Goldman Sachs Group Inc. economists anticipate the Federal Reserve will start lowering interest rates by the end of next June, with a gradual, quarterly pace of reductions from that point.

“The cuts in our forecast are driven by this desire to normalize the funds rate from a restrictive level once inflation is closer to target,” Goldman economists including Jan Hatzius and David Mericle wrote in a note dated Sunday.

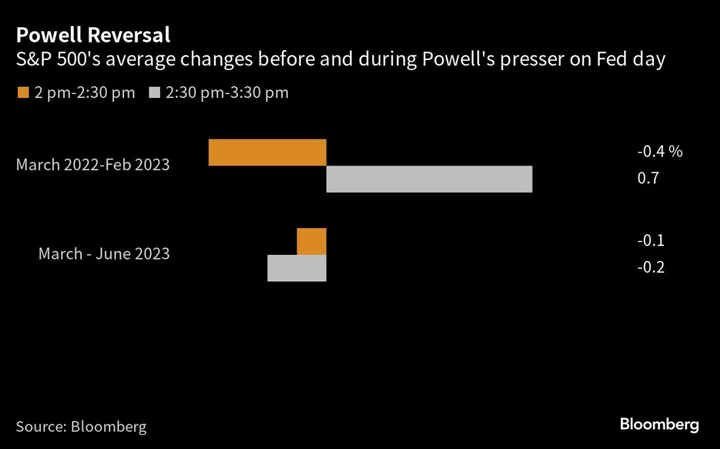

For now, the Goldman team is penciling in rate cuts to begin in the second quarter of 2024. The rate-setting Federal Open Market Committee is expected to skip a hike next month, and conclude at the November meeting “that the core inflation trend has slowed enough to make a final hike unnecessary.”

“Normalization is not a particularly urgent motivation for cutting, and for that reason we also see a significant risk that the FOMC will instead hold steady,” the Goldman economists wrote. “We are penciling in 25 basis points of cuts per quarter but are uncertain about the pace.”

Last week, data showed US inflation rose at a slower-than-expected headline rate of 3.2%, with the core consumer price index — which strips out energy and food costs — running at a 4.7% annual pace.

Fed policymakers in March 2022 began ramping up their target for the benchmark rate to a range of 5.25% to 5.5%.

“We expect the funds rate to eventually stabilize at 3-3.25%,” Goldman’s team wrote.