Altice makes up such a large part of the European junk bond index that the news police had detained one of the media giant’s co-founders as part of a corruption investigation is proving a major headache for the region’s high yield portfolio managers.

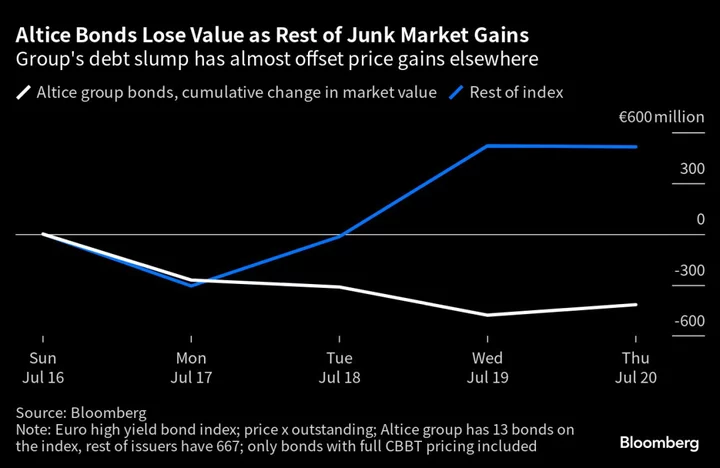

Since July 14, bonds issued by Altice International and Altice France Holding SA have lost €420 million ($467 million) in market value, while the rest of the index increased by €519 million over the same period. Without them, the Bloomberg Euro High-Yield index would have recorded double its gains over the past week.

A shrinking universe of high-yield bonds combined with Altice’s bloated capital structure has magnified the impact of its woes. The telecoms group’s debt burden has ballooned after years of aggressive acquisitions fueled by cheap money. Meanwhile, Europe’s junk bond market has contracted since late 2021, as companies pay down debt, or switch to other types of borrowing in an era of rising interest rates.

“Everyone is hurting,”said Simon Matthews, senior portfolio manager at Neuberger Berman. “You would struggle to find anyone that has zero exposure to this capital structure.”

Representatives for Altice International and Altice France didn’t immediately respond to a request for comment.

Together, Altice France and Altice International entities have the third-largest weighting in the European high-yield bond index, with €9.75 billion of bonds outstanding.

Meanwhile, the amount of euro-denominated junk bonds has fallen around 14% from its peak in November 2021 to €378.2 billion, according to a Bloomberg index tracking corporate high-yield debt.

In a higher interest-rate environment, companies have increasingly opted for floating-rate leveraged loans over junk bonds to finance deals, in the expectation that rates will fall. Private lenders have also taken up market share, while some companies have opted to pay down debt instead of refinance.

Read more: Drahi’s Telecom Empire Wrestles With Corruption Probe Fallout

Corruption Investigation

Altice Group bond prices fell sharply after co-founder and former Chief Operating Officer Armando Pereira was detained as part of a three-year investigation by Portuguese authorities into corruption, tax fraud, forgery and money laundering. Altice International has also placed several employees in Portugal and other countries on leave.

The company has said it’s cooperating with authorities, and an internal investigation is underway. Pereira is “completely” innocent, Manuel Magalhaes e Silva, one of his lawyers, said on Thursday.

Subordinated bonds issued by Altice International due in 2028 dropped to as low as 50.19 cents on the euro following the news, before recovering somewhat to 56.26. Meanwhile, another bond issued by Altice France dipped to lows of around 36% of face value.

The group’s debt-fueled strategy had already come under the spotlight as investors fretted over how it would deal with its heavy debt pile in a high interest rate environment.

“The central issue is the softer earnings outlook and a large amount of gross leverage at a time when the cost of capital has moved materially upwards,” Matthews said. “Meanwhile, there aren’t many levers that the company can pull to reduce its debt.”

Bondholders are particularly concerned about Altice France’s maturity wall in 2025. The company has just over €1 billion ($1.1 billion) in euro bonds maturing in early 2025 as well as some term loans outstanding.

Altice France management has said that the company could use proceeds from a potential sale of French data centers to pay down some of the maturities. A deal could value the portfolio at around €1 billion.

“Altice has a huge debt stack so everyone is long: banks are long, the buyside is long, and all big passive structures are long,” Adam Darling, high-yield bond fund manager at Jupiter Asset Manager, said. “That means that even if the bonds look cheap, having sold off quite significantly, there aren’t enough buyers to help rebalance the market.”