The International Monetary Fund’s Kristalina Georgieva expressed confidence that the US will reach a deal on the debt ceiling and urged central banks around the world to keep monetary policy tight in the face of inflation risks.

“History tells us that US will wrestle with this notion of default but come the 11th hour it gets resolved,” the fund’s managing director said at the Qatar Economic Forum in Doha on Wednesday. “And I have confidence that they will again.”

Earlier, Nouriel Roubini warned that talks to avoid a US default could drag on, with failure to agree on a debt ceiling likely to hit markets and damage confidence in the dollar over the longer term.

“They may get to the last hour before there’s an agreement,” he told Bloomberg TV. “Or it’s possible they don’t reach an agreement. If that doesn’t happen, then the market is going to crash.”

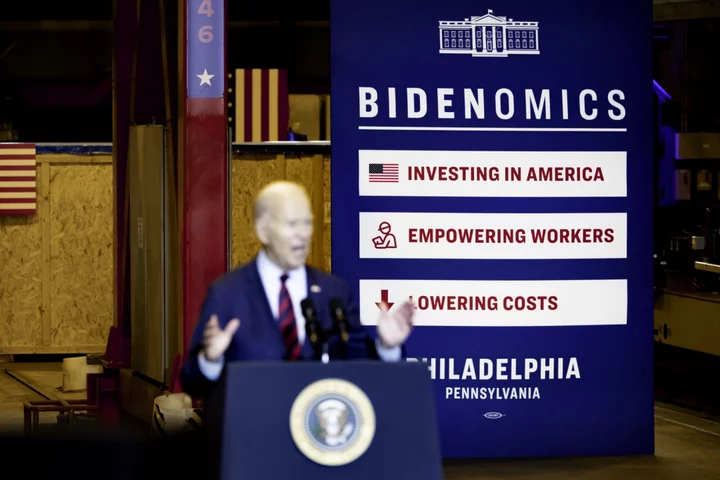

Debt limit talks in Washington have hit a fresh impasse with negotiators far apart on key issues, especially the spending cuts demanded by Republicans, as time runs short to avert a historic US default. Republicans escalated their accusations that President Joe Biden lacked urgency in negotiations, while a Democratic aide called House Speaker Kevin McCarthy unwilling to compromise across a wide spectrum of disputed points, threatening the legislative prospects of a deal.

The standoff in Washington continues to affect stock markets. If a default does occur, economists project it could throw the US into recession, with widespread job losses and other economic consequences spilling into the coming election year.

NOTE: The government of the State of Qatar is the underwriter of the Qatar Economic Forum, Powered by Bloomberg.

Consumers Are ‘Remarkably’ Resilient, Mastercard Says (2:27 p.m. Doha)

Shoppers across the world have been “remarkably” resilient during the past years’ crises, with only a little “moderation” recently in the US, according to Mastercard CEO Michael Miebach.

He sees potential for more post-pandemic recovery momentum in Asia, with Mastercard data suggesting that outbound travel from China is currently at 65% of pre-Covid levels. Inbound travel is at around 45%. “You start to see a lot of people from Asia now traveling and venturing out. So that is looking good,” Miebach said.

Qatar Still Committed to Egypt Investments (1:00 p.m. Doha)

Qatar is still committed to investing in Egypt, which is trying to sell around $2 billion of state assets to ease a foreign-exchange crisis.

“We are open for more” investments, the Gulf state’s finance minister, Ali Al-Kuwari, told Bloomberg TV, adding that the country is looking at Egypt’s manufacturing, telecoms and tourism sectors.

However, he said gone are the days when Qatar will simply bail out Middle Eastern allies with blank checks. “With Egypt, it’s purely commercial,” he said.

IMF’s Georgieva: ‘Don’t Kiss Your Dollars Goodbye Just Yet’ (12:10 p.m. Doha)

The IMF’s Georgieva said the dollar’s global standing is supported by the strength of the US economy and the depth of its capital markets. “We don’t expect a rapid shift in reserves,” she said. “Don’t kiss your dollars goodbye just yet.”

Georgieva also cautioned that while headline price growth may be peaking globally, core inflation “is still not trending down the way it should.”

“Central banks have to stay the course because if they move back on interest rates prematurely then inflation may pick up,” she said. “Interest rates are tight, they will stay tight for longer, but we are expecting 2024, early 2025 they will change”

Luxury Hotels Are on Hiring Spree, Accor Boss Says (12:00 p.m. Doha)

Accor SA hired 123,000 people over the last 12 months, taking its total headcount to about 300,000 employees, CEO Sebastien Bazin said in an interview with Bloomberg TV.

The hotel firm has increased its payroll by about 7% and is offering salary increases “well above 10%” in some cases, Bazin said. “We probably should have done it a long time ago” to help retain staff, he added.

Accor has enjoyed “a good, solid seven months” with particularly strong demand in the Middle East and Singapore — where the best suite at Raffles demands a rate of “probably $35,000,” Bazin said.

Marcelo Claure Dedicates Next Decade to Latin America (11:30 a.m. Doha)

Latin America is one of the “few spots where I believe opportunities are greater than the capital that is available,” Marcelo Claure, CEO of investor Claure Group, said in an interview.

Claure also said that he’s seeing “tremendous” amounts of capital coming from the Middle East, including Qatar, Saudi Arabia and the United Arab Emirates.

Qatar Says Dollar Peg Still Appropriate for Gulf Nations (11:25 a.m. Doha)

A dollar peg remains the best option for countries in the six-member Gulf Cooperation Council given their heavy reliance on oil and gas exports, according to Qatar’s central bank governor.

“Our peg to the dollar is appropriate for the economy and we don’t see any immediate need to change that,” said Sheikh Bandar Al-Thani. “It’s very effective for our economy.”

Georgian Premier Defends Ties With Russia Amid War (10:45 a.m. Doha)

Georgian Prime Minister Irakli Garibashvili said his government is “absolutely” ready to ensure that only non-sanctioned flights will operate between Russia and his country, after the US and the EU criticized last week’s restoration of commercial air services.

The resumption of flights is a “part of economic relations with Russia,” Garibashvili said in an interview. While Georgia has complied with international financial sanctions on Russia over the war in Ukraine, it’s not in the country’s interests to sever economic relations, he said.

Russia this month unexpectedly lifted a ban on flights to Georgia that was imposed in 2019.

Roubini and Petraeus Talks on China and Geopolitics (10:35 p.m. Doha )

The chairman of Roubini Macro Associates, who is best known for his predictions of doom, said geopolitical tensions from Ukraine to Iran, and worsening ties between the US and China could prove a major challenge for the global economy this year.

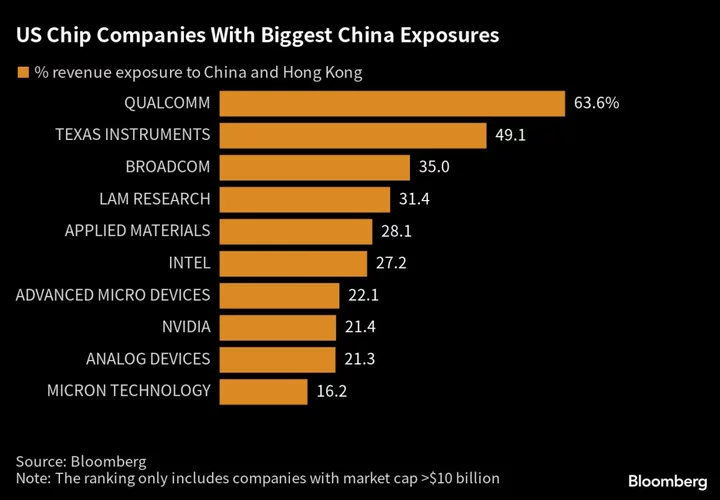

On the US-China theme, retired US General David H. Petraeus, who is now a partner at KKR and chairman of KKR Global Institute, said a decoupling of the US and Chinese economies is “not possible” as trade between the two countries continues to rise despite chilly political ties.

A Chinese invasion of Taiwan remains “unlikely” though the US and its allies should maintain their military capabilities and readiness to deter such a move, he said in an interview.

IMF Deal Will Help Ghana Reposition Its Economy, President Says (10:30 a.m. Doha)

A $3 billion funding package that Ghana secured from the IMF this month will provide a foundation for repositioning the economy and enable the authorities to better control inflation and interest rates, President Nana Akufo-Addo said.

Discipline will be exercised in implementing the deal with the IMF and efforts will be made to ramp up domestic savings, controlling public expenditure and giving impetus to private-sector investment, Akufo-Addo said in an interview.

Ghana, the world’s second-biggest cocoa producer, wants to begin producing its own chocolate to derive more revenue from the industry, but the process is a “daunting” one, according to the president. The government is confident of meeting new European Union standards for cocoa exports, and is working on penetrating new markets for its crop in Asia and other regions, he said.

Banking Turmoil Isn’t Over, Says Commercial Bank of Kuwait CEO (10:16 a.m. Doha)

The turmoil in the banking industry, which has seen the collapse of four US lenders and the takeover of Credit Suisse Group AG, isn’t over and growth is a concern, the chief executive officer of Kuwait’s fourth-largest lender said.

“Many things are happening at the same time, so the world is worried,” Elham Mahfouz, CEO of Commercial Bank of Kuwait, told Bloomberg TV on the sidelines of the QEF. The tumult “isn’t finished.”

Banking Turmoil Isn’t Over, Says Commercial Bank of Kuwait CEO

Some of the Middle East’s biggest investors were the hardest hit by the crisis at Credit Suisse that eventually led to it being taken over by UBS Group AG. In recent months, four regional lenders in the US have collapsed amid steep Federal Reserve interest-rate hikes and deposit outflows.

Bangladesh Will Buy Oil From Whoever Offers Good Price, PM Says (9:50 a.m.)

Bangladesh will buy crude oil from whoever supplies to it at a good price, Prime Minister Sheikh Hasina told the Qatar Economic Forum. The country’s foreign policy is “friendship to all,” she added, indicating the South Asian nation will not take sides as the US looks to isolate Russia over its war in Ukraine.

In August 2022, Hasina asked her cabinet to find ways to import fuel from Russia amid the nation’s lingering energy crisis. But Bangladesh has not purchased oil from Moscow since the invasion.

Hasina also said her country was in a position to repay its loan from the International Monetary Fund. The nation’s ability to implement the Washington-based lender’s prescriptions will remain key as it weighs a credit rating downgrade, Moody’s Investors Service said in April.

Insider’s Cilingir Says Valuation Close to $2 Billion After New Funding (8:30 a.m. Doha)

Hande Cilingir, CEO and co-founder of Turkey’s AI-backed marketing platform Insider, said the firm’s valuation was “close to $2 billion” after it received $105 million in additional funding from Qatar Investment Fund and Istanbul-based Esas Private Equity.

She said the money would exclusively be used for mergers and acquisitions with a focus on US and European markets. She expects to launch an Initial Public Offering in 2025 or early 2026.

--With assistance from Ercan Ersoy, Fiona MacDonald, Manus Cranny, Helena Bedwell, Kwaku Gyasi, Nicolas Parasie, Caroline Hyde, Ben Priechenfried, Muneeza Naqvi and Arun Devnath.

(Updates with comments from Mastercard CEO and Qatar finance minister.)