Australian retail sales climbed more than expected in May, suggesting that household spending remains resilient in the face of rising interest rates and cost of living pressures.

Sales advanced 0.7% from a month earlier, when they were little changed, and exceeded a forecast 0.1% gain, Australian Bureau of Statistics data showed Thursday. The result was driven by discretionary spending and dining out, the bureau said.

“This latest rise reflected some resilience in spending,”said Ben Dorber, head of retail statistics at the ABS. “Retail turnover was supported by a rise in spending on food and eating out, combined with a boost in spending on discretionary goods.”

An early start to some end of financial year sales events boosted turnover along with Mother’s Day and the “Click Frenzy Mayhem,” the bureau said in a statement.

The largest sales rise since January shows some underlying strength in the economy that’s also been highlighted by a tight labor market. The policy-sensitive three-year government bond yield rose after the release and the currency edged up as traders boosted bets on a rate hike next week.

In contrast, stocks pared gains on concerns about further tightening.

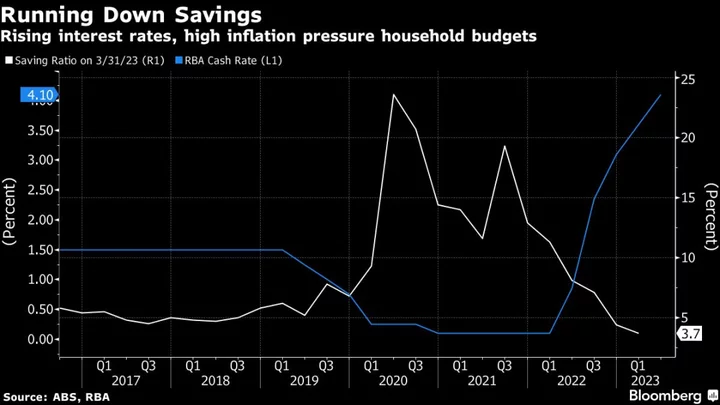

The RBA unexpectedly hiked earlier this month to take the cash rate to 4.1% from a record-low 0.1% when it began tightening a little over a year ago. A weaker inflation reading a day ago had increased confidence that the RBA will stand pat on Tuesday.

Retail sales are an important factor in rate decisions given that consumption accounts for roughly 60% of gross domestic product. Resilient household spending — backed by savings built up during the pandemic — has given policymakers’ confidence that the economy can withstand higher rates.

Still, Thursday’s report jars with signs that consumers are being squeezed between higher borrowing costs and elevated inflation.

Australia’s Recession Risk Spikes as RBA Peak Rate Seen at 4.35%

In a further headwind, a large number of mortgages that were fixed for three years at record low rates during the pandemic are due to switch to higher floating rates in coming months.

Today’s retail report also showed:

- Businesses, including online-only retailers, florists, and pharmaceutical and cosmetics retailers recorded the biggest gain at 2.2%; cafes, restaurants and takeaway food services advanced 1.4%

- Clothing, footwear, and personal accessory retailing slid 0.6% and department stores dropped 0.5% — the only categories to fall

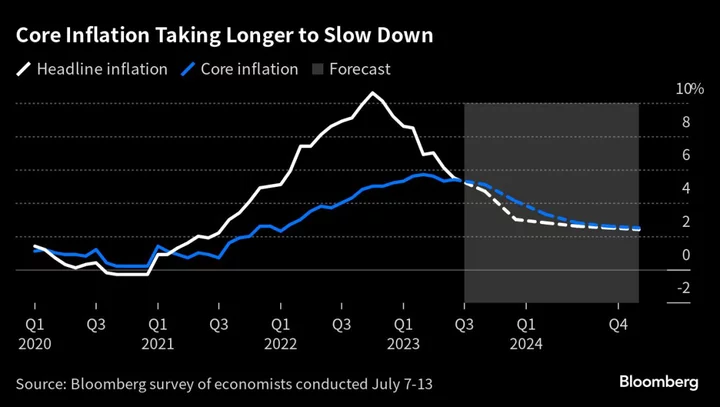

Bloomberg Economics expects weakness in 2023 as the full impact of policy tightening passes through to household budgets. Economist James McIntyre said the outlook for retail sales remain challenging despite strong job gains, rising wages, increasing population growth and house prices climbing again.

“Overall, sales are likely to remain tepid until the RBA reverses course and begins cutting rates, which we see happening in the first quarter of 2024,” McIntyre said.

--With assistance from Matthew Burgess.