As US politicians hold talks to avoid a historic debt default, PGIM Fixed Income has spotted an opportunity to bet on the next crisis.

Greg Peters, the firm’s co-chief investment officer, has bought long-dated credit default swaps — insurance against a future default — on the basis that the US will find itself in a similar impasse all over again.

These are tough situations for investors to navigate: politicians are largely seen reaching a deal soon to lift the debt ceiling, yet the X-date — the point at which the government loses the ability to pay its obligations — is dangerously close.

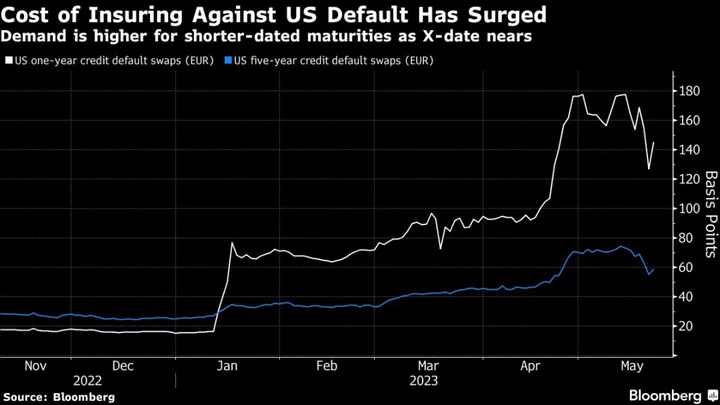

Some investors are betting on short-dated Treasury bills, given dislocations in the market around the potential X-date. But Peters says those wagers simply aren’t worth it for his funds at PGIM Fixed Income, which oversees $793 billion of assets. Instead, he’s focusing on the US CDS curve.

“The US CDS curve is highly inverted, which means people are paying up for default protection in the near term,” he said in a phone interview. “We went out the curve somewhat, as our sneaking suspicion is that it will continue year after year. The congressional disruption in DC is not going away anytime soon.”

The debt ceiling has increasingly become a partisan weapon in Washington. The current deadlock is stoking memories of 2011, when talks went down to the wire and ratings agency Standard & Poor’s slapped the US government with its first ever credit downgrade, roiling global markets.

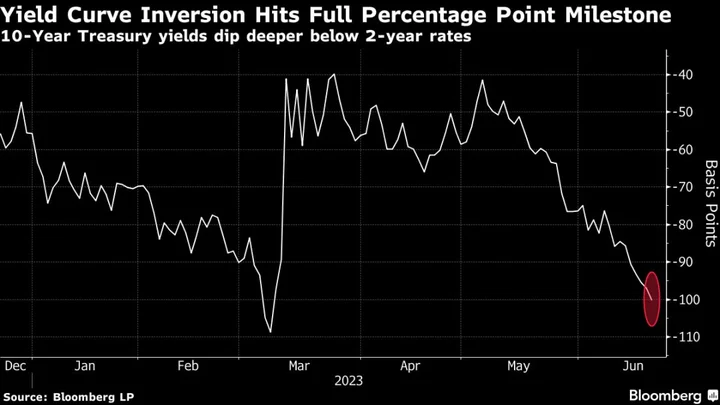

Traders are getting jittery. The ICE BofA MOVE Index, a widely used gauge of bond volatility, has already risen this year to levels last seen during the Great Financial Crisis.

Read more: US Default Scenarios Span From Localized Pain to Dimon’s ‘Panic’

Treasury Secretary Janet Yellen said Monday that it’s now “highly likely” that her department will run out of sufficient cash in early June, possibly as soon as June 1. PGIM has assigned a 5% probability to a default scenario this summer — low, but nonetheless “higher than it should be”, said Peters, who previously worked at the Treasury.

“It’s a very difficult investment thesis because you have this low probability, high catastrophe type of outcome,” he said. “What do you do with that? It’s like the opposite of a lottery ticket! It suggests being closer to home on your risk.”

Peters also remains wary of the inflation threat and still sees the interest-rate cuts priced by markets as excessive, even though they’ve started to fade. Federal Reserve official James Bullard said Monday that he backed two more 2023 rate increases, following hawkish comments from his Minneapolis colleague Neel Kashkari.

“I still believe that front-end rates in particular will stay higher than what is being priced in the market place,” Peters said. “Even if we get a recession, I think it’s already embedded in the price.”