China will provide emergency funding to heavily indebted local governments as needed, central bank Governor Pan Gongsheng said — comments that underscore the importance authorities place on the problem.

“When it’s necessary, the People’s Bank of China will provide emergency liquidity support to regions with a relatively heavy debt burden,” Pan said in a speech at the Financial Street Forum in Beijing on Wednesday.

Financial regulators have worked with other authorities to resolve debt risks at the local level this year, Pan said, according to a transcript of the speech on the PBOC’s website. He added that government debt levels are at a mid- to low level compared to other nations.

Pan also said the few provinces where smaller banks face higher financial risks were drafting plans to resolve the matter. They will use various channels to replenish capital for the lenders, he said.

The yuan rose as much as 0.2% after Pan’s comments. It pared the gain to trade flat at 7.2777 per dollar as of 2:58 p.m. in Shanghai.

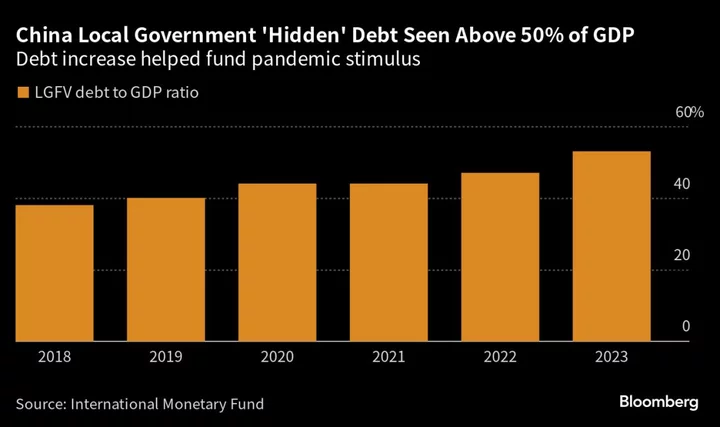

China has been attempting to defuse risks from its large pile of off balance-sheet local government debt, without resorting to major bailouts. That’s a difficult task for President Xi Jinping’s government because it faces a fragile economic recovery hindered by a property slowdown.

See: China Vows Enduring Local Debt Cleanup at Key Policy Meeting

At a recent twice-a-decade policy meeting attended by Xi, China vowed to set up a long-term mechanism to resolve debt risks tied to local authorities and signaled a willingness to expand central government borrowing.

Beijing has over the past year asked the nation’s largest banks to shoulder some of the responsibility by providing support to troubled developers as well as local government financing vehicles, which sit on a $9 trillion pile of debt. Fulfilling those duties is likely to hurt their profit-margins.

China’s regional banks could incur a capital hit of 2.2 trillion yuan ($302 billion) from their LGFV debt, S&P Global Ratings warned last month in a research note. In “a downside scenario,” about a fifth of the regional lenders could sink below the minimum regulatory capital adequacy ratio of 8% and require recapitalization, S&P added.

Local governments could ask local asset management firms to help acquire bad debt but those with fewer financial resources will face increasing challenge to contain the risks, Fitch Ratings Inc. said in a report last month.

The government may resort to “more unconventional approaches” to handle the pressure banks face over asset quality, it added.

Pan also vowed to satisfy the financing needs of all types of developers regardless of whether they are private or state-owned. The spillover impact on the financial system from the real estate market’s correction is generally manageable, he said.

Other highlights of his speech:

- The PBOC will resolutely prevent any “over-adjustment” in the yuan’s exchange rate and avoid any one-sided expectations

- It will adjust interest rates mainly based on domestic conditions

- It aimed to prevent risks related to the property market from spreading

--With assistance from Iris Ouyang.

(Updates with yuan price and other comments from Pan.)