Stock futures suggest small declines in Asia on Tuesday after equities on Wall Street scratched out marginal gains ahead of the Independence Day holiday.

Contracts for benchmarks in Japan, Hong Kong and Australia all slid 0.3% or less, following an advance of just 0.1% for the S&P 500 in a shortened session that ended at lunchtime. The Nasdaq 100 added 0.2% on a day that brought data showing a slowdown in manufacturing.

US equity futures were marginally lower in Asian trading while currencies steadied. The yuan and yen, which have been weakening in recent months, will remain in focus Tuesday, as will the Australian dollar ahead of an interest-rate decision.

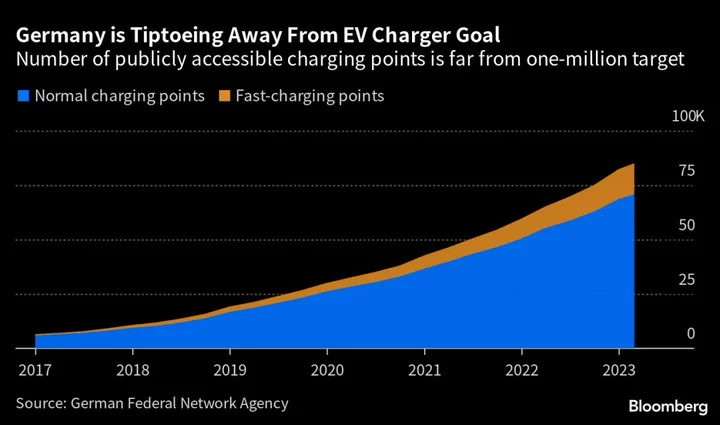

Traders will also be looking for any market fallout from China’s escalation of the tit-for-tat technology trade conflict with the US and its allies. China is imposing restrictions on exports of gallium and germanium, which are crucial for for semiconductor, telecommunications and electric vehicles.

The Australian dollar was little changed in early trading after modest increases over the past three days, with both economists and traders divided on likelihood of a rate hike or pause Tuesday.

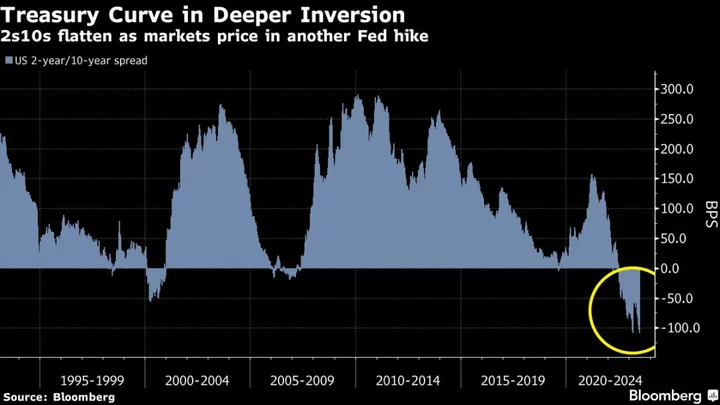

Meanwhile, a key part of the US Treasury yield curve approached its most inverted level in decades as traders priced in further hikes from the Federal Reserve. Two-year yields exceeded the 10-year by around 111 basis points.

Cooling signals in the world’s biggest economy — which are set to influence the trajectory of the Fed’s monetary-tightening cycle — mean investors are tempering expectations for stocks for the remainder of the year, especially as central banks worldwide have maintained their hawkish rhetoric.

The manufacturing sector painted a grim picture as US factory activity fell to its weakest level in more than three years. Production and new orders data also suggested a pullback.

Still, if an economic slump fails to materialize and political crises can be averted inflation could bottom out at 3% before resuming a climb, according to Jim Bianco, president and founder of Bianco Research. That could mean more interest rate increases.

“If the inflation rate bottoms at three and starts drifting higher, the Fed’s going to find this unacceptable, and that two rate hikes that we have priced in for the rest of the year will happen, if not three,” Bianco said on Bloomberg Television.

Meanwhile, US crude prices steadied around $70 a barrel after Saudi Arabia’s state-run news agency said the country will prolong its unilateral oil production cut by one month, keeping a lid on supply even as the market is expected to tighten. Its OPEC+ ally, Russia, also announced fresh curbs on exports.

Key events this week:

- Australia interest rate decision, Tuesday

- US Independence Day national holiday. Financial markets closed, Tuesday

- China Caixin services and composite PMI, Wednesday

- Eurozone S&P Global Eurozone services PMI, PPI, Wednesday

- OPEC International Seminar, speakers including OPEC+ oil ministers, kicks off in Vienna, Wednesday

- FOMC issues minutes on June policy meeting, Wednesday

- New York Fed President John Williams in “fireside chat” at meeting of the Central Bank Research Association at the New York Fed, Wednesday

- US initial jobless claims, trade, ISM services, job openings, Thursday

- Dallas Fed President Lorie Logan speaks on a panel about the policy challenges for central banks at CEBRA meeting, Thursday

- US unemployment rate, nonfarm payrolls, Friday

- ECB’s Christine Lagarde addresses an event in France, Friday

Some of the main moves in markets today:

Stocks

- S&P 500 futures fell 0.1% as of 7:39 a.m. Tokyo time. The S&P 500 rose 0.1%

- Nasdaq 100 futures fell 0.2%. The Nasdaq 100 rose 0.2%

- Nikkei 225 futures fell 0.2%

- Australia’s S&P/ASX 200 Index futures were little changed

- Hang Seng Index futures fell 0.3%

Currencies

- The euro was little changed at $1.0913

- The Japanese yen was unchanged at 144.68 per dollar

- The offshore yuan was little changed at 7.2539 per dollar

- The Australian dollar was little changed at $0.6671

Cryptocurrencies

- Bitcoin was little changed at $31,109.83

- Ether fell 0.1% to $1,956.07

Bonds

- The yield on 10-year Treasuries advanced two basis points to 3.85%

Commodities

- West Texas Intermediate crude rose 0.5% to $70.14 a barrel

This story was produced with the assistance of Bloomberg Automation.