European lenders are set to focus more on cost savings in 2024, as benefits from rising interest rates reach their limit and pressure on margins mounts.

A squeeze on net interest margin — already reported by UK banks Barclays Plc and NatWest Group Plc for the quarter through September — alongside inflation-linked hike in expenses will likely impact revenue growth, increasing the need for cutbacks, according to Bloomberg Intelligence.

A key metric that shows the difference between revenue and cost growth — called operating jaws — is expected to turn negative for 15 of 26 European lenders in 2024, jumping from three this year, BI analysts Philip Richards and Mar’Yana Vartsaba said.

Some of the widest negatives are expected at SEB AB, Svenska Handelsbanken AB and Unicredit SpA, at -8%, -6% and -4%, respectively. With sector expenses up 10% since the start of 2022, cost savings will be imperative to protect profitability, according to Richards.

Monetary authorities at both the Bank of England and the European Central Bank in recent weeks have signaled an end to their rate tightening cycle. As interest rates peak and depositors demand greater pass-through for their savings, banks will no longer be able to rely on the gains they enjoyed over the last year.

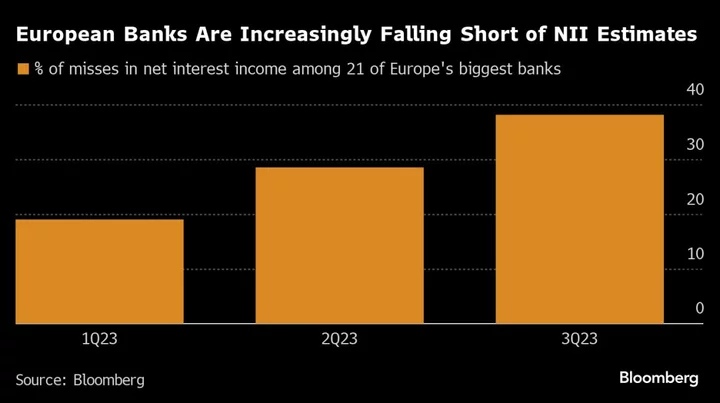

UK banks’ third-quarter earnings suggest high interest rates are becoming a burden, with intensifying mortgage and deposit competition pressuring net interest income (NII). Of 21 of Europe’s biggest banks, 38.1% fell short of NII estimates last quarter, up from just 19% in the first quarter of the year, according to data compiled by Bloomberg.

Investment banking might be the first area where banks will likely start cutting costs if needed, Johan Torgeby, SEB’s chief executive officer, said on an earnings call last month.

Some of Europe’s biggest lenders, including Deutsche Bank AG, UBS Group AG and Barclays, have already started slashing roles and have signaled further reductions.

Barclays is set to announce new financial targets in February with a cost-management plan likely to be presented for its investment bank. The lending giant reduced its outlook for net interest margin in its domestic market this year for the second time since July.

Peer NatWest also faced concern over cost controls from analysts after paring its net interest margin forecast for the year.

Uncertainty remains high in the sector. “European banks enter 2024 with profitability and capital strength at decade-plus highs, yet those aren’t reflected in sentiment,” BI’s Richards said.

Author: Maggie Shiltagh and Chloé Meley