Investors in Asian assets faced a host of competing forces as trading got underway in the region in Monday, from the risk of higher interest rates and recession to a potential turning point for Chinese tech companies and constructive dialogue between Beijing and Washington.

Trading in major currencies painted a mixed picture, with the yen steadying against the dollar after strengthening the most since March on Friday. The euro was little changed and the greenback stuck within narrow ranges against most of its other peers.

Equity futures for Australia and Hong Kong rose earlier, while those for Japan slipped slightly. Friday’s session on Wall Street saw US stocks close on the backfoot, two-year Treasury yields fall while 10-year yields rose and a gauge of dollar strength slipping the most in more than three months.

A spate of jobs reports last week have tamped down speculation the Federal Reserve would leave interest rates unchanged later this month. The outlook beyond that was unclear. Government jobs data fell short of estimates but brought signs that wage inflation remained a threat to the Fed’s fight against price gains.

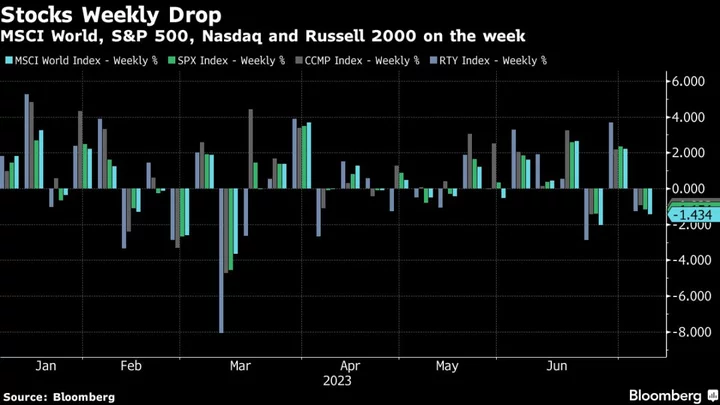

The S&P 500 fell 1.2% over the shortened holiday week while the Nasdaq 100 slid 0.9%. Futures for these benchmarks fluctuated after the open of Asian trading.

Traders will be closely watching this week’s US consumer price print. Bloomberg economists are expecting the headline number to fall 3.1% though they don’t see that stopping the Fed hiking on July 26. Reports from big banks including Citigroup Inc. and JPMorgan Chase & Co. may also set the tone for second quarter earnings.

Treasury Secretary Janet Yellen warned over the weekend that she wouldn’t rule out the threat of a US recession, noting that it was “appropriate and normal” for growth to moderate and that inflation remains too high.

Yet she also offered a glimmer of positivity in strained relations between the US and China after a visit to Beijing. “I expect that this trip will help build a resilient and productive channel of communication with China’s new economic team,” she said.

News for Chinese technology companies was constructive, with the imposition of large fines on Alibaba Group Holdings Ltd. affiliate Ant Group Co. and Tencent Holdings Ltd. seen as signaling an end to a crackdown on the sector.

An index of US listed Chinese companies rallied more than 3% on Friday, with Alibaba surging 8%. Ant is also proposing to buy back as much as 7.6% of shares, according to a person familiar with the matter.

Chicago Fed President Austan Goolsbee left the door open for more data to sway officials ahead the central bank’s next meeting. “We’re getting to a more sustainable pace, which is what we need to do for inflation,” Goolsbee said of Friday jobs data in an interview on CNBC.

Friday’s payroll numbers were not yet weak enough to stop the central bank’s tightening, according to Seema Shah, chief global strategist at Principal Asset Management.

“Jobs growth has slowed but remains too strong to justify an extended Fed pause,” she said. “More significantly, with average hourly earnings surprising to the upside, wage pressures are still too strong.”

Crude futures traded slightly lower Monday after rising Friday as the Biden administration said its purchasing 6 million more barrels of oil for strategic reserves.

Key Events This Week:

- China CPI, PPI, Monday

- US wholesale inventories, Monday

- Federal Reserve speakers include Mary Daly, Loretta Mester, Raphael Bostic and Michael Barr, Monday

- Bank of England Governor Andrew Bailey delivers speech, Monday

- St. Louis Fed President James Bullard speaks, Tuesday

- Canada rate decision, Wednesday

- US CPI, Wednesday

- Federal Reserve issues Beige Book, Wednesday

- Federal Reserve speakers include Neel Kashkari, Loretta Mester, Raphael Bostic, Wednesday

- Bank of England Governor Andrew Bailey speaks, Wednesday

- China trade, Thursday

- Eurozone industrial production, Thursday

- US initial jobless claims, PPI, Thursday

- US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 7:25 a.m. Tokyo time. The S&P 500 fell 0.3%

- Nasdaq 100 futures were little changed. The Nasdaq 100 fell 0.4%

- Nikkei 225 futures fell 0.2%

- Australia’s S&P/ASX 200 Index futures rose 0.4%

- Hang Seng Index futures rose 2.1%

Currencies

- The euro was little changed at $1.0969

- The Japanese yen was unchanged at 142.21 per dollar

- The offshore yuan was little changed at 7.2317 per dollar

- The Australian dollar was little changed at $0.6695

Cryptocurrencies

- Bitcoin fell 0.2% to $30,136.5

- Ether fell 0.4% to $1,861.87

Bonds

- The yield on 10-year Treasuries advanced three basis points to 4.06%

Commodities

- West Texas Intermediate crude fell 0.3% to $73.63 a barrel

This story was produced with the assistance of Bloomberg Automation

--With assistance from Isabelle Lee and Vildana Hajric.