The People’s Bank of China urged patience and confidence in the economy’s recovery as it pledged to use its policy tools to support growth.

China will implement targeted and forceful monetary policy and strengthen counter-cyclical adjustments, Deputy Governor Liu Guoqiang told reporters in Beijing on Friday. That was largely a repeat of the PBOC’s recent monetary stance.

Zou Lan, head of the monetary policy department, specified the PBOC would use its policy tools, including the reserve requirement ratio and other instruments like the medium-term lending facility, to ensure ample liquidity in the economy.

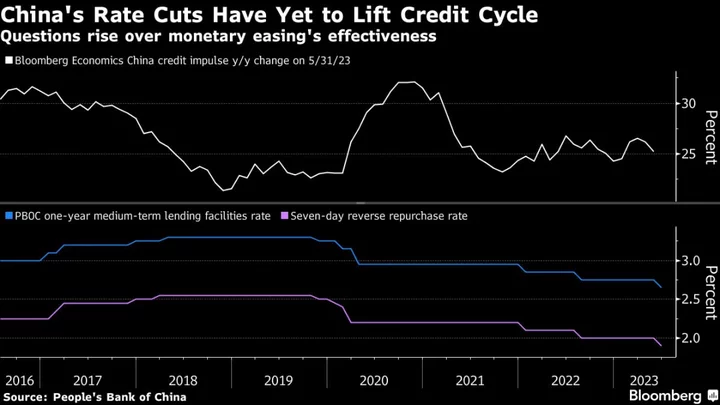

The PBOC is grappling with several challenges, including the looming prospect of deflation, subdued economic growth and a faltering property market. While speculation has grown the central bank will act again after a surprise interest rate cut in June, economists say weak business and consumer confidence are reducing the effectiveness of monetary easing.

Liu said international experience suggests the economy will take one year to recover from the pandemic, pointing out that it’s only about half a year since China dropped its Covid controls. The fundamentals of the economy’s long-term growth hasn’t changed, he said.

While inflation will remain low in July, it’s likely to pick up in August and avoid deflation in the second half of the year, Liu said. Consumer-price growth will likely trend closer to 1% at the end of the year, he said.

Rising interest rates in the US and high debt levels in the Chinese economy have prompted officials to take a more measured approach to stimulus this year. The yuan is down more than 3% against the dollar this year, although pressure on the currency has eased recently amid signs the Federal Reserve may be nearing the end of its tightening cycle.

PBOC Governor Yi Gang has stressed the PBOC’s prudent approach, writing in a commentary this week that China’s “domestic-focused” strategy means it’s not simply following policy action in other major economies. The yuan’s flexibility has helped the PBOC deal with pressure from the Fed’s hikes, he added.

(Updates with comments from PBOC officials starting in first paragraph)