Asian stocks were set for a mixed open after US equities struggled for direction throughout most of the day before closing higher. Treasury yields climbed along with the dollar.

Futures for Australia’s benchmark were little changed while those for Japan rose. Hong Kong is set to play catch-up as trading resumes following a holiday while mainland markets remain shuttered. The S&P 500 snapped a three-day slide Thursday after swinging between gains and losses earlier in the session, while the Nasdaq Golden Dragon China index of US-listed shares ended marginally in the red.

The yen was little changed in early Asia trading Friday ahead of inflation data expected to show slowing that will reinforce the case for the Bank of Japan to hold stimulus in place. That follows the currency’s worst performance among its Group-of-10 peers as the BOJ’s dovishness contrasted sharply with the hawkishness of other major central banks.

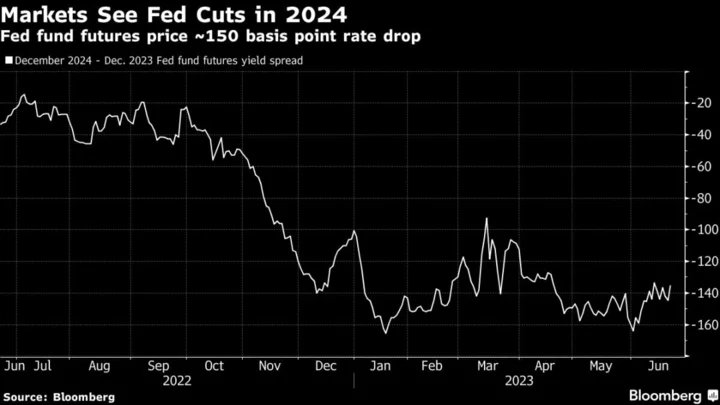

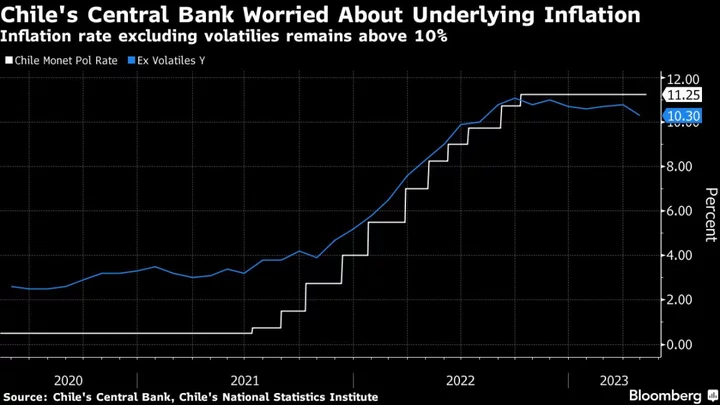

Treasury two-year yields hit the highest since March as Federal Reserve Chair Jerome Powell said the US may need one or two more rate increases in 2023. The Bank of England cautioned it may have to hike again after delivering a half-point boost, while a key section of the German yield curve inverted the most since 1992 on economic concern. Yields on Australian 10-year notes rose 3 basis points early on Friday.

Read More: Global Inflation Alarm Augurs a Long Hot Summer of Rate Hikes

“We’ve seen central banks say: ‘Oh, we haven’t done enough.’ They thought at the beginning of the year they had, and everybody thought we were going into recession, and now what we’re seeing is the data sequentially move away from that,” said Phillip Colmar, global strategist at MRB Partners. “If you’re not in a recession, it’s also really hard to get core inflation down because you need to weaken the employment sector in order to do so.”

Treasury Secretary Janet Yellen said she sees diminishing risk for the US to fall into recession, and suggested that a slowdown in consumer spending may be the price to pay for finishing the campaign to contain inflation.

To Kristina Hooper, chief global market strategist at Invesco, if the Federal Reserve does tighten two more times this year, it risks sending the economy into a “significant recession.”

“I’m sounding like a broken record, but I’ll say it again: There is a lengthy lag between when monetary policy is implemented and when it actually shows up in the real economy data,” Hooper said. “We haven’t seen much of an impact yet because of that lag. That’s why we have to worry so much about overkill.”

There are signs of low conviction in the S&P 500’s 14% rally this year, with the index set to end its longest weekly winning streak since 2021. Bank of America Corp.’s latest survey shows a net 25% of global money managers are still underweight US equities, despite a recent improvement in allocation.

Meanwhile, global index provider MSCI Inc. decided to retain South Korea on its list of emerging markets following an annual review, once again thwarting the nation’s bid for an upgrade to the coveted developed-market status.

In commodities, oil erased all of this week’s gains as worries about high interest rates rattled investors, overshadowing a drop in US crude inventories. Gold is set for its biggest weekly drop since early February.

Elsewhere, Turkey’s lira slumped as the central bank delivered a significantly smaller interest-rate increase than anticipated, as policymakers embark on what they said will be a gradual transition from an era of ultra-cheap money.

Key events this week:

- Eurozone S&P Global Eurozone Manufacturing PMI, S&P Global Eurozone Services PMI, Friday

- US S&P Global Manufacturing PMI, Friday

- Fed Bank of St. Louis President James Bullard speaks, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 7:54 a.m. Tokyo time. The S&P 500 rose 0.4%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 1.2%

- Australia’s S&P/ASX 200 futures were little changed

- Nikkei 225 futures rose 0.8%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0953

- The Japanese yen was little changed at 143.07 per dollar

- The offshore yuan was little changed at 7.1957 per dollar

- The Australian dollar was little changed at $0.6759

Cryptocurrencies

- Bitcoin fell 0.7% to $29,953.48

- Ether fell 0.7% to $1,874.15

Bonds

- The yield on 10-year Treasuries advanced eight basis points to 3.79%

- Australia’s 10-year yield advanced three basis points to 4.00%

Commodities

- West Texas Intermediate crude was little changed

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Rita Nazareth.