China’s economic recovery is losing momentum after an initial burst in consumer and business activity early in the year, prompting calls for more policy stimulus to bolster growth.

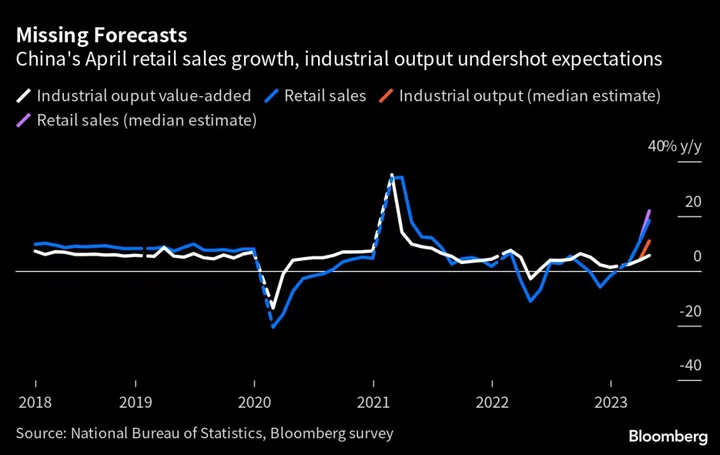

Official data Tuesday showed industrial output, retail sales and fixed investment grew at a much slower pace than expected in April. The figures were disappointing even though the low base of comparison from last year, when Shanghai was in lockdown, helped to boost the data.

A major worry was the jump in the unemployment rate for young people to a record high of 20.4%, a sign that the post-pandemic recovery isn’t strong enough to absorb the millions of new entrants to the labor market.

The data confirms signals from other recent indicators showing the recovery is waning. The property market remains weak despite early signs of a pickup in housing sales, inflation is close to zero and consumers are reluctant to borrow.

Economists say more policy action will be needed to keep the recovery going, although central bank steps alone won’t be enough to boost consumer and business confidence.

“Policy support is important, but the question is, which policy stimulus is most important,” Haibin Zhu, chief China economist at JPMorgan Chase & Co. said in an interview with Bloomberg TV. “Industry policy probably will play a more important role, then fiscal stimulus, particularly on the consumption stimulus.”

“Monetary policy can play a supplementary role, but honestly, a rate cut is not the most urgent response,” he said.

Chinese stocks were down 0.1% as afternoon trading resumed, paring an earlier loss of 0.4%. The onshore yuan weakened 0.1% to 6.959 per dollar as of 1:01 p.m. local time.

There were several warning signs in Tuesday’s data pointing to a faltering recovery. Property investment contracted 16.2% in April from a year earlier even though home sales grew, according to Bloomberg calculations based on official data. Construction of new homes continued to decline.

Output of key commodities used in construction, like aluminum and steel, fell in April from the previous month.

The People’s Bank of China hinted on Monday it could provide more support, pledging “appropriate” levels of money supply and credit, and dropping the phrase of “not flooding the economy with stimulus” for the first time in more than a year.

Several economists said the PBOC could take stronger action in coming months, including lowering the reserve requirement ratio or cutting interest rates.

“Consumption remained solid, yet the spike in youth unemployment to a record high raises questions about how sustainable that recovery can be,” said Michelle Lam, Greater China economist at Societe Generale SA. “Today’s data opens the door for further cuts in the reserve requirement rate and interest rates, possibly in June.”

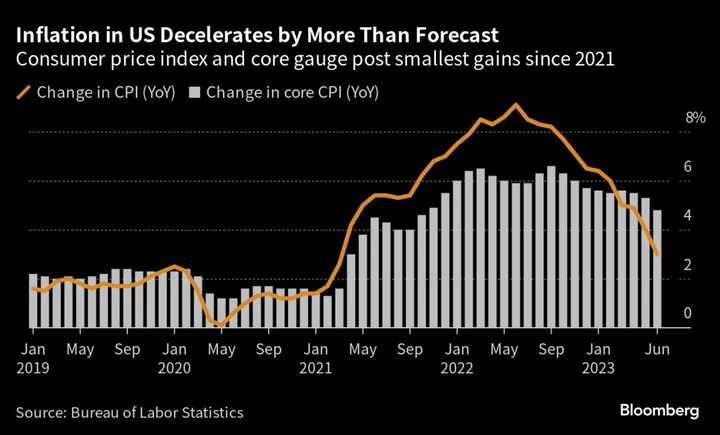

A weakening global economy is also adding to the gloom. High inflation and rising interest rates in China’s major markets have cut consumer demand for Chinese-made goods. Exporters at China’s largest trade fair recently reported a drop in orders from overseas, while purchasing managers surveys also signaled weakness in the manufacturing sector.

The National Bureau of Statistics on Tuesday highlighted global and domestic risks, saying “the global environment is still complex and grim, and domestic demand still looks insufficient.” The economy’s “internal drive for rebound is still not strong,” it said.

What Bloomberg Economics Says...

The headline figures for production and retail sales rose – but only by comparison with last year’s terrible numbers, which cratered during Shanghai’s lockdowns. Measured against March, they are stalling. Meanwhile, slowing investment shows government spending isn’t gaining traction. Bottom line: The data are weak and add to the case for more monetary easing.

For the full report, click here

Chang Shu and David Qu

Retail sales were buoyed last month by car purchases and restaurant spending, the NBS data showed. Auto manufacturing also boosted industrial output last month, although textiles and pharmaceuticals output continued to contract.

“Today’s weaker-than-expected data show how difficult it is to keep the growth engine running after restarting it,” said Bruce Pang, chief economist for Greater China at Jones Lang LaSalle Inc. “China will continue to deliver strong year-on-year growth of activity data in the second quarter of 2023 on the back of a low base, but at a slower quarter-on-quarter pace than the first quarter as the recovery is losing steam.”

--With assistance from Shikhar Balwani, Zhu Lin and Chester Yung.

(Updates with additional details.)