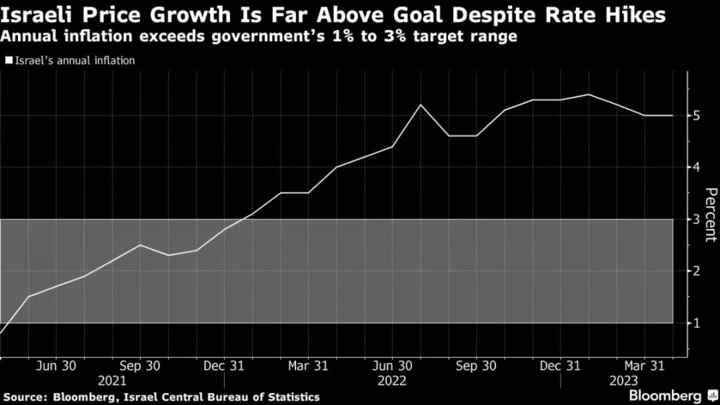

Above Target

The monetary tightening so far has fallen short of taming inflation that’s on track to exceed the government’s 1% to 3% target for the second year.

Price growth in April unexpectedly didn’t slow and remained at 5% from a year earlier, driven by higher costs for housing rentals, produce and outbound travel. On a monthly basis, it reached 0.8%, double what economists had anticipated.

“We would’ve expected by this stage for inflation to be a lot lower than where it is now,” Abir said. “The fundamentals of the Israeli economy are very good and so you should see inflation coming down quite a lot” should the shekel strengthen if a compromise is reached over the judicial plans, he said.

The central banker said “probably the predominant factor” behind the shekel’s depreciation this year is the change in the behavior of Israeli institutional investors. “They didn’t sell as many dollars to hedge their foreign exchange exposure as they would normally have done,” he said.

The shekel extended its losses after the decision. It traded about 0.5% weaker against the dollar as of 8:42 p.m. in Tel Aviv, the third-worst performer on Monday among the basket of expanded major currencies tracked by Bloomberg.

Tightening Pace

The central bank’s latest rate decision marked its second straight increase of 25 basis points following a string of more aggressive moves starting in April 2022, when rates were near zero.

And as the Bank of Israel follows its counterparts around the world in contemplating if rates are already high enough, policymakers will be mindful of an economy that’s headed for its slowest expansion since contracting during the global pandemic.

The central bank risks a “policy error” if it decides on another rate hike at the next meeting in July without waiting to assess the effect of its monetary tightening on the economy, said Guy Beit-or, chief economist at Psagot Investment House.

“In order to see a real moderation in the sticky inflation, a significant slowdown in economic activity is required and in our estimation a significant impact is yet to come,” he said.

Last Tuesday, the Finance Ministry reduced this year’s outlook to 2.7% growth from a previous 3%. The International Monetary Fund in a report this month similarly saw the economy gaining just 2.5% — from 6.5% in 2022 — and warned that continued uncertainty around the government’s contentious proposal to weaken the courts presents a risk.

The upshot for economists and the market is that Israel will likely taper off monetary tightening in the coming months. Israel’s one-year currency swaps indicate investors see the base rate rising near 5% a year from now.

Goldman Sachs Group Inc. said after the decision on Monday that it saw “the near-term risks as skewed toward further hikes” even though the US bank’s baseline forecast is for official Israeli rates to peak at 4.75%.

“We continue to think that inflation will remain above the Bank of Israel’s target for a prolonged period and that, without the support of the exchange rate, it will be much harder for the central bank to achieve its inflation objective,” Goldman analysts Tadas Gedminas and Kevin Daly said in a report. “Policy rates will remain higher for longer than the market is pricing in.”

--With assistance from Harumi Ichikura.

(Updates with economist comment under ‘Tightening Pace’ subheadline)

Author: Amy Teibel, Alisa Odenheimer and Paul Abelsky