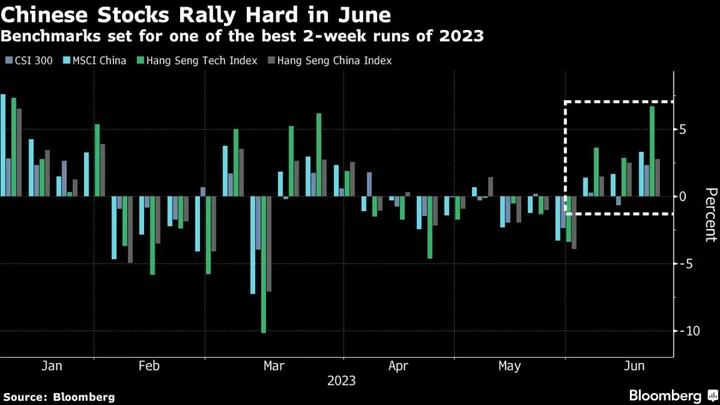

Asian equities headed for a third weekly gain, helped along by expectations of more stimulus from China.

Benchmarks in China, Australia and South Korea rose Friday. An advance for Hong Kong’s Hang Seng Index placed the gauge on pace for its second week of gains in excess of 2%, as worries about Chinese growth morph into hopes for further policy support.

Japanese shares bucked the trend, falling after a strong rally earlier in the week. The yen reversed a small gain to weaken 0.3% versus the dollar after the Bank of Japan kept is negative rate and yield curve control program unchanged.

Underscoring the broadly positive sentiment in stocks, the S&P 500 rose for a sixth day on Thursday — its longest winning run since November 2021. The Nasdaq 100 hit the highest since March 2022, helped along by exuberance surrounding artificial intelligence that has also raised concerns about an overbought market.

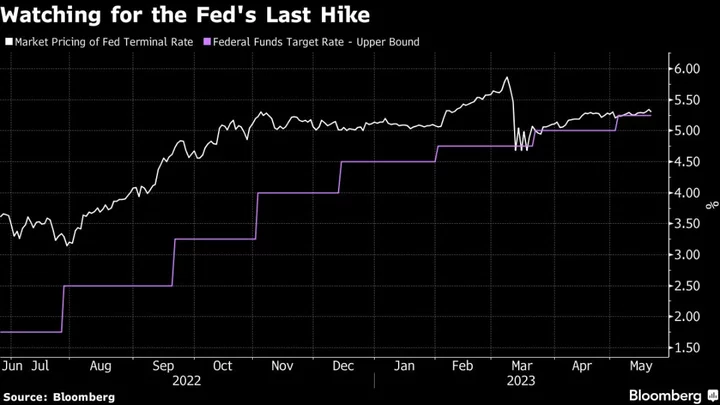

Bets that the Federal Reserve will soon end its tightening cycle also boosted risk sentiment.

The wins for the Asia gauge has it poised for the best run of weekly advances since January, when excitement over China’s reopening lifted stocks across the region. US and European futures were slightly lower.

Australia’s yield curve reversed its Thursday inversion, the first since 2008, as three-year yields fell more than 10-year yields. New Zealand yields also declined after a rally in Treasuries on Thursday when the 10-year Treasury yield declined seven basis points to 3.72%. Treasury yields inched higher Friday.

The dollar rose slightly after slumping Thursday while the euro held most of a rally after the European Central Bank lifted interest rates by another quarter-point, with President Christine Lagarde describing a further hike in July as “very likely.”

The move came a day after Fed officials paused their series of interest-rate hikes, but projected borrowing costs will go higher than previously expected, owing to what Chair Jerome Powell called surprisingly persistent inflation and labor-market strength.

The Fed is now in a “data-dependent” mode before it delivers what may be just one final increase in US borrowing costs next month, former Vice President Richard Clarida said.

Elsewhere, oil and gold were slightly lower after a rally in commodity prices Thursday pushed the Bloomberg Commodity Index to its biggest advance since November. Bitcoin fell slightly to trade at around $25,500.

Wall Street’s fervor will face a big test on Friday with the expiration of a massive amount of options contracts tied to stocks and indexes. The event, known as OpEx, typically obliges traders to either roll over existing positions or start new ones. That usually involves portfolio adjustments that lead to a spike in volume and sudden price swings.

Key events this week:

- Bank of Japan rate decision, Friday

- US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures fell 0.2% as of 11:51 a.m. Tokyo time. The S&P 500 rose 1.2%

- Nasdaq 100 futures fell 0.3%. The Nasdaq 100 rose 1.2%

- Japan’s Topix fell 0.5%

- Australia’s S&P/ASX 200 rose 0.6%

- Hong Kong’s Hang Seng rose 0.5%

- The Shanghai Composite rose 0.3%

- Euro Stoxx 50 futures were little changed

Currencies

- The Bloomberg Dollar Spot Index rose 0.1%

- The euro was little changed at $1.0938

- The Japanese yen fell 0.2% to 140.59 per dollar

- The offshore yuan fell 0.3% to 7.1404 per dollar

- The Australian dollar fell 0.2% to $0.6874

Cryptocurrencies

- Bitcoin fell 0.2% to $25,506.78

- Ether fell 0.3% to $1,663.82

Bonds

- The yield on 10-year Treasuries advanced two basis points to 3.73%

- Japan’s 10-year yield was little changed at 0.425%

- Australia’s 10-year yield was little changed at 4.00%

Commodities

- West Texas Intermediate crude fell 0.2% to $70.45 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.