European stocks were set for their biggest drop in almost four months as robust US jobs data reinforced worries about a hawkish-for-longer Federal Reserve, while investors also weighed early corporate earnings reports.

The Stoxx 600 was down 2% at 2:55 p.m. in London — tracking the biggest one-day drop since March 15. Figures showed US companies added almost half a million jobs in June, the most in over a year and underscoring the ongoing strength of the labor market. All European sectors were in the red, with investors booking profits in some of the biggest winners of the first half, such as travel and leisure and retail.

Among individual movers, Hunting Plc soared by the most since 1991 after it said trading was ahead of management expectations with revenue and operating profit surpassing targets set at the start of the year. Currys Plc, on the other hand, tumbled as it reported revenue for the full year that met the average analyst estimate.

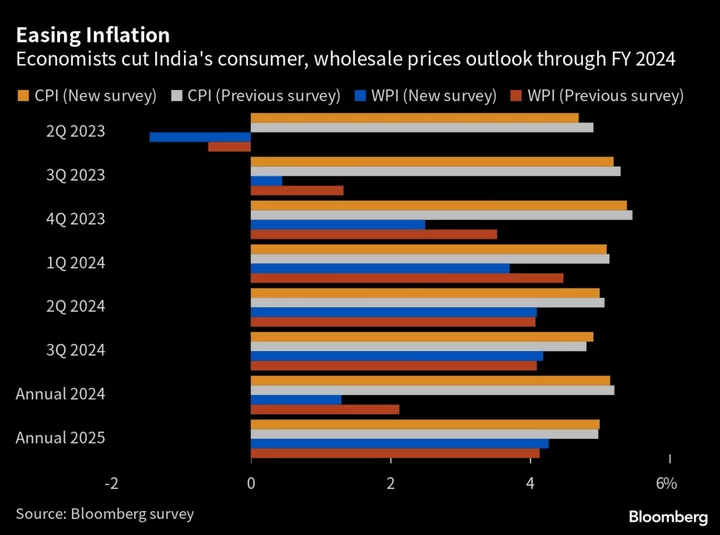

After rallying nearly 9% in the first half of the year, European equities have started July with declines as investors also worry about the impact of high inflation on corporate earnings. Minutes of the Fed’s meeting, released Wednesday, showed officials struck a tenuous agreement to pause interest-rate increases in June, all but committing to hike again later this month.

Stocks are also facing increasing competition from bond markets, which now offer more lofty returns accompanied by potentially fewer risks.

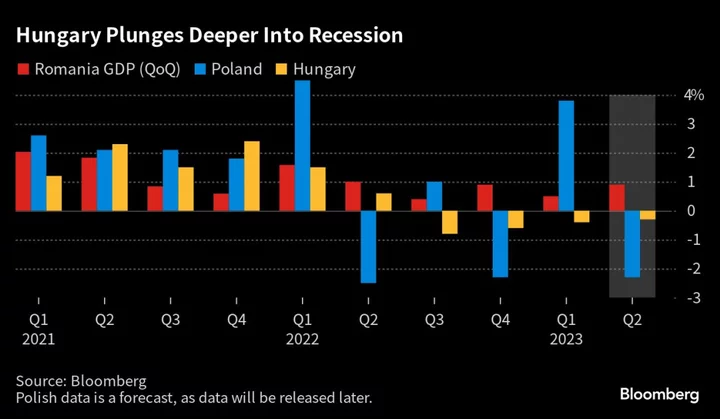

Investors shrugged off data on Thursday data showing German factory orders rebounded in May, a sign the manufacturing slump may be easing as Europe’s biggest economy shakes off a recession.

Focus now turns to the second-quarter earnings season. Joachim Klement, head of strategy, accounting and sustainability at Liberum Capital, said that although he expects to see more profit downgrades, investor sentiment “is improving and many stocks have reached oversold levels so a short-term bounce in coming weeks is on the cards, in our view, before earnings season starts in earnest,” Klement said.

SECTORS IN FOCUS:

- Oil stocks after US energy giant Exxon said lower natural gas prices and refining margins will reduce second-quarter earnings by about $4 billion compared with the previous three months.

For more on equity markets:

- Equities Face Increased Competition From Bonds: Taking Stock

- M&A Watch Europe: Thyssenkrupp’s Nucera, Man Group, Brenntag

- London Gets its First Chinese GDR Listing in a Year: ECM Watch

- US Stock Futures Unchanged; American Air Falls

- Numis Sees ‘Difficult’ Market Persisting: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika.