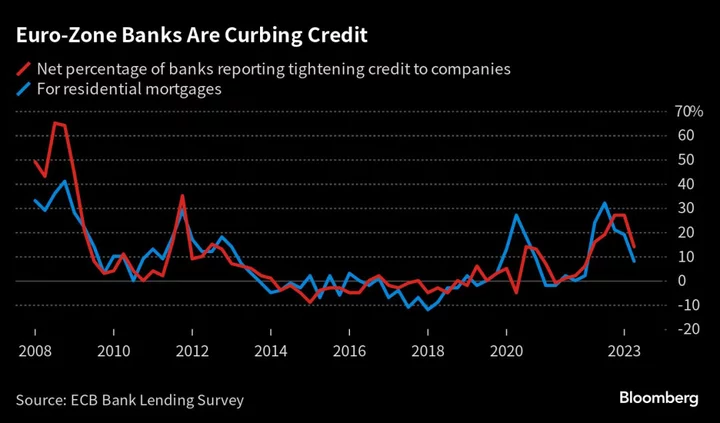

Demand for loans among companies in the euro zone plunged by the most on record in the second quarter — a clear signal that the European Central Bank’s yearlong campaign of interest-rate hikes is feeding through to the 20-nation economy.

The drop, which was “substantially stronger” than lenders expected, came alongside a further decline in demand for mortgages and other consumer borrowing, according to the ECB’s Bank Lending Survey, published Tuesday.

The quarterly poll, which began in 2003, offers an updated glimpse at how the ECB’s unprecedented inflation-fighting efforts are affecting lending — a key channel through which officials are seeking to return price gains to the 2% target without derailing the already struggling economy.

As well as demand softening, banks in the euro area also tightened the criteria they use to issue loans to companies and households due to costlier funding and a weaker economy, the survey showed. Separate data Tuesday revealed the business outlook in Germany remained subdued this month after it entered a recession in the winter.

“The cumulated net tightening since the beginning of 2022 has been substantial,” the ECB said, noting that lenders expect more to come in the third quarter.

While the previous set of survey results faced heightened scrutiny — arriving amid contagion fears following Credit Suisse’s demise — the survey remains a crucial input in policymaking. The ECB is poised to raise its deposit rate by another quarter-point, to 3.75%, on Thursday and isn’t ruling out one final move after that.

Since banks play a dominant role in financing the economy, assessing how they respond to higher interest rates “is a first-order task for the ECB,” Chief Economist Philip Lane said July 12.

And the effect may not be the same as in the past. As officials discussed at June’s policy meeting, longer fixed-rate periods for mortgages and a slower increase in how much lenders pay on deposit accounts may be delaying the transmission of tighter lending conditions to households.

Policymakers also need to determine how much those tighter credit standards affect the wider economy and, ultimately, inflation. ECB Vice President Luis de Guindos said this month that “we are now beginning to see the impact on parts of the real economy.”

(Updates with German Ifo in fourth paragraph.)