Asian stocks rose Wednesday, with hopes for stimulus in China, a positive sign in geopolitics and hints of more broad-based strength in US shares bolstering sentiment.

Benchmark indexes were higher at the open in Japan, South Korea and Australia, while futures for Hong Kong jumped 1.9% and a measure of US-listed Chinese companies jumped 3.8% overnight.

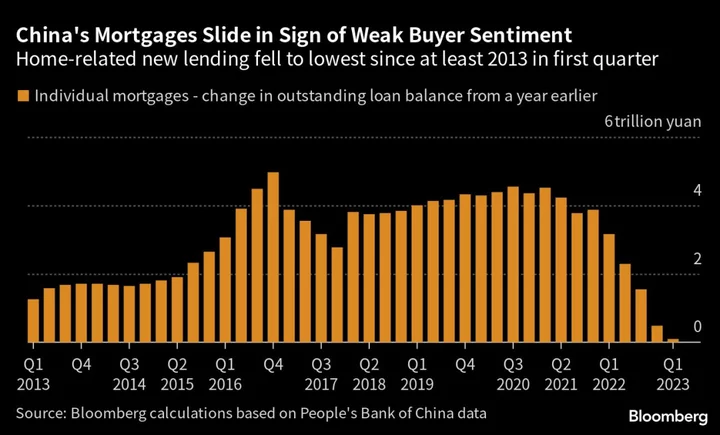

With traders on the lookout for more government help to support China’s tepid economic recovery, optimism for stimulus is rising after authorities asked the nation’s biggest banks to lower their deposit rates. Bloomberg Economics expects the People’s Bank of China to lower its one-year benchmark interest rate “as soon as mid-June.”

“The coming two months are the critical window for action” in China, a team of analysts at Citigroup Global Markets Inc., including Xiangrong Yu, wrote in a note.

Meanwhile, US Secretary of State Antony Blinken plans to visit China in the coming weeks, providing scope for improvement in fraught relations between Washington and Beijing, which have weighed on stocks in Hong Kong and Shanghai.

The Citi analysts said the Chinese government will need to keep up growth momentum to revive confidence and to ensure a smooth transition towards 2024 when economic cycles normalize. “For investors, a predictable policy setting and structural drivers for wealth creation will be key,” they wrote.

US stock futures were little changed Wednesday. A rotation into financial shares Tuesday suggested the breadth of the S&P 500’s recent rally might extend beyond technology soon. While a decline in Apple Inc. crimped gains, the benchmark gauge still rose 0.2%. The KBW Regional Bank index added more than 5% and the Russell 2000 climbed 2.7%.

In currency markets, a gauge of greenback strength fell 0.1%, the yen rose slightly and the Australian dollar extended a rally after the central bank hiked interest rates on Tuesday.

Government bond yields in Australia and New Zealand were higher at the short end of the curve. Treasury yields were steadied across tenors after a Treasury bill auction announcement weighed on short-dated US bonds on Tuesday.

The small gain on Wall Street Tuesday still left the S&P 500 just short of a bull market. The mood across global markets has been cautious with some questioning if prices have run up too fast on the hype for artificial intelligence.

“It’s too early to say if this is bottom-fishing or a real bet that the most economically sensitive stocks — many of which are unprofitable — are the place to be,” said Steve Sosnick, chief strategist at Interactive Brokers. “But the outperformance that we saw in RTY on Friday and today is very much worth watching because it could explode the narrowing breadth concerns.”

Still, for a second time in three days, the Russell 2000 beat the tech-heavy Nasdaq 100 by at least 2.5 percentage points. Not since November 2020 have small-cap stocks scored frequent, big wins like this.

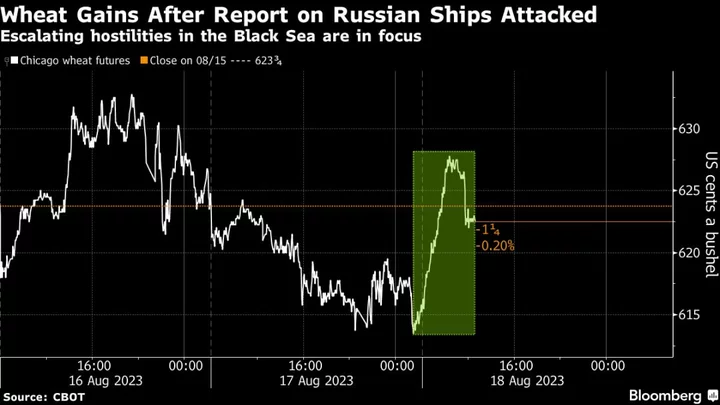

In commodities, gold was little changed and oil steadied after giving up gains Tuesday off news of Saudi Arabia’s supply cut. Wheat surged after Ukraine said Russian forces blew up a giant dam in the country’s south.

Bitcoin advanced for a second day despite deepening crypto crackdown in the US by the Securities and Exchange Commission.

The World Bank said in a report Tuesday the global economy is in a precarious situation as sharp interest-rate hikes hit activity and stir vulnerabilities in lower-income countries. Those fears have suppressed equities.

But with the rate of US inflation still high, traders increasingly expect the Federal Reserve will hold rates steady at its June meeting, while keeping the option for hikes later on open. Former vice-chair Richard H. Clarida also said Tuesday it was unlikely the US central bank will start cutting rates until 2024.

Key events this week:

- China forex reserves, trade, Wednesday

- US trade, consumer credit, Wednesday

- Canada rate decision, Wednesday

- EIA crude oil inventory data, Wednesday

- Eurozone GDP, Thursday

- Rate decisions in India, Peru, Thursday

- Japan GDP, Thursday

- US wholesale inventories, initial jobless claims, Thursday

- China PPI, CPI, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 9:25 a.m. Tokyo time. The S&P 500 rose 0.2%

- Nasdaq 100 futures were little changed. The Nasdaq 100 was little changed

- Japan’s Topix index rose 0.3%

- Australia’s S&P/ASX 200 Index rose 0.2%

- Hong Kong’s Hang Seng futures rose 1.9%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0701

- The Japanese yen was little changed at 139.53 per dollar

- The offshore yuan was little changed at 7.1231 per dollar

- The Australian dollar rose 0.2% to $0.6685

Cryptocurrencies

- Bitcoin rose 1% to $27,218.78

- Ether rose 0.5% to $1,886.1

Bonds

- The yield on 10-year Treasuries was little changed at 3.67%

- Australia’s 10-year yield advanced two basis points to 3.82%

Commodities

- West Texas Intermediate crude rose 0.2% to $71.85 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Isabelle Lee, Carly Wanna and Vildana Hajric.