A concrete expanse the size of Monaco jutting off China’s southern coastline is the imposing centerpiece in Beijing’s efforts to slow its growing dependence on imported oil.

More than 15,000 workers can be on site at one time at the facility at Zhuhai, near the gambling mecca of Macau. Run by a unit of China National Offshore Oil Corp., it’s been churning out production platforms to be deployed in China’s offshore oil fields.

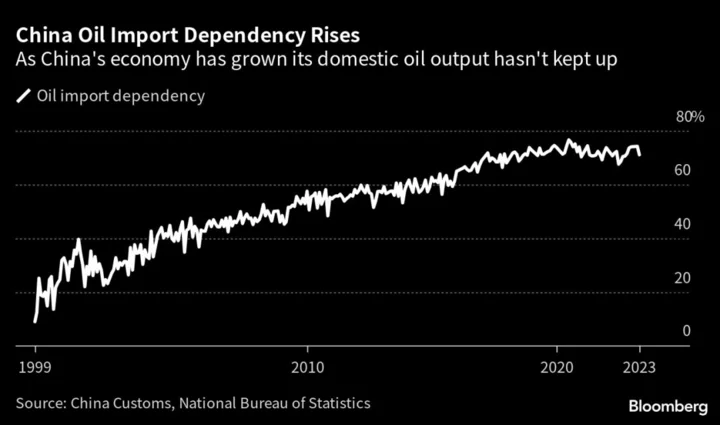

The deepwater drilling push comes as China’s aging onshore wells and insatiable appetite for energy force it to become ever-more reliant on foreign crude. The world’s biggest oil importer gets more than 70% of its supply from overseas, compared with less than 10% at the turn of the millennium.

With its sprawling industrial base and deepwater ambitions, Cnooc, one of China’s three main state-owned oil firms, is on a spending spree to develop the drilling technology currently dominated by western oil majors. But pushing into waters contested by China’s neighbors has also put it in conflict with the US government.

Washington blacklisted Cnooc in 2021, saying that it acted in concert with China’s military to “bully” neighboring countries over its disputed claims over large parts of the South China Sea. The company has denied the allegations.

The Chinese oil major has developed the Bohai Sea between northern China and the Korean peninsula into the country’s largest oil field and is expanding the Liuhua and other fields in the eastern South China Sea. Wells at sea accounted for 60% of China’s new oil production last year.

“With significant untapped volumes offshore China, domestic offshore barrels are expected to become an indispensable growth engine for the coming decade,” said Baihui Yu, senior research analyst at S&P Global Commodity Insights. “Technology progress and increased access have enabled more drilling to be focused into deeper waters.”

China isn’t the first country to have to go to sea to replace dwindling onshore reserves. US drillers opened up the Gulf of Mexico in the 1960s, and European firms turned the North Sea into a major production hub in the 1970s and 1980s.

Cnooc is China’s exclusive offshore oil producer and its domestic production grew to account for 23% of the country’s total in 2021, compared with 15% in 2013, according to company filings and BP Plc data. The explorer is investing heavily to raise output by 4% to 6% this year and then by a further 12% by 2025.

As well as geopolitical hurdles, the technical challenges of deep-water drilling are also immense. On a recent weekday afternoon at the site in Zhuhai, one of the world’s largest such facilities, sparks flew into the air as a small group of workers put the finishing touches on what looked like the Eiffel Tower laying on its side.

The steel structure, called a jacket, will be dragged onto a boat and taken 200 kilometers offshore, where its 338.5-meter-length will let it stretch from the sea floor to above the ocean’s surface. The jackets, which need to be strong enough to withstand massive waves and typhoons, are too large to be moved by crane so they are constructed horizontally and rolled sideways onto a ship.

Oil majors like Chevron Corp. and Shell Plc are still the most advanced players in the sector, with the technological capability to drill in harsher and deeper offshore environments. But Cnooc is catching up.

A year ago it built the largest jacket in Asian history for its Haiji-1 field, and it’s increasing exploration in deeper waters further from China’s coast. Cnooc expects to produce between 650 million to 660 million barrels of oil equivalent this year and is also participating in projects globally, including Exxon Mobil Corp.’s mammoth find off the coast of Guyana.

At another construction site in Qingdao, it’s experimenting with even more advanced technology, building a new cylindrical-shaped vessel designed to float near the jacket and oil platform, processing and storing the oil on board before offloading it onto tankers.

Technical progress like this has made some previously uneconomic offshore fields now viable for development, according to the company.

The Week’s Diary

(All times Beijing unless noted otherwise.)

Monday, June 12

- China to release May aggregate financing & money supply by June 15

- CISA green steel technology symposium in Shanghai, day 1

- Shanghai International Carbon Neutrality Expo, day 2

Tuesday, June 13

- CISA green steel technology symposium in Shanghai, day 2

- Shanghai International Carbon Neutrality Expo, day 3

Wednesday, June 14

- CCTD’s weekly online briefing on Chinese coal, 15:00

- China EPOWER exhibition in Shanghai, day 1

- China LNG & Gas Summit in Shanghai, day 1

- Shanghai International Carbon Neutrality Expo, day 4

Thursday, June 15

- China sets monthly medium-term lending rate, 09:20

- China new home prices for May, 09:30

- China industrial output for May, including steel & aluminum; coal, gas & power generation; and crude oil & refining. 10:00

- Retail sales, fixed assets, property investment, residential property sales, jobless rate

- Jiangxi Copper online earnings briefing, 15:00

- China EPOWER exhibition in Shanghai, day 2

- China LNG & Gas Summit in Shanghai, day 2

Friday, June 16

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- China EPOWER exhibition in Shanghai, day 3

- China LNG & Gas Summit in Shanghai, day 3

Saturday, June 17

- Nothing major scheduled

Sunday, June 18

- China’s 2nd batch of May trade data, including agricultural imports; LNG & pipeline gas imports; oil products trade breakdown; alumina, copper and rare-earth product exports; bauxite, steel & aluminum product imports

On the Wire

China’s indebted local governments are using a controversial way to generate revenue as they struggle to pay bills: imposing egregious levies on their public.

The US expanded a ban on imports from China’s Xinjiang region, placing two more companies on its so-called entity list, the first additions since a law targeting forced labor in the area took effect a year ago.

--With assistance from Jason Rogers.

(Updates with diary items)