Brazil’s central bank kept its key interest rate unchanged at a six-year high and stopped short of endorsing imminent reductions, frustrating a growing campaign for looser monetary policy championed by President Luiz Inacio Lula da Silva, business leaders and top politicians.

Policymakers kept the benchmark Selic at 13.75% for a seventh straight meeting as widely anticipated late on Wednesday. In an accompanying statement, the central bank removed language pledging to resume rate hikes in case inflation doesn’t behave as expected, but repeated that “patience and serenity” are needed for future policy decisions.

The board “judges that the strategy of maintaining the Selic rate for a long period has been adequate to ensure the convergence of inflation,” they wrote. Policymakers added that the next steps in monetary policy will depend on “inflationary dynamics” such as the long-term outlook for consumer prices as well as measures of economic slack.

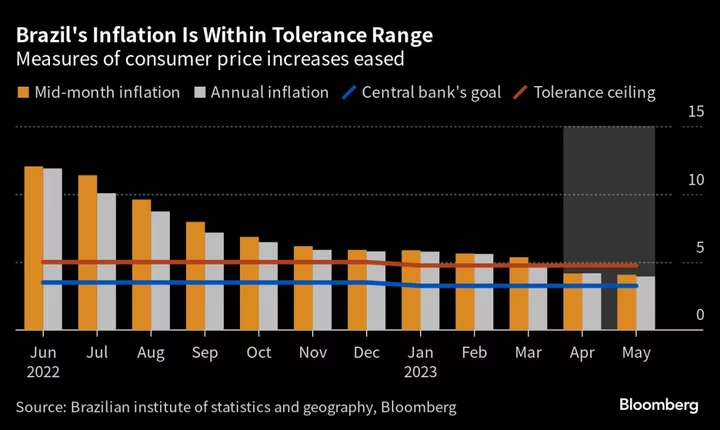

Brazilian central bankers, who were among the first to raise borrowing costs in the aftermath of the pandemic, are remaining cautious despite signs their strategy is paying off. Annual inflation eased to 3.94% in May, further within the monetary authority’s tolerance range, as core measures excluding energy and food slow down. Before the decision, traders in the futures market fully priced in a 25 basis-point cut in August, with some betting on a bigger drop.

“The central bank didn’t support the expectations for easing that are priced in,” said Natalie Victal, chief economist at SulAmerica Investimentos. “The board indicates that they need to see additional developments and improvements in the outlook before starting to discuss cuts.”

Read More: Lula Lashes Out and Sends Warning to Central Bankers Everywhere

Resonating Criticism

Lula has been campaigning for lower borrowing costs since taking office in January. After repeatedly calling current interest rate levels “absurd” and saying they’re propelling unemployment, his criticism started to resonate beyond the government.

Top executives including Magazine Luiza SA’s Luiza Trajano have demanded immediate rate cuts, saying small and medium-sized companies are suffering with insufficient access to credit, high inventories and low sales. Senators, who are the ultimate guarantors of the central bank’s autonomy, have also joined the chorus of disapproval.

Read More: Brazil Central Bank Criticism Broadens Before Key Rate Decision

Wednesday’s central bank statement irked Lula’s government, which expected at least a clearer indication that the beginning of a monetary easing cycle was near.

What Bloomberg Economics Says

“Brazil’s central bank acknowledged at its June meeting that conditions may soon warrant an interest-rate cut, while reaffirming its commitment to tackle inflation. Attempting to strike this delicate balance, policymakers paved the way for an August move, in our view — if expected and underlying inflation improve over the next six weeks. We’re skeptical of the time frame, and for now maintain our call of a September cut.”

— Adriana Dupita, Brazil and Argentina economist

— Click here for full report

In their statement, policymakers lowered their 2023 year-end inflation forecast to 5% from 5.8% while cutting next year’s estimate to 3.4% from 3.6%. They also wrote that the economy will slow in coming quarters.

Central bankers removed an alternative inflation outlook, which considered the Selic unchanged for longer and also neutral interest rates, which neither stimulate nor contract the economy, above the current 4% estimate.

“One can’t affirm that the start of the easing cycle will be in August, but the doors are open,” said Rodolfo Margato, an economist at XP Investimentos. “In our view, most economic data will continue to improve at the margin and can create space for a cut of 25 basis points.”

Board members led by Roberto Campos Neto target inflation at 3.25% this year and 3% in both 2024 and 2025.

‘Residual’ Uncertainties

In their statement, central bankers wrote that there is “residual uncertainty” about the final fiscal framework to be approved by lawmakers.

In coming weeks, congress will move ahead with a set of proposals that members of Lula’s economic team consider as helping the central bank to cut borrowing costs, including a bill to shore up public finances.

Another key decision for monetary policy will be made later this month, when Campos Neto is expected to discuss inflation targets with Finance Minister Fernando Haddad and Planning Minister Simone Tebet.

If the 3% inflation target for 2024 and 2025 is reaffirmed, estimates for future price increases could drop further, potentially creating a virtuous cycle that could allow borrowing costs to fall faster.

“The central bank is data-dependent,” said Mirella Hirakawa, an economist at AZ Quest Investimentos. “They have a check-list, a list of factors that have to be met in order to start a cycle of easing.”

--With assistance from Giovanna Serafim, Martha Beck and Simone Iglesias.

(Recasts lead and updates with economist comments starting in fifth paragraph)