A sluggish Chinese economy is causing distress to pop up in unexpected corners of Europe’s junk credit markets, with companies pushed into debt restructurings due to events happening far away.

Take Wittur Holding GmbH, a German maker of elevator components: Its revenue plunged after a real estate bubble burst in China, one of its main markets. As construction of new buildings all but stopped, demand dried up. Eventually, its debt load became just too much to sustain and the shareholders, Bain Capital LP and a Canadian pension fund, handed ownership to creditor KKR & Co.

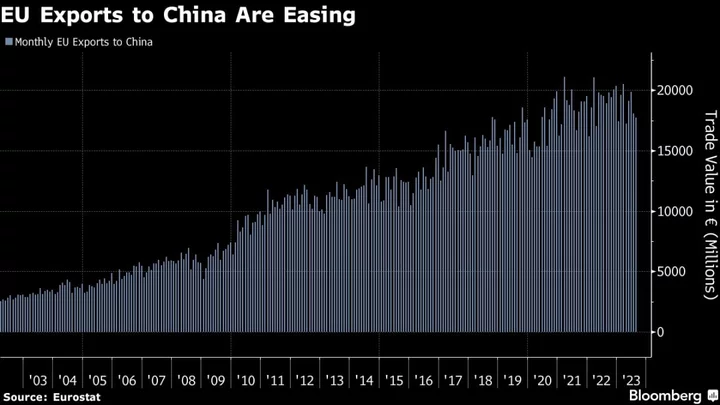

With China’s property crisis raging on and the economy slowing, there are likely to be plenty more stories like that. Buyout firms loaded up European companies with debt in the easy-money era, and many of those businesses now face a double blow: Borrowing costs have soared at the same time that one of their fastest-growing markets is in the doldrums. Things are so bad that European Union exports to China are on course for their first annual decline since at least 2002, according to EU statistics.

“Highly levered companies with a concentrated portfolio have limited flexibility to deal with financial challenges, so for them slowing demand in China can bring about difficulties and credit risks,” said Svitlana Ukrayinets, a Frankfurt-based analyst at Moody’s Investors Service.

The impact of a slowing China won’t be systemic — Moody’s estimates that among the European companies it provides credit ratings for, only 8% of revenues on average come from China — but will bring pain across several industries for those businesses that rely heavily on the market.

IGM Resins BV, owned by private equity firm Astorg Partners SAS, makes energy curing products for a variety of industries including graphic arts, industrial coatings and adhesives. China accounts for a third of the market for ultraviolet curing products, according to Moody’s, but economic growth slumped last year, failing to reach official targets and the levels recorded in previous periods.

The delayed ramp-up of its new production facility in China also added to the company’s struggles. Now IGM Resins is at risk of running out of cash in the next 12 to 18 months and will struggle to refinance loans due in 2025, according to Moody’s, which cut the Dutch company’s rating twice this year. A spokesperson for Astorg declined to comment.

Even the wine business is feeling the stress. Accolade Wines Ltd, an Australian company that has done much of its borrowing in sterling, has been racing to sell assets including vineyards and is in talks with creditors ahead of a wall of maturing loans in 2024 and 2025, said people familiar with the matter, who asked not to be identified.

The main reason for Accolade struggling to refinance is that its business model is built around the export of wines to China, where the government hiked up import taxes, according to the people familiar. Hence, Accolade has been shifting its strategy to target other geographies, but with little time left to address its debt deadlines, a debt-for-equity swap — with sponsor Carlyle Group Inc handing over the keys to creditors — is the most likely outcome, said the people familiar.

A spokesperson for Carlyle declined to comment.

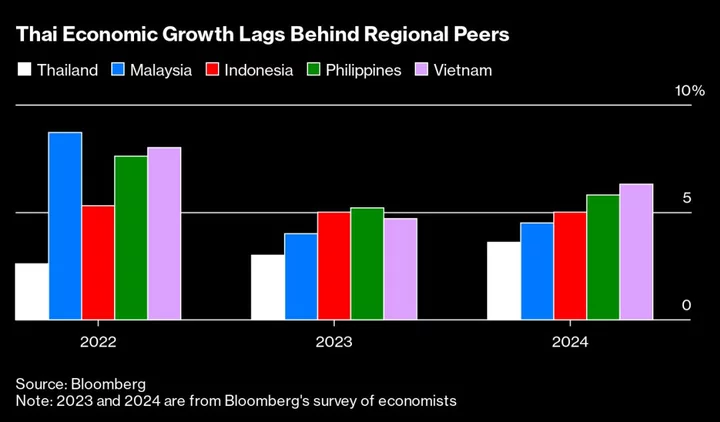

“When you’re sitting in an economy growing at 8%, 9%, or 10%, then there is opportunity for everyone,” said Jens Eskelund, president of the European Union Chamber of Commerce in China. “When they’re sitting in a economy growth at 3%, 4%, 5%, then there would be opportunities in specific sectors but not all that. So China would continue to present interest in opportunities for many of our members, but for others, it’ll be a less interesting opportunity.”

Troubles Ahead

Looking ahead, there are plenty of question marks over China’s economy: Chinese President Xi Jinping this week made a series of rare policy moves, including increasing the budget deficit, to boost the economy while refraining from massive stimulus.

In fact, while some key indicators are inching up — gross domestic product in the third quarter surpassed expectations on strong consumer — the crisis in the real estate sector shows no signs of abating.

Developer Country Garden Holdings Co. this week was deemed to be in default on a dollar bond for the first time, underscoring its fall into distress. Another wounded property company, China Evergrande Group, is struggling to finalize a restructuring plan and may yet end up being liquidated. The crisis carries the risk of further contagion that’s weighing on China’s economic recovery.

Read more: Country Garden’s Crisis Is Upending Tens of Thousands of Lives

So further stresses might emerge for European companies.

In the same industry as Wittur, TK Elevator GmbH has come under the spotlight. For the German elevator components firm, owned by buyout firms Advent International LP and Cinven Ltd and German foundation RAG-Stiftung, a slow recovery in China has translated into a slower-than-expected improvement in margins, weighing on an already heavily indebted capital structure.

While the company’s earliest debt deadlines are in 2027, the high leverage prompted Fitch Ratings to revise the outlook on the issuer to negative. The company’s unsecured notes are quoted at a discount of 14 cents to their face value and carry a CCC+ rating, seven steps into junk territory.

Representatives for Advent and Cinven declined to comment, while a spokesperson for RAG-Stiftung didn’t respond to a request for comment by Bloomberg News.

“The Chinese market plays a big part for many companies in Europe, including many small and mid-sized manufacturers,” said Tommy Wu, a Singapore-based economist at Commerzbank AG. “Many of them might have expected and prepared for a cyclical downturn in China, but we may see more of them facing challenges if there is a structural downturn in China, especially those with larger exposure to the property sector.”

Author: Giulia Morpurgo, Pearl Liu and Irene García Pérez