China’s consumer inflation rate unexpectedly flatlined in September while factory-gate deflation persisted, suggesting the economy’s path to growth is still fragile and in need of additional support.

The consumer price index was unchanged last month from a year earlier, the National Bureau of Statistics said Friday, weaker than expectations for a slight increase and edging closer to the deflationary level it fell to in July. Core CPI — which strips out volatile food and energy costs — rose 0.8%, same as August. Producer prices fell 2.5%, moderating slightly from the prior month’s decline.

“September inflation data came out below consensus, suggesting a long way to go for the PBOC’s fight against deflation,” said Zhaopeng Xing, senior China strategist at Australia & New Zealand Banking Group Ltd., referring to the central bank. “The government has announced hundreds of counter-cyclical measures to boost domestic demand. But consumer confidence remains weak.”

China’s economy has shown signs of stabilization in recent weeks, with factory activity picking up and declines in exports easing. But there’s lingering concern over the recovery, which still faces drags from a property crisis and waning sentiment. Chinese consumers traveled and spent less over the recent Golden Week holiday period than the government had hoped, while lukewarm home sales stirred concerns about whether more support will be needed to bolster growth.

Chinese stocks declined in early trading on Friday, with the Hang Seng China Enterprises Index losing as much as 1.9%, poised to end a six-day winning streak. The onshore benchmark CSI 300 Index of stocks also fell nearly 1%.

Golden Week may have accounted for slower growth in food prices, according to Dong Lijuan, chief statistician with the NBS, who in a statement attributed the softer rate to ample food supply prior to the holiday. She also cited a high base of comparison with last year as a reason for the flat CPI.

“CPI inflation at zero indicates the deflationary pressure in China is still a real risk to the economy,” said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management. “The recovery of domestic demand is not strong, without a significant boost from fiscal support.”

Earlier this week, Bloomberg News reported that the government is considering raising its budget deficit for the year as part of a plan to spend more on infrastructure — a form of stimulus to help the economy meet an official growth target of about 5%.

Economists also expect policymakers to consider other measures before the end of 2023, including another cut to policy rates. That may not come for another month or two, though: Analysts expect the People’s Bank of China to hold the rate on its one-year medium term lending facility steady on Monday.

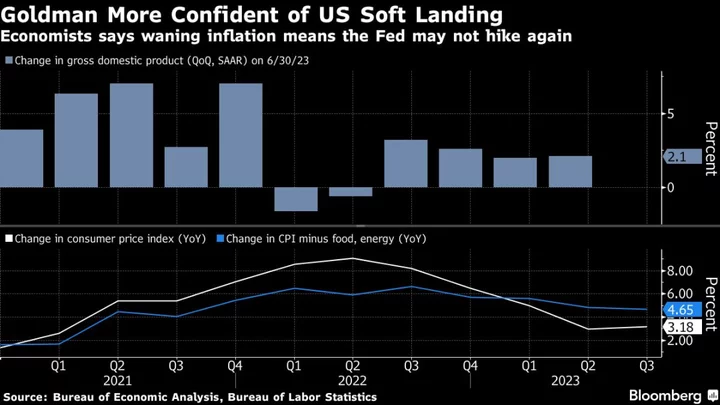

Monetary policy room may be constrained depending on future moves by the Federal Reserve. US consumer prices advanced in September at a brisk pace, reinforcing the Fed’s intent to keep interest rates high to bring down inflation.

The IMF recently cut its growth forecast for China for this year to 5% from 5.2%, and for next year to 4.2% from 4.5%. The economy is losing momentum because of declines in real estate investment and housing prices that endanger government revenues from land sales, as well as weak consumer sentiment, according to the Fund.

Additional data next week will also provide more clues on the state of the economy in the third quarter, including gross domestic product figures and indicators on retail sales, industrial output and unemployment.

--With assistance from Zhu Lin and Fran Wang.

(Updates throughout with economist and market reaction.)