By Stella Qiu

SYDNEY Asian shares fell on Wednesday after a slowdown in China's services activity dented sentiment and as markets turned their focus to the release of Federal Reserve minutes and a key U.S. jobs report later in the week for the rate outlook ahead.

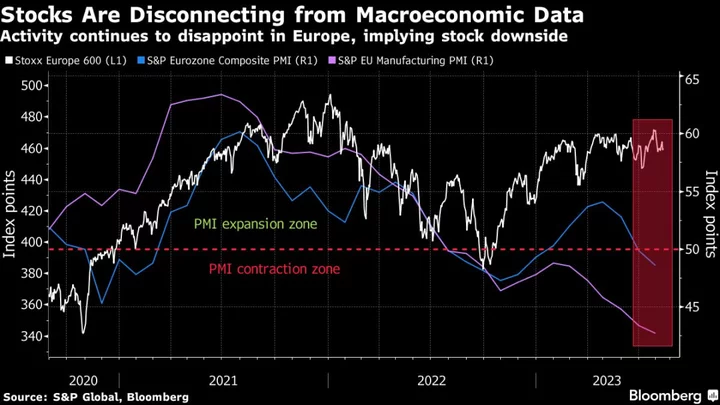

Market conditions were subdued following the Independence Day public holiday on Wall Street on Tuesday. EUROSTOXX 50 futures slipped 0.2%, while both S&P 500 futures and Nasdaq futures eased 0.1%.

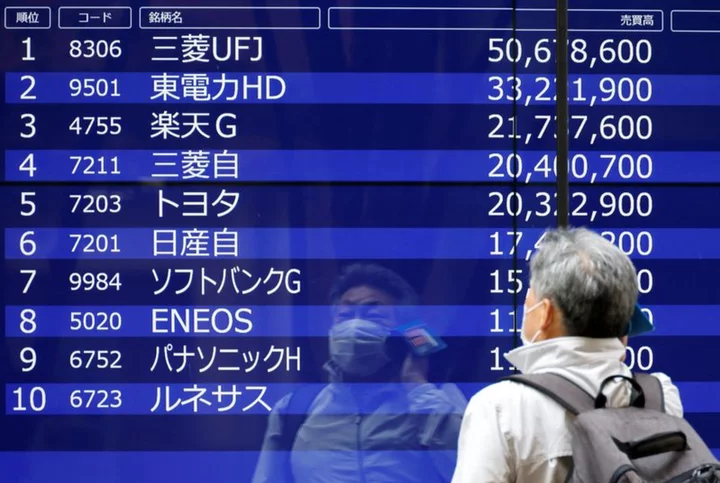

MSCI's broadest index of Asia-Pacific shares outside Japan dropped 0.6%. Japan's Nikkei also fell 0.3%, on profit-taking from investors after climbing to three-decade highs.

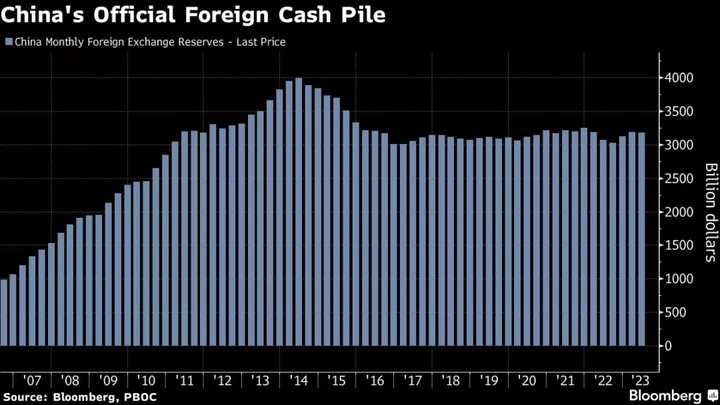

In China, a survey showed the services sector, which has rebounded strongly after the lifting of lockdowns, expanded at the softest pace in five months in June, adding to evidence that the economic recovery is losing steam.

Chinese blue chips fell 0.6% and Hong Kong's Hang Seng index slumped 1.3%.

"While it may feel like China has taken two steps back, the next move could be three forward," said Andrew McCaffery, global chief investment officer at Fidelity International, adding that Chinese shares are trading at a significant discount.

"This may feel slightly contrarian at present, but it is an attractive entry point, especially as there are some signs of stabilisation in the US/China relationship."

U.S. Secretary of Treasury Janet Yellen will visit China later this week, but escalating tensions in the tech space, with Beijing restricting exports of two metals and Washington reportedly banning Chinese firms from accessing cloud computing, weighed on broader sentiment.

However, shares of some Chinese makers of products used to make chips rallied as supply concerns sent prices of the metals higher.

Traders are now looking ahead to the release of the minutes of the Fed's last policy meeting later on Wednesday and the non-farm payrolls report on Friday to see whether the Fed would need to hike more than once to contain inflation.

Markets are almost certain that the Fed will hike in July after pausing last month, but have only priced in a 32% chance that the central bank would need to deliver another hike by October.

Economists polled by Reuters expect the United States added 225,000 jobs last month, slowing from 339,000 job gains before, while the growth in average earnings likely held steady at 0.3% from the previous month.

Chris Weston, head of research at Pepperstone, said it was just a month ago that the market wanted to see a cooling job market for signs that the Fed's rate hikes are working.

"It now seems the thesis has evolved, and the market wants to see strong job creation, conditional on subdued wage growth."

In the currency markets, moves are largely muted. The yen eased 0.1% to 144.63 per dollar, just a touch below 145.07, which was its weakest in eight months when fears of official intervention abound.

The Australian dollar slid as well as the Chinese yuan on China services PMI data.

The Aussie was 0.2% lower at $0.6681, after a whipsaw session that saw it recover all of the losses from the Reserve Bank of Australia's policy pause on Tuesday and test a key resistance of $0.6696.

Short-term Treasury yields eased 2 basis points to 4.9152% while 10-year yields were little changed at 3.8546%.

Oil prices gave up some of their gains on Wednesday after advancing on supply concerns stemming from production cuts by top producers Saudi Arabia and Russia.

Brent crude futures fell 0.5% to $75.83 a barrel after climbing 2.1% overnight.

Gold prices were flat at $1,925.49 per ounce.

(Reporting by Stella Qiu; Editing by Sam Holmes)